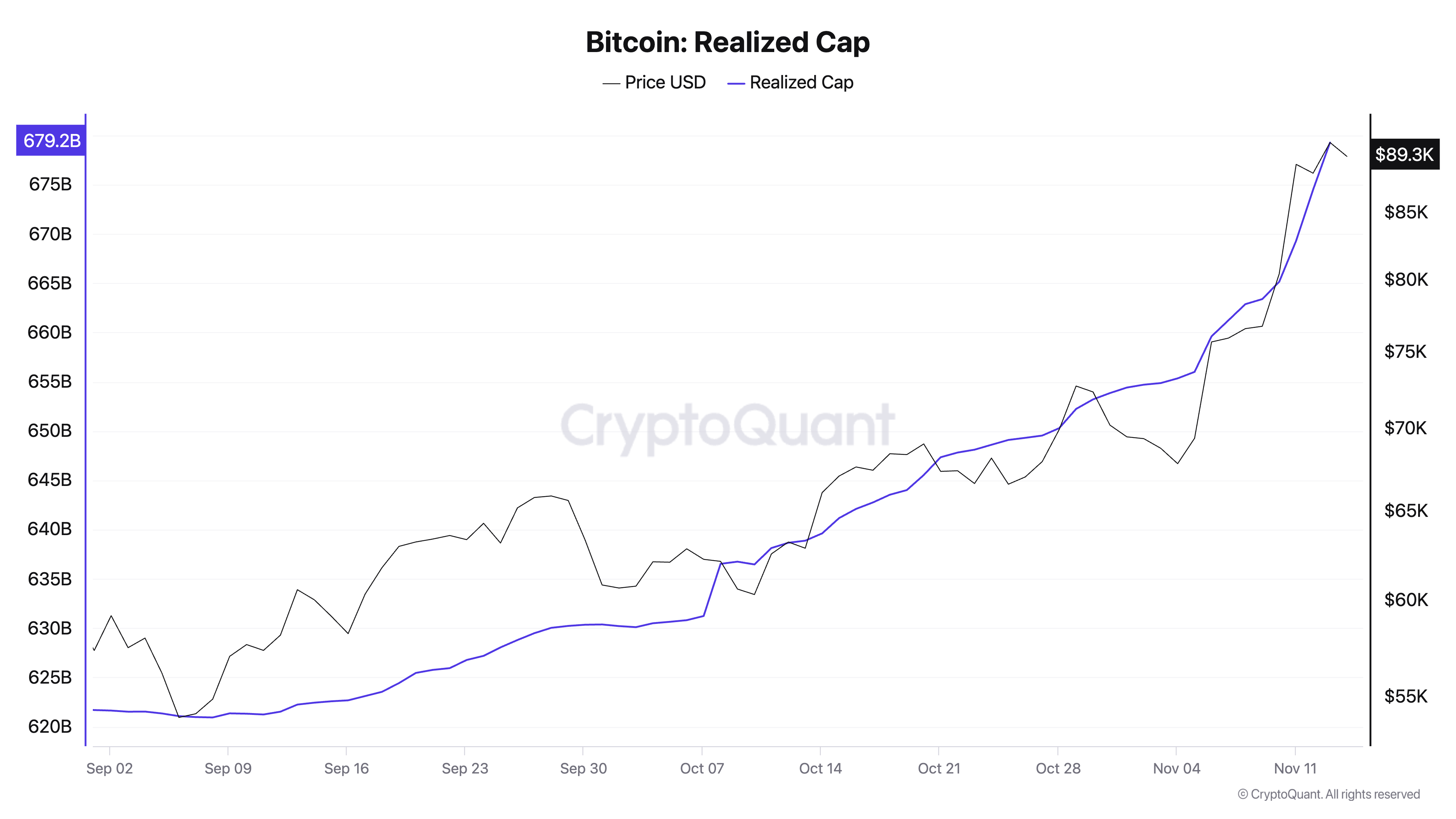

The distinction between Bitcoin's realized and market cap is an underestimated indicator of the phases of Bitcoin's value cycles. The realized cap reveals the worth of Bitcoin based mostly on the final value of every coin that moved and reveals the precise capital invested within the asset.

When the market cap, which displays the worth of all present cash based mostly on the present spot value, is considerably totally different from the realized cap, it signifies a shift in sentiment. These shifts have traditionally been according to phases of both euphoria or concern.

