Ki Younger Ju, CEO of Blockchain Analytics platform Cryptoquant, stated Bitcoin Bull Cycle is over. Specifically, the premiere cryptocurrency tried to create a everlasting uptrend because it hit a brand new historic most of round $ 109,000 in January, inflicting doubts in regards to the viability of the present bull working.

Bitcoins not responding to the market pricing factors

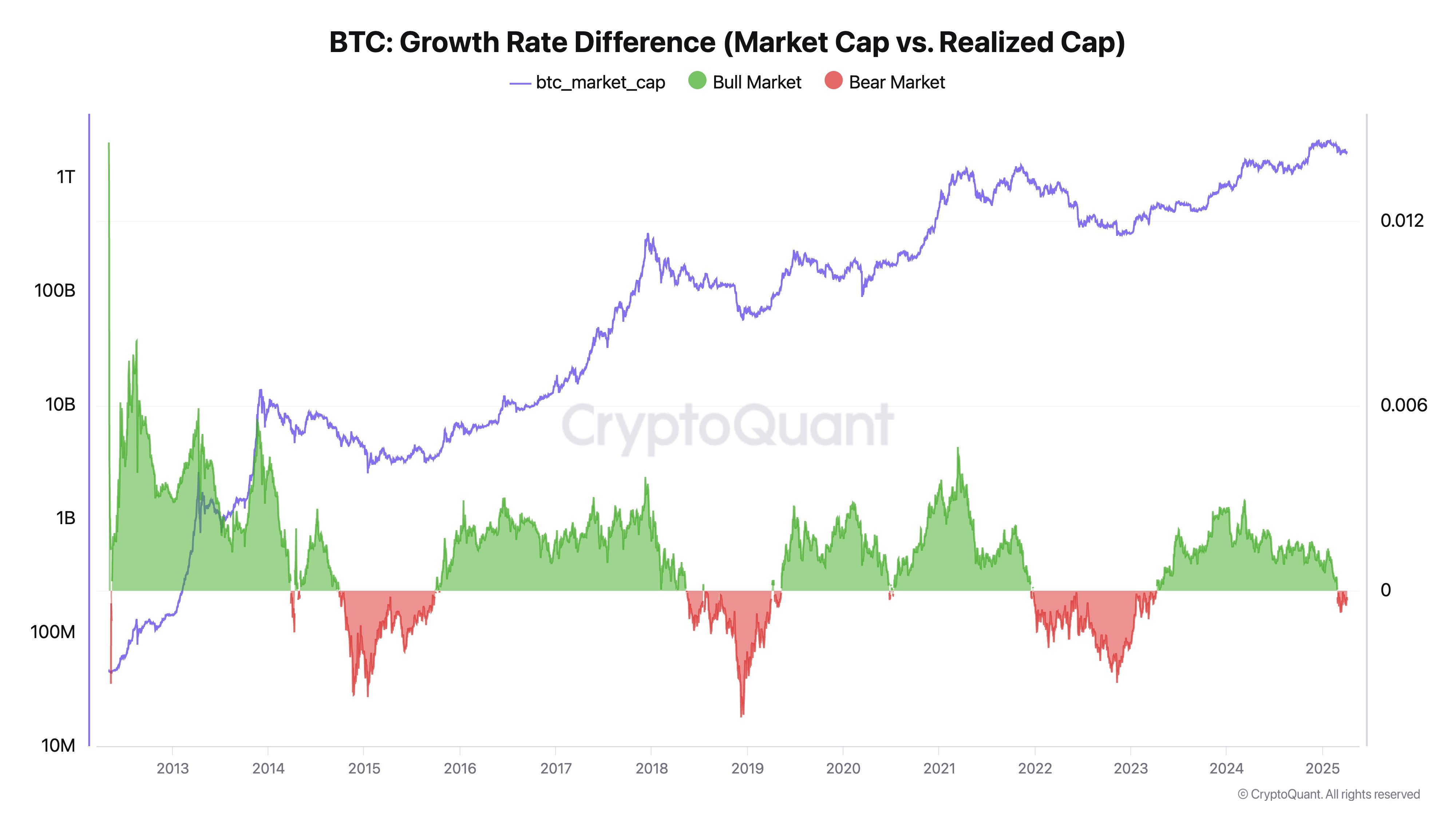

Within the paper X April 5, Ki Younger Ju shared an attention-grabbing concept of why Bitcoin may shut his present bull working. A outstanding cryptomat character based this postulation on information chain ideas across the realized cap and market ceiling.

Younger Ju describes the realized cap as the general capital that flows to the BTC market, as revealed by the true exercise of the on-line. The realized lid reveals extra correct BTC measuring by census at which every coin final moved.

Then again, the market restrict supplies BTC awards based mostly on the newest inventory buying and selling costs. Cychptoquant explains that market limits/costs don’t enhance or lower in proportion to transactions on the idea of widespread misconceptions, however in response to the steadiness between buying and strain promoting.

Younger Ju states that in the midst of low strain on sale, a small buy may cause value enhance and market ceiling. Then again, giant Bitcoin purchases throughout excessive strain might fail in a optimistic value response as a result of the market consists of a excessive variety of sellers.

Taking a look at each ideas, it implies that the realized CAP measures the inflow of capital to the BTC market, whereas the market restrict suggests a value response to those tides. Subsequently, Kryptoquant explains that the rise within the ceiling, whereas the market ceiling is declining or stays unchanged, represents a traditional bear sign as a result of costs don’t reply positively regardless of new investments.

Alternatively, the stagnant ceiling is accompanied by an elevated market ceiling by a former sign that displays a low degree of sellers; Subsequently, any small quantity of recent capital may cause appreciable value positive aspects.

Ki Younger Ju states that the previous scenario is presently being performed on the Bitcoins market, with costs to extend the tide, as proven within the chain information in change transactions, ETF markets and the exercise of binding wallets. This growth signifies the presence of a bear market. Whereas Younger Ju states that the present strain of the vendor may disappear at any time, historic information promotes a interval of conversion no less than six months.

An summary of bitcoin costs

Through the press, Bitcoin traded for $ 83,700, which mirrored a lower of 0.94% on the final day.

Primary image from Threstreet, Graph from TradingView

Editorial course of For , it’s targeted on offering a totally explored, correct and neutral content material. We keep strict supply requirements and every web page undergoes cautious overview of our workforce of the most effective expertise consultants and seasoned editors. This course of ensures the integrity, relevance and worth of our content material for our readers.