Disclaimer: The knowledge offered on this article is a part of sponsored/press launch/paid content material meant for promotional functions solely. Readers are suggested to train warning and do their very own analysis earlier than taking any motion associated to the content material of this website or the Firm. Coin Version shall not be answerable for any loss or harm incurred on account of or in reference to using mentioned content material, services or products.

CoinEx Analysis has launched its complete cryptocurrency market report for July, highlighting important volatility, notable recoveries and key developments all through the month.

Volatility and market restoration

The cryptocurrency market noticed important volatility in July. Bitcoin costs initially fell to a low of $53,500 as a result of German authorities sell-off, however subsequently confirmed outstanding resilience. The value shortly rebounded and even touched $70,000 after the Trump assassination incident. On the finish of the month, Bitcoin oscillated between $64,000 and $66,000. This value motion demonstrates the maturity of Bitcoin as an asset and highlights market members' confidence in its long-term worth.

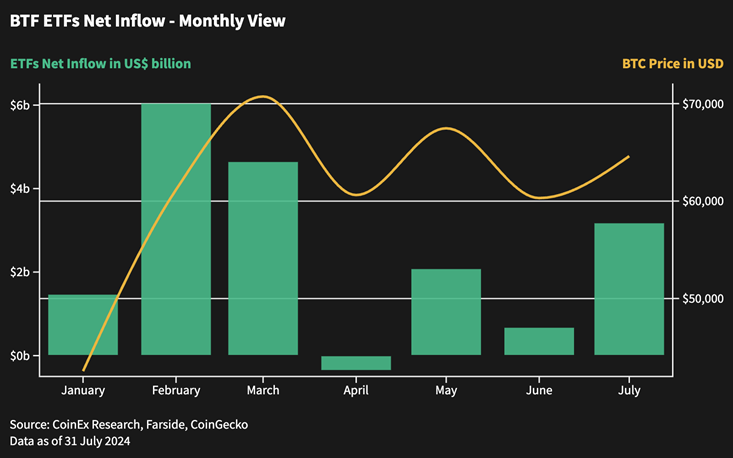

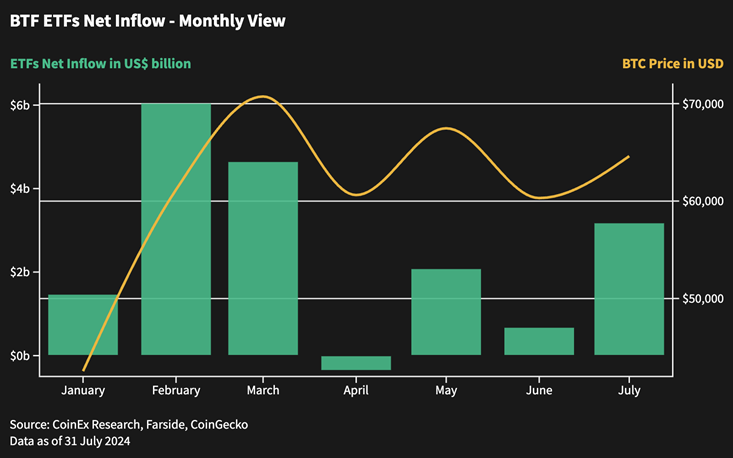

A powerful inflow of ETFs

Bitcoin ETFs carried out extraordinarily properly in July, with internet inflows reaching $3.1 billion, a major enhance from June's $666 million. This knowledge displays the rising curiosity of institutional traders in Bitcoin and signifies an accelerating convergence between conventional monetary markets and cryptocurrency markets. The robust inflow of ETFs gives further liquidity and stability to the Bitcoin market, serving to to reasonable short-term value volatility and laying the groundwork for future value development.

The affect of the German authorities sell-off

The sale of roughly 50,000 Bitcoins by the German authorities has introduced appreciable provide stress to the market, equal to an outflow of roughly $3 billion. Nonetheless, the market has demonstrated a formidable absorption capability. This selloff didn’t result in a market crash, however it helped create a powerful stage of help for Bitcoin within the close to time period. Concurrent internet inflows of $1 billion into ETFs additional offset this stress, highlighting institutional traders' confidence in bitcoin and the general enchancment in market liquidity.