A excessive market cap relative to the realized cap reveals that buyers are holding unrealized income. Whereas this can be a clear signal of bullish sentiment available in the market, it could additionally preempt potential overextension. Conversely, when the market capitalization falls beneath the realized ceiling, it alerts a large-scale capitulation and undervaluation of the asset.

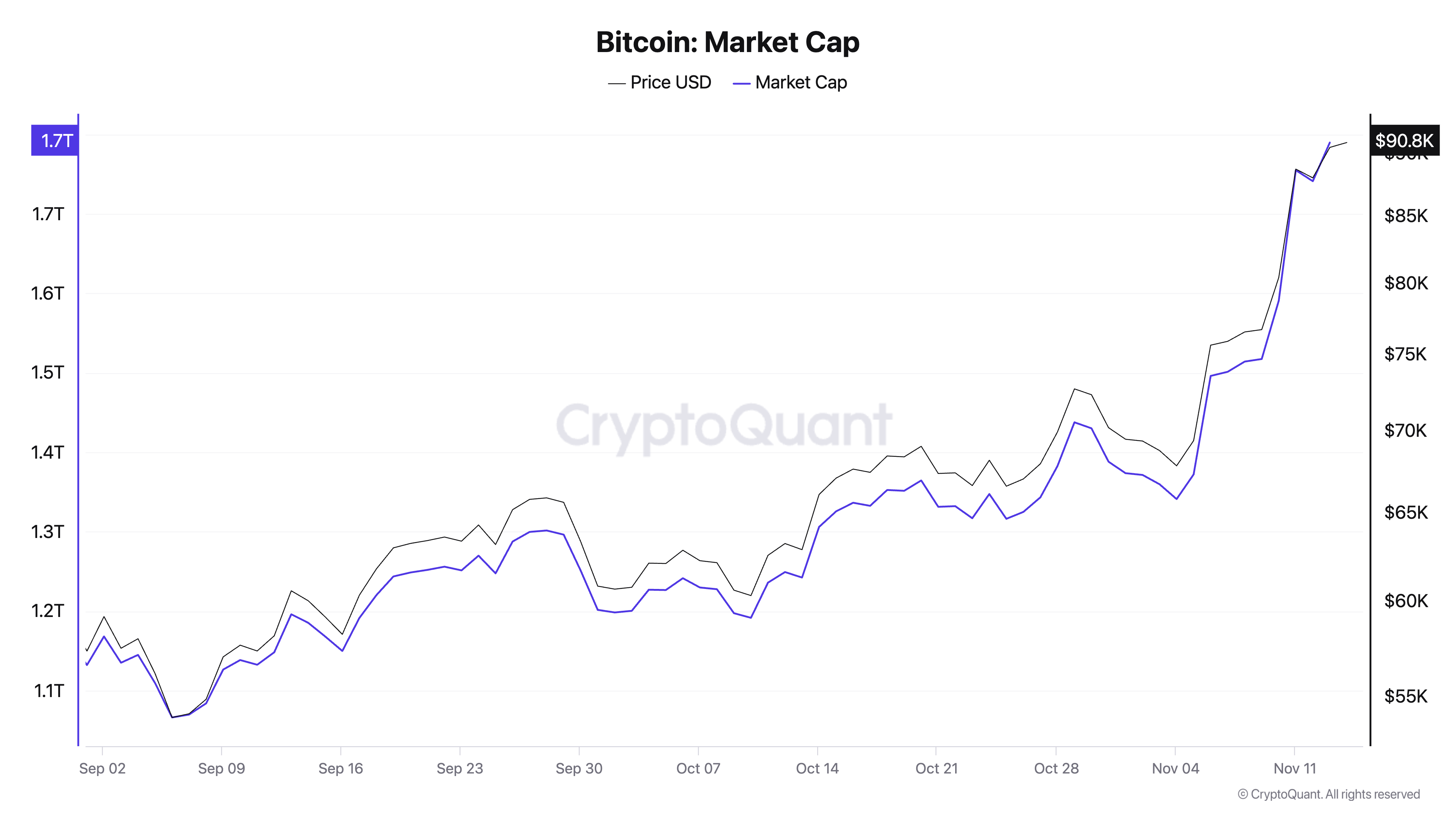

The present mismatch between Bitcoin's market cap and realized capitalization displays the overwhelming bullish sentiment that has dominated the market this month.

The rise within the value of Bitcoin was pushed by optimism surrounding the US presidential election. On November 5, President Donald Trump's victory sparked a rally within the crypto market as his incoming administration is anticipated to implement particular insurance policies concentrating on Bitcoin.

