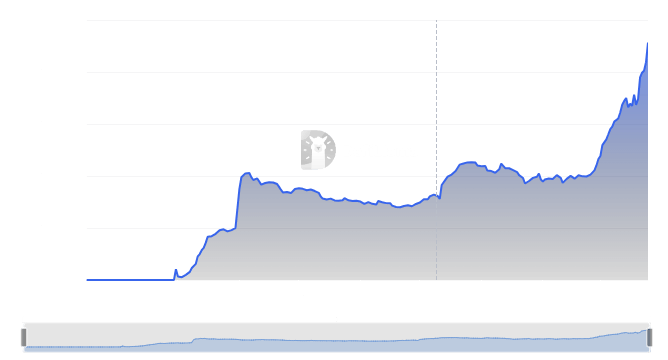

- Core TVL is up greater than 126% over the previous month, from round $405 million as of February twenty fifth.

- TVL hit $913 million amid the meme coin frenzy and will hit $1 billion this week.

Whole Worth Locked (TVL) on Base, the Ethereum layer-2 protocol launched by Coinbase, has reached a brand new excessive above $900 million.

DeFiLlama information confirmed that TVL was greater than $913 billion on March 25, up greater than 126% from $405 million on February 25. Bridged TVL was valued at over US$1.15 billion.

Core meme cash ship TVL hovering

Up to now few weeks, consideration has been centered on meme cash based mostly on Solana. Like dogwifhat, Bonk E-book of Meme, Slerf and Myro have dominated the market with huge income.

However Base meme cash have seen an honest enhance prior to now 24 hours, with information displaying their market cap rising by greater than 400% to almost $1 billion in 24 hours.

The shopping for frenzy hit tokens like Toshi (TOSHI), Degen (DEGEN) and Mochi (MOCHI), which surged greater than 30% within the final day.

Nansen highlighted TVL progress, with a rise of as much as $1 billion this week.

Core TVL is up greater than 25% from final week ($705M to $892.6M), with the community on monitor to hit $1B TVL this week

it seems like @base szn is right here pic.twitter.com/x5rRRxnw1s

— Nansen

(@nansen_ai) March 25, 2024

RWA tokens on the rise

Actual World Belongings (RWA) have additionally helped make Base a power out there.

Because of Dencun’s current improve, interplay with dApps is rising because of low charges. Customers and traders are additionally taking key dips within the RWA market and searching for gems.

Chain information exhibits a big influence on Base TVL from RWA tasks, together with a 28% enhance in TVL for Materials RWA and virtually 6% for Cygnus Finance.

The general enhance in RWA tokens has seen the market cap of the sector develop by over 25% to over $7 billion. The very best tokens on this market embody Ondo Finance, Polymesh, Pendle and TokenFi.

Along with meme cash and RWAs, two different tales more likely to lead the bull cycle are Synthetic Intelligence (AI) and DePIN networks of decentralized bodily infrastructure.