The distribution problem of Mt. Gox

How the chapter case of Mt. Gox, the market faces one other wave of potential provide stress. Presently, 59,000 bitcoins (out of a complete of 142,000) have been distributed to lenders by way of the Kraken and Bitstamp exchanges. Whereas this will likely elevate some issues, provided that the market has efficiently absorbed the large-scale German authorities sell-off, business specialists typically consider that this new stress on provide may also be successfully managed. Furthermore, for the reason that distribution course of will take a number of months, its affect may be subtle, lowering the instant market shock.

Political implications

July's Nashville Bitcoin Convention was one other spotlight of the month, with speeches by presidential candidates Donald Trump and Robert F. Kennedy Jr. garnering widespread consideration. Trump proposed making a strategic bitcoin reserve for the nation, whereas Kennedy urged the Treasury Division purchase 550 bitcoins a day till the US has a reserve of 4 million bitcoins. These proposals replicate the rising acceptance of cryptocurrencies within the political sphere and, if applied, might result in a extra favorable regulatory atmosphere that may appeal to extra institutional funding.

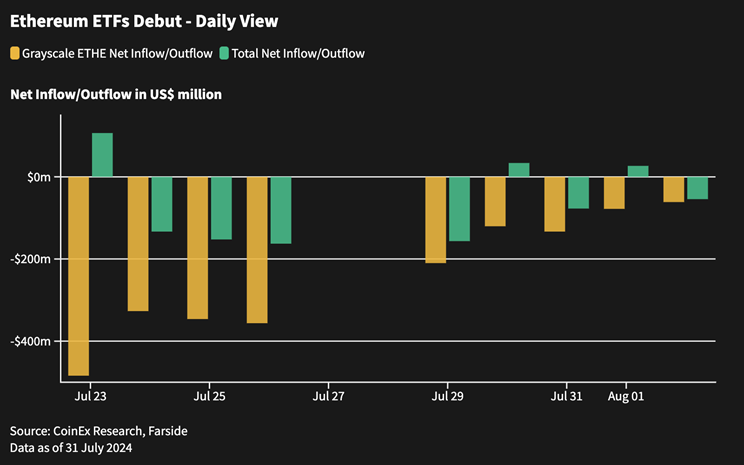

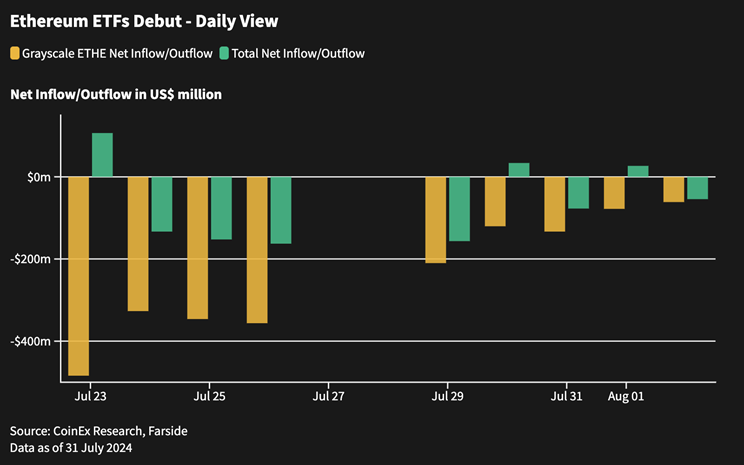

Launch of Ethereum ETF

Following the approval of Bitcoin ETFs in January of this yr, 9 spot Ethereum ETFs started buying and selling on July twenty second, marking one other necessary milestone within the cryptocurrency business and regulatory atmosphere. Nonetheless, the primary week of buying and selling noticed a internet outflow of $542 million, with Grayscale's ETHE fund alone seeing an outflow of $1.97 billion. This preliminary efficiency noticed the value of Ether drop from round $3,500 earlier than the ETF launched to round $3,000 by the top of July. Analysts count on that if the present charge of outflows continues, the outflow stress from Grayscale's ETHE might ease inside 1-2 months.

Solana's Rise

Solana is an impressive participant on this bull market whose ecosystem is primarily powered by the meme token sector. The Pump.enjoyable platform emerged because the winner, producing greater than 1.5 million meme tokens and producing 510,000 SOL income. From the chain knowledge, Solana surpassed Ethereum in each day lively customers and each day transactions, and even surpassed Ethereum in DEX commerce quantity for the primary time in July, though a few of that quantity may be attributed to “wash buying and selling”. This pattern displays the variety and velocity of innovation of the cryptocurrency ecosystem, whereas highlighting the intensifying competitors between completely different public chains.

