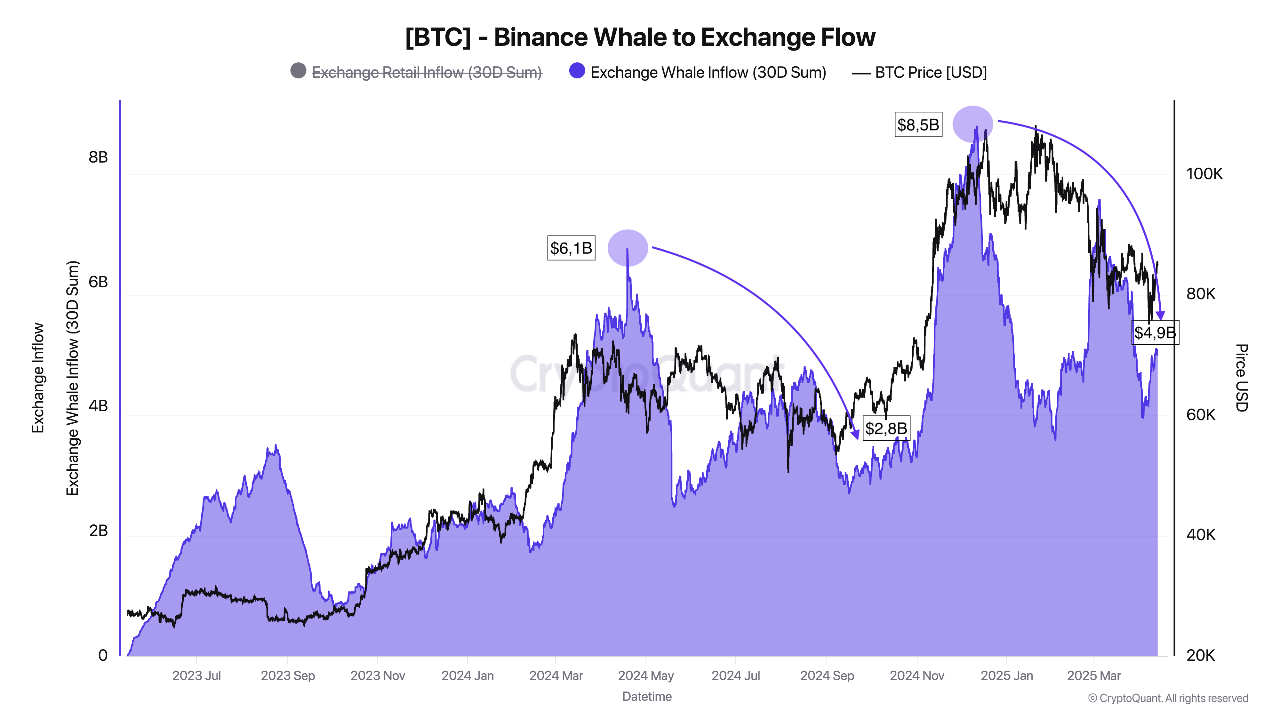

- The Binance Whale The Whale has fallen by greater than 3B, indicating lowered gross sales strain.

- In keeping with the analyst Kingo Mevsimi, potential restoration might take months.

- Fast ranges of help for BTC are $ 83,195 (0.618 FIB) and $ 85,704 (0.786 FIB).

Bitcoin finds stability round $ 84,500 after a prolonged correction section. With stabilizing whale habits, the primary institutional lengthy wager has hit the market and key technical indicators transferring to the bull, the sentiment slowly turns into optimistic for traders.

Specifically, in response to analyst Darkfost, current information on the binance chain present that giant holders or whales don’t present the habits of panic.

