- Egrag Crypto shares a graph of XRP, alerts the potential future motion of costs.

- XRP is traded for $ 2.23, which is 5.8% in 24 hours and seven.3% within the final month.

- Level $ 2 is a key degree of assist, whereas $ 3.00 stays a zone of resistance.

Ripple's XRP has lately drawn a renewed neighborhood curiosity, despite the fact that its worth is directed to strain down. Regardless of the good regulatory victory with the discharge of the SEC XRP motion, he has not seen a pointy enhance within the worth that many anticipated, presently traded round $ 2.23 after ~ 5.8% of the day by day decline.

This worth motion assessments the extent of important assist, which triggered analysts to think about shut dangers in opposition to longer -term bulls, a few of them goal as much as $ 15.

Assessments XRP Important 2,22 $ Assist: What reveals Egrag's chart

The analyst “Egrag” emphasised the significance of degree $ 2.22 for XRP. His graph evaluation identifies this worth level as key fast assist, the world was examined a number of instances earlier.

Based on Egrag, if the client efficiently defended this degree, it could be more likely to mirror again to the principle space of resistance round $ 3. Nevertheless, a everlasting break beneath $ 2.22 might enhance quick -term bear strain and doubtlessly lead the XRP to repeat the decrease assist zones.

Lengthy -term view: Analyst repeats a goal of $ 15 after revenue 600%

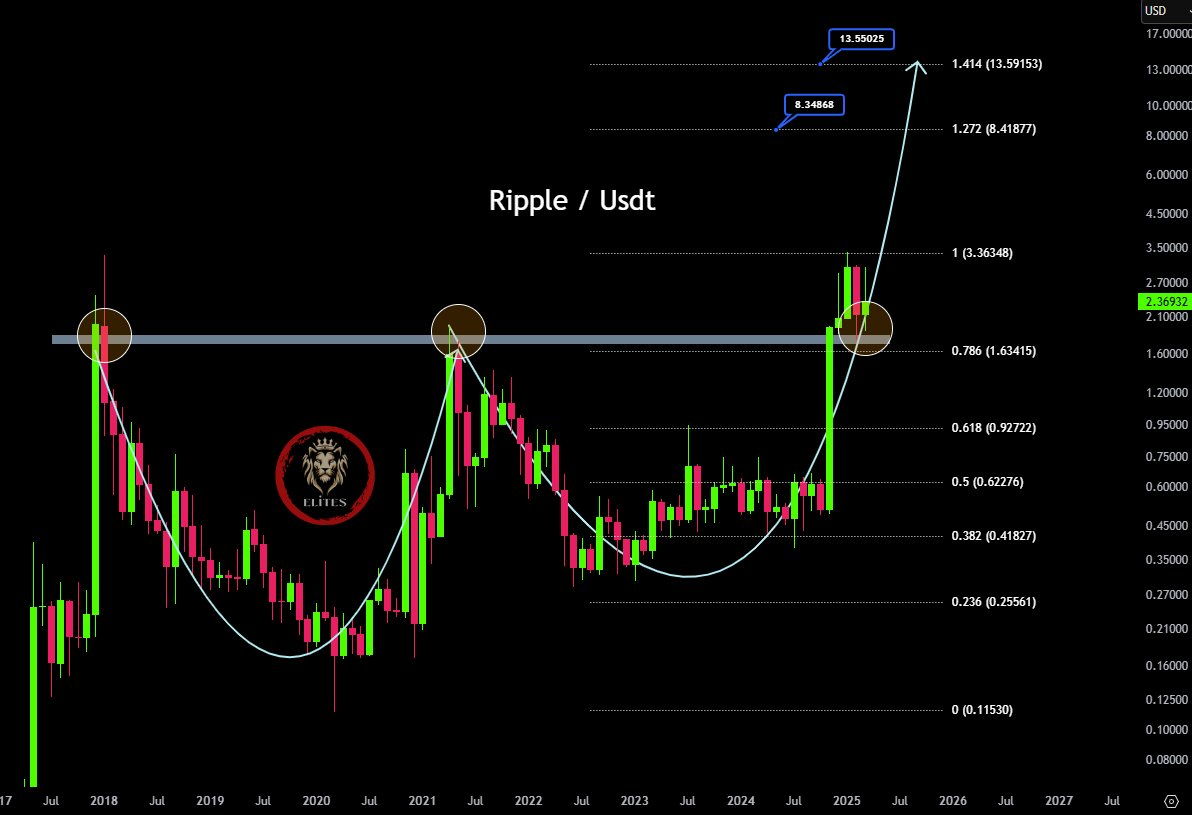

The “Cryptoelite” analyst, which gives considerably extra bull lengthy -term perspective, has lately reaffirmed a daring worth goal of $ 15 for XRP. Particularly, this analyst reportedly shared this outlook for the primary time when XRP traded close to $ 0.50.

They quote a decisive XRP break over multi-year resistance (previously $ 1,95-2.10) and potential creation of a big cup and deal with sample as a key technical affirmation.

Cryptoelite evaluation, based mostly on Fibonacci extensions, factors to potential targets of practically $ 8.34 and at last $ 13.55-15, if sturdy bull dynamics continues and attracts parallels to earlier market cycles.

Associated: Anatomy 600% Name: Analyst explains why XRP's $ 15 goal prices

Regulatory readability and hopes ETF stay key catalysts

Based on these bull technical outlooks, constructive shifts within the US regulatory panorama for XRP are important. Amongst different issues, researcher “Anders” factors to the discharge of the SEC case to get rid of nice authorized uncertainty for Ripple. He additionally notes that the abolition of 122 (SAB 122), which now permits regulated US banks to supply a crypto binding – a growth that might profit the secure provide of ripple and foster institutional adoption.

Associated: “You don’t have any concept”: Laborious analytite graphs TIPS at actually big worth overvoltage

Hypothesis surrounding the potential American spot XRP ETF remains to be rising. Nate Geraci, a properly -known ETF knowledgeable, known as such an ETF “inevitable”. Market predictions additionally mirror excessive neighborhood expectations and lately present 82% perceived probability of approval, which is more likely to happen this yr. ETF approval is extensively perceived as a possible recreation converter that is ready to entice important institutional capital to XRP.

Renunciation of duty: The data on this article is just for data and academic functions. The article doesn’t symbolize monetary recommendation or recommendation of any form. Coin Version just isn’t answerable for any losses as a result of using content material, services or products. It is strongly recommended that the readers ought to proceed with warning earlier than taking any measures with the corporate.