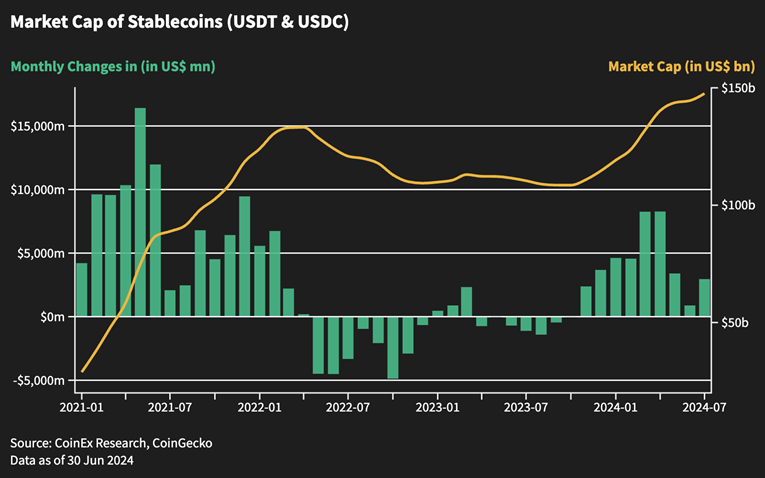

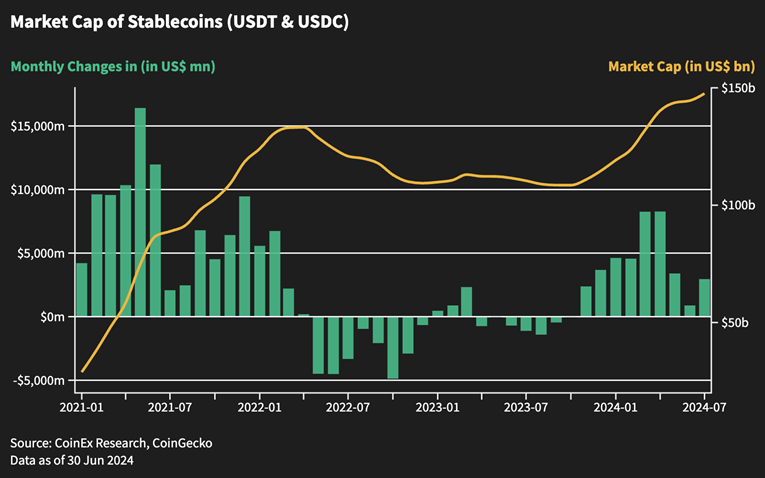

Influx of stablecoins will increase, market liquidity improves

Stablecoin inflows started to get well in July with internet issuance of roughly $290 million, approaching the degrees seen in December of final yr. This development signifies bettering market liquidity and will sign the onset of one other wave of market development. In comparison with August 2021, when stablecoin inflows continued to develop after a two-month correction, fueling subsequent market development, business insiders count on even stronger stablecoin inflows in August and September this yr, probably bringing extra liquidity and market development momentum.

Conclusion

Regardless of the challenges and volatility in July, the cryptocurrency market, significantly Bitcoin, confirmed outstanding resilience and maturity. Sturdy ETF inflows, bettering liquidity and growing institutional curiosity paint a optimistic image for Bitcoin. Nonetheless, traders ought to stay alert to ongoing components such because the distribution of Mt. Gox and broader financial traits. The cryptocurrency market continues to evolve, with key occasions such because the rise of Solana and the launch of the Ethereum ETF pointing to a dynamic and aggressive panorama forward.

About CoinEx

CoinEx is a worldwide cryptocurrency trade that was based in 2017 to facilitate buying and selling. The platform gives a spread of providers together with spot and margin buying and selling, futures, swaps, automated market maker (AMM) and monetary administration providers to greater than 5 million customers in additional than 200 international locations and areas. Based with the unique intent of making an equal and respectful cryptocurrency atmosphere, CoinEx is concentrated on eradicating conventional monetary obstacles by providing easy-to-use services and products that make cryptocurrency buying and selling accessible to everybody.

CoinEx Analysis stays dedicated to offering in-depth evaluation and perception into the evolving cryptocurrency market and serving to traders navigate the complexities and alternatives that lie forward.