The election outcome sparked bullish momentum and buyers had been bracing for a way more favorable regulatory atmosphere for cryptocurrencies. This sentiment drove the worth of Bitcoin above $90,000, creating a brand new ATH.

The rise in value was mirrored in bitcoin's market cap, which by mid-November had elevated from $1.132 trillion in early September to $1.789 trillion. Most of this enhance occurred within the days following the election, indicating elevated shopping for exercise and capital inflows into the market.

Whereas the surge actually displays market enthusiasm and confidence in bitcoin's long-term potential underneath the Trump administration, the worth itself probably additionally fueled speculative shopping for. Such fast development in market capitalization, particularly after a significant occasion resembling a nationwide election, is commonly an indication of elevated hypothesis.

Whereas the market capitalization has grown considerably, the realized capitalization of Bitcoin has grown far more slowly. Shifting from $621.691 billion on September 1 to $679.281 billion on November 13, the rise within the realized cap clearly reveals that new capital continues to enter the market.

This upward development within the realized cap reveals that bitcoins are being purchased and bought at progressively increased valuations, steadily setting new price base ranges. The election additionally seems to have accelerated this development within the realized cap, with a notable enhance from $656.006 billion on November fifth to $679.281 billion by November thirteenth.

The widening hole between the market and realized cap throughout this era is especially telling. In September, the distinction between them was round $510 billion; by mid-November, it had grown to about $1.1 trillion.

The divergence means that the present market value of Bitcoin is considerably increased than the common value paid by holders, suggesting that many buyers are actually holding vital unrealized income. Traditionally, such a big hole has been related to market cycles approaching a euphoric section, when optimism and hypothesis drive costs properly past earlier ranges.

Whereas the expansion of the realized cap alerts a gradual influx of capital and continued curiosity in Bitcoin, a fast growth of the market cap relative to the realized cap may point out an overhyped market the place valuations could also be considerably inflated by speculative shopping for.

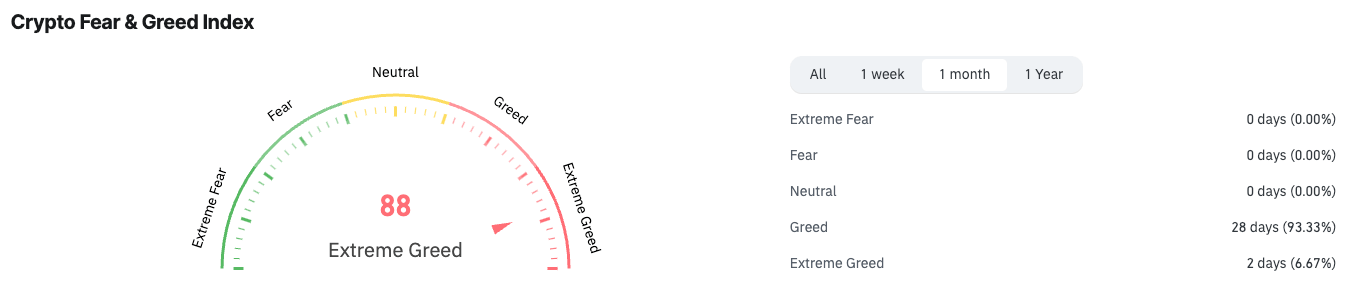

This hazard can be evident when trying on the concern and greed crypto index, which has dipped properly into excessive greed territory and remained tied to greed for 28 of the previous 30 days, in accordance with CoinGlass information.

This divergence sample typically precedes a interval of consolidation or correction. Bitcoin's run above $92,000 was comparatively short-lived and was instantly adopted by a correction to round $87,500 on November 13.

The worth has since ranged between roughly $87,000 and $91,500 at press time. Brief, aggressive corrections like these may be anticipated within the coming weeks because the hole between the market cap and the realized cap persists.

If realized cap development slows or reverses within the coming weeks, it may point out that long-term holders are starting to pare down their holdings in response to persistently excessive costs. This might put additional upward stress on costs and we may see one other, bigger correction beneath $90,000.

Nevertheless, the regular enhance within the realized cap so far reveals that long-term holders stay assured, including to the energy of this rally even because the market cap will increase.

It is going to be necessary to observe adjustments within the positions of huge institutional holders, with a selected deal with ETFs and derivatives. The dimensions of those positions is more likely to spur retail investor motion and alter sentiment within the coming weeks.

The publish Divergence Between Bitcoin Market and Realized Caps Indicators Euphoria appeared first on fromcrypto.