Ethereum goes by means of its longest interval of inflation, with greater than 350,000 ETH (value round $1.1 billion) since Dencun's improve in March, in accordance with Ultrasound.cash information. Ethereum's present inflation fee is 0.35%.

The rise introduced the full provide to 120.4 million ETH, leaving just below 95,000 ETH, matching the degrees seen within the September 2022 Ethereum Merger.

Nearly two years of ETH provide discount was erased in simply seven months by EIP-4844, often known as Dencun or Proto-Danksharding.

How Dencun Modified Ethereum's Provide Dynamics

The Dencunu replace introduced important adjustments that diminished the bottom fee of burning Ethereum charges.

By allocating particular block area for layer 2 networks to course of aggregated transactions, generally known as blobs, competitors for primary community area was diminished. As well as, the proto-danksharding mechanism made information availability extra environment friendly and induced a pointy drop in base charges.

These occasions have severely affected transaction charges on the blockchain community, leading to Ethereum issuing extra ETH than it burns in most blocks.

For context, Ethereum burned 45,022 ETH whereas issuing 78,676 ETH within the final 30 days. This resulted in a internet provide enhance of over 30,000 ETH, underscoring the inflationary influence of the diminished base payment atmosphere.

The influence of staking

The rise in Ethereum inflationary strain can be associated to the rising ratio of ETH stakes. Coinbase analyst David Han famous that whereas Dencun's improve has had a big influence on the Ethereum ecosystem, the adjustments within the inflation fee look like associated to broader elements, together with the rising ETH staking ratio, which accelerates all token issuance.

Ethereum's transfer to Proof of Stake (PoS) strengthened community safety and elevated participation, but additionally led to extra ETH issuance. Validators who lock their ETH to safe the community are rewarded in newly minted tokens.

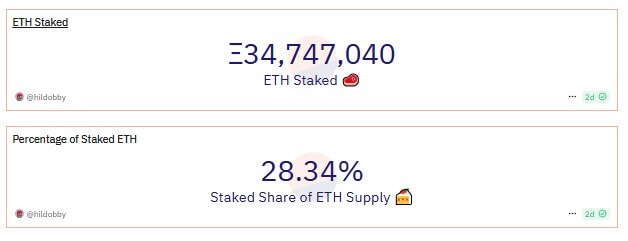

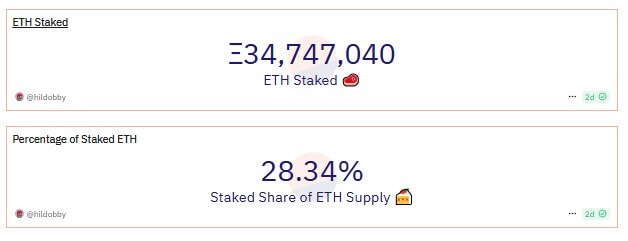

In line with Dune Analytics, round 34.7 million ETH are at present being staked – about 28% of the full provide. This staked ETH helps safe the community and generates rewards, additional rising Ethereum's provide.

Furthermore, this impact amplifies the rising development of refolding, particularly for protocols like EigenLayer. Customers reinvesting their staking rewards generate much more ETH, rising the inflationary influence.