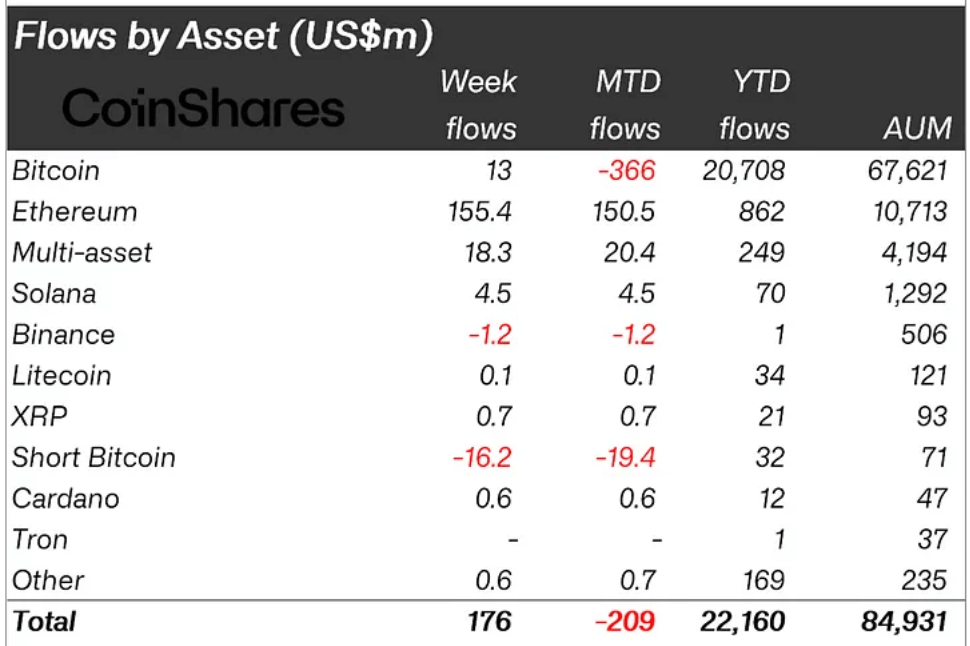

Based on the most recent weekly report from CoinShares, crypto funding merchandise noticed a big influx of $176 million as buyers cashed in on latest worth drops.

James Butterfill, head of analysis at CoinShares, famous that complete property beneath administration (AUM) for crypto ETPs fell to $75 billion throughout the correction, however rebounded to $85 billion as of the most recent report.

Buying and selling quantity in exchange-traded merchandise (ETPs) climbed to $19 billion throughout the interval, surpassing this 12 months's weekly common of $14 billion.

Ethereum dominates

Ethereum noticed essentially the most substantial profit from the market correction with an influx of $155 million final week. This took its year-to-date influx to $862 million, essentially the most since 2021, largely because of the latest launch of US spot ETFs.

Market specialists have praised the efficiency of Ethereum ETFs since their launch in July. For context, Nate Geraci, president of the ETF Retailer, identified that the BlackRock iShares Ethereum ETF is now one of many prime six ETFs to hit the market in 2024.

Geraci famous:

“The iShares Ethereum ETF has attracted greater than $900 million in lower than three weeks and is prone to hit $1 billion this week.”

In the meantime, Bitcoin had a blended efficiency final week. The flagship digital asset began the week with outflows however noticed a reversal in direction of the tip as buyers piled $13 million into BTC-related funding merchandise.

In distinction, quick Bitcoin ETPs noticed essentially the most vital outflow since Could 2023, at $16 million, or 23% of its AUM. This discount in AUM for brief positions displays a big exit of buyers.

Different digital property, together with Solana, XRP, Cardano and Litecoin, additionally noticed modest inflows of round $6 million final week.

Curiously, inflows have been seen throughout all areas, indicating broadly optimistic sentiment in direction of the asset class following the latest worth correction.

The US led with $89 million, adopted by Switzerland with $20 million, Brazil with $19 million and Canada with $12.6 million. Nonetheless, the US stays the one nation to have recorded web outflows totaling $306 million for the reason that begin of the month.