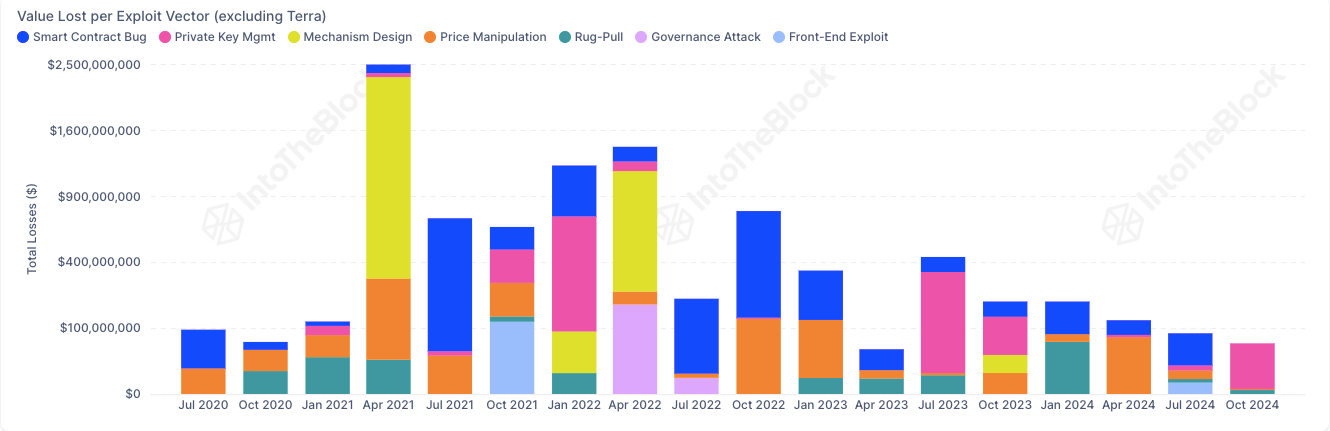

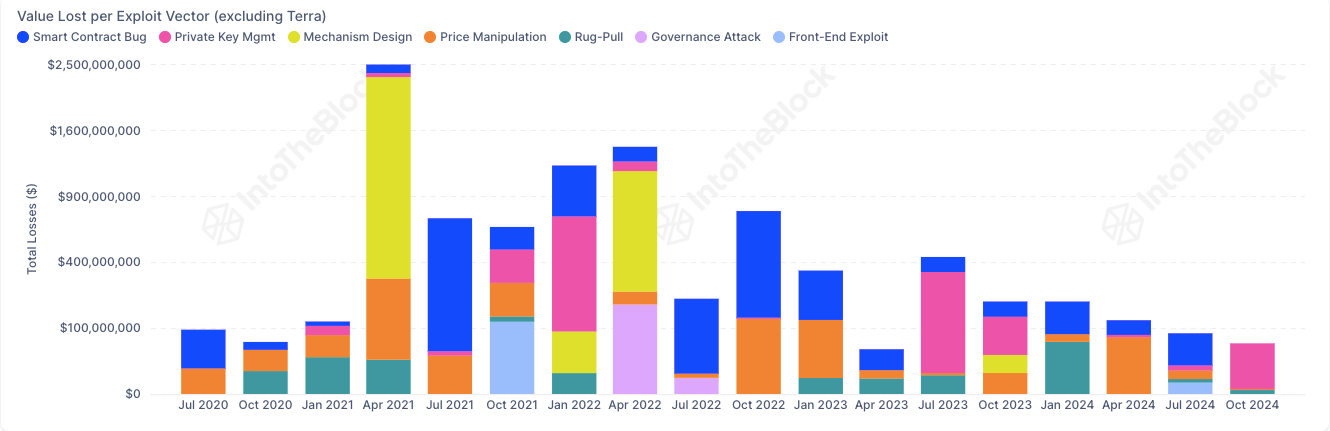

- DeFi abuse losses have dropped considerably to $1 billion in 2024, indicating improved protocol safety.

- April 2021 had the very best losses of $2.5 billion resulting from mechanism errors, highlighting the preliminary dangers of DeFi.

- The $50 billion Terra/Luna collapse underscored the dangers in algorithmic stablecoins, affecting DeFi confidence.

Losses from decentralized finance (DeFi) exploits have decreased in 2024, with reported losses solely hovering round $1 billion. This can be a important enchancment over earlier years when the trade confronted quite a few breaches.

“Worth Misplaced to Exploits (exterior Terra)” knowledge from July 2020 to October 2024 exhibits adjustments in crypto asset losses, with theft exercise growing in 2021 and 2022. Decreased losses associated to exploitation in 2024 point out that safety enhancements in DeFi protocols are working, with current losses falling beneath $250 million.

Evaluation of DeFi Exploit Losses Over Time

Since July 2020, the crypto market has suffered losses resulting from DeFi abuse. The biggest improve occurred in April 2021, with losses of over $2.5 billion resulting from flaws within the design of the mechanism.

Additionally Learn: Pendle Saves $105 Million on DeFi Exploit, Stops Penpie Hack

From January 2022 to October 2022, there have been additional spikes, notably in January, April and October, with losses starting from $500 million to $1 billion. By October 2024, reported losses had been beneath $250 million, probably resulting from higher danger administration and safety infrastructure inside DeFi.

The Terra/Luna Disaster: A Distinctive Case

In contrast to different exploitation losses, the Terra/Luna disaster precipitated a large lack of over $50 billion. This incident concerned the collapse of the stablecoin TerraUSD (UST) and its related token LUNA resulting from design flaws in its mechanism.

Additionally learn: Institutional traders flock to Ethereum, betting on DeFi and long-term development

Though believed to have occurred on account of an financial onslaught, the de-peg of the UST was largely resulting from poor design practices. This occasion had a serious influence on DeFi, affecting greater than 25% of its complete worth locked (TVL) and lowering confidence in algorithmic stablecoins. In April 2021, a lack of over US$2.5 billion was attributed to issues with the design of the mechanism and different difficulties with value management and personal key administration.

Value manipulation, governance assaults, and good contract bugs have been persistent vectors of abuse, with good contract vulnerabilities inflicting important losses since mid-2023. Whereas carpet pulling occurred in some intervals, it was much less widespread than different forms of exploits.

Disclaimer: The knowledge supplied on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shall not be responsible for any losses incurred on account of using stated content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.