Chain view: Whale habits indicators much less gross sales strain

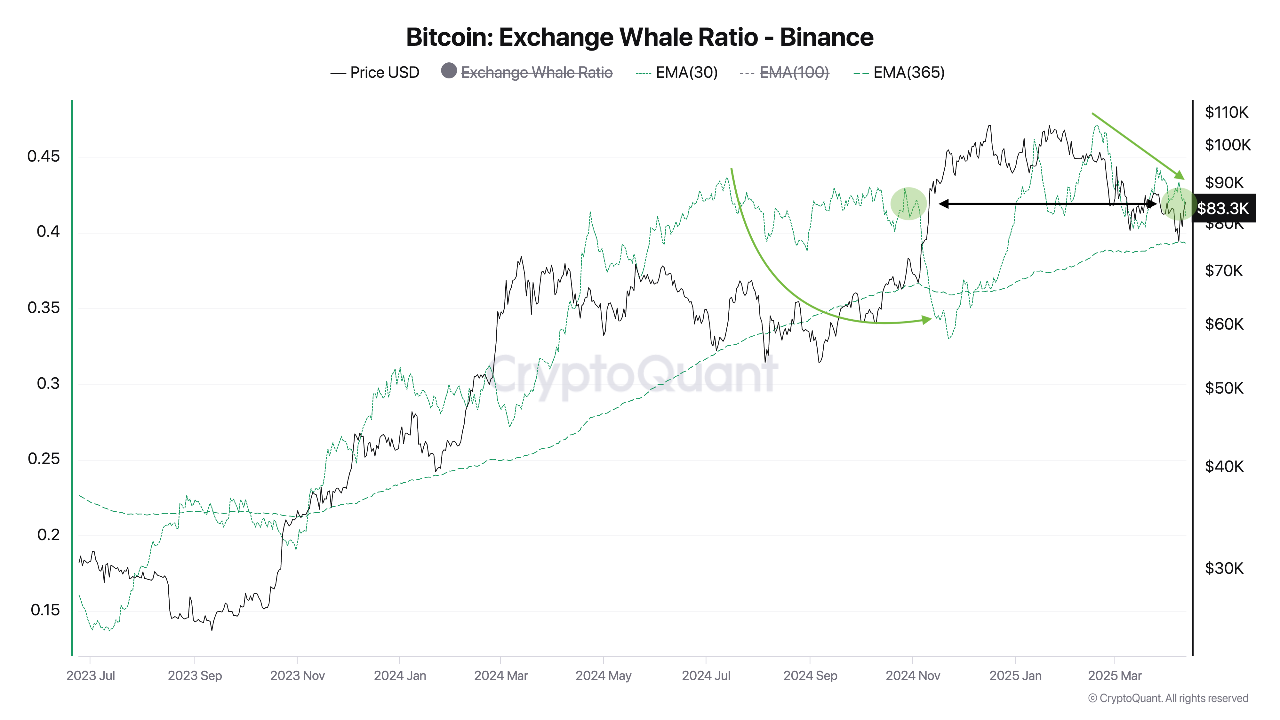

Darkfost famous that the 365 -day gliding common of the trade whale ratio is on a constant upward pattern.

Because of this whales have a higher impact on the Binance Fund for longer durations and point out primary beliefs.

Nevertheless, the 30 -day diameter of the identical metric is reducing and returns to the final stage on the finish of 2024. This quick -term decline

The bay of this, the whole inflow of Binance whales dropped by greater than $ 3 billion, a step that displays the habits that happens throughout earlier repairs.

Associated: “Ate up the Clock”: Hayes combines the stress of the market with coming bitcoin positive aspects

General, this pattern means that whales are at the moment not dashing to the east. As an alternative, they in all probability determine to take a seat firmly and keep away from an incredible sale.

Care Rigorously: Historical past reveals that restoration might take time

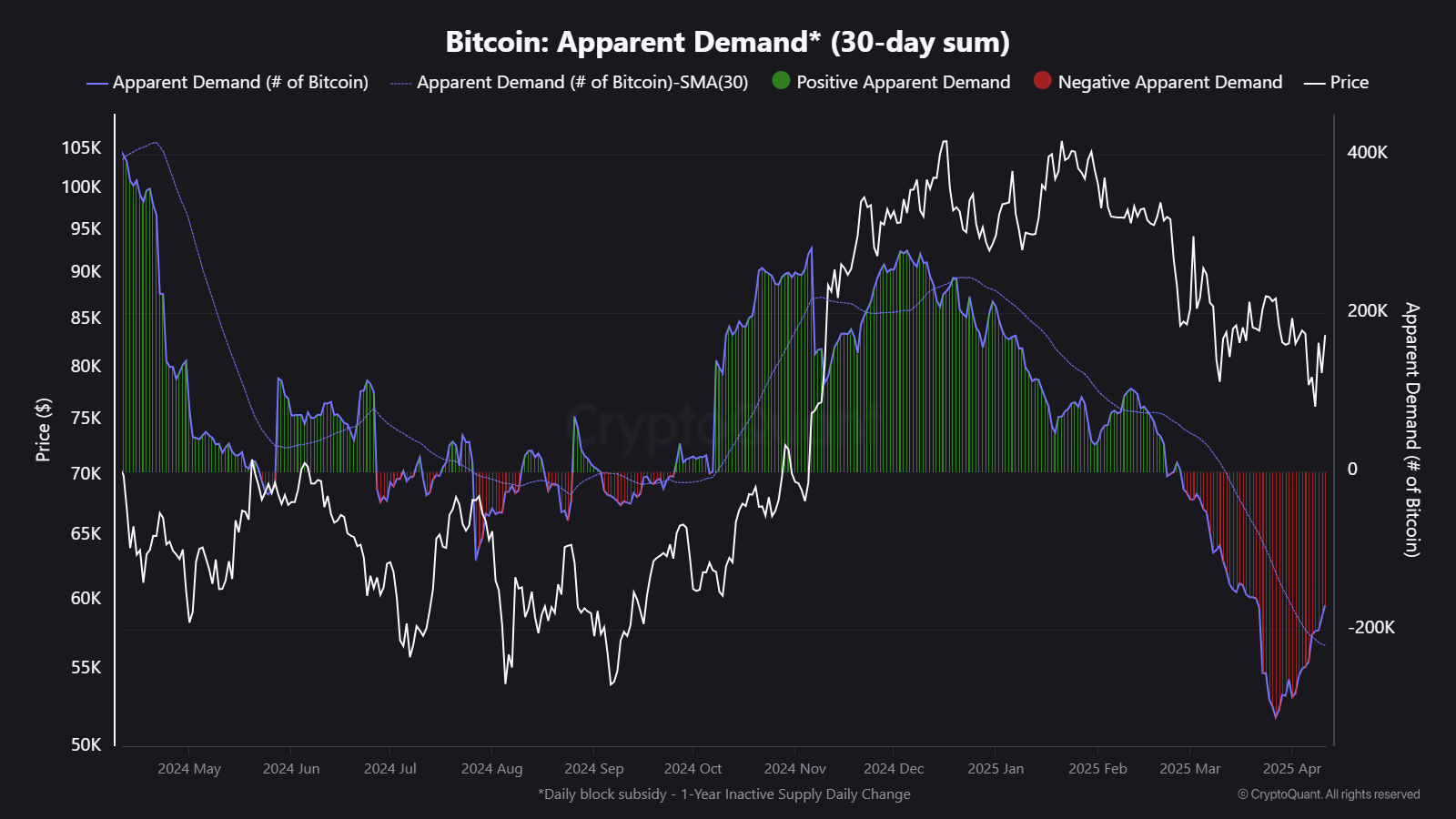

Regardless of the improved technical and chain, some analysts urge persistence. In keeping with analyst Kripto Mevsimi, historic formulation, particularly from cycle 2021, they present that even when metrics like demand or value start to bounce, the actual structural restoration might take months.

Throughout the earlier cycles, demand metrics remained unfavorable or virtually zero for a very long time earlier than any sustainable bull pattern.

Whereas the current 30 -day 30 -day bitcoins demand reveals reflection, it might probably replicate short-term reduction, unconfirmed accumulation or definitive backside. Everlasting quantity and time to buy a full market are nonetheless required to verify the complete market.

Technical setting presents a constructive quick -term picture

The each day chart of bitcoins at the moment corresponds to cautious optimism. Retracement Fibonacci depicted USD 74,434 from the native backside to the highest to $ 88,772, displaying that Bitcoin regenerated key ranges.

BTC is at the moment traded above 0.618 ($ 83,195) and exams a stage of 0.786 ($ 85,704). The earlier most of $ 88,772 stays a right away main resistance.

Associated: The Freedom of Digital Property in North Carolina appears to be like extra like a bitcoin account

If the worth penetrated $ 88,772, one other predominant purpose is to be 1.618 Fibonacci extension to $ 97,633, adopted by doable actions to $ 111,971, $ 126,309, and even $ 135,170 in everlasting UPTRED.

The flicks comparable to MacD additionally help the bull's view. The MacD line has lately exceeded the sign line and the histogram stripes rise to a optimistic space. This can be a traditional sign that patrons regain management.

Renunciation of accountability: The data on this article is just for data and academic functions. The article doesn’t signify monetary recommendation or recommendation of any form. Coin Version is just not chargeable for any losses on account of the usage of content material, services or products. It is strongly recommended that the readers ought to proceed with warning earlier than taking any measures with the corporate.

The ratio of exchanged whales to binance:

The ratio of exchanged whales to binance: