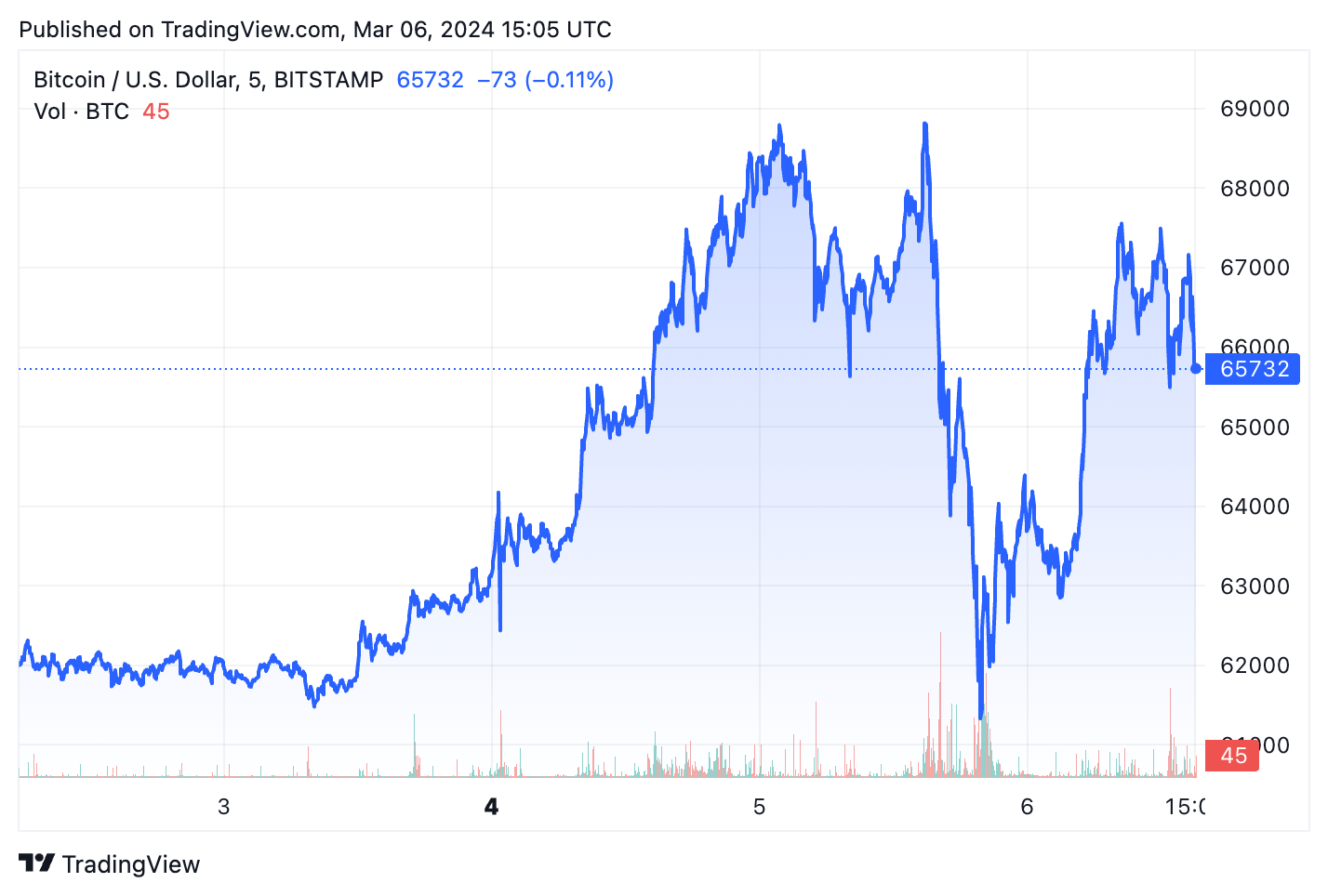

On March 5, Bitcoin hit the all-time excessive it posted in November 2021, breaking by $69,000 within the late afternoon UTC. Nevertheless, Bitcoin’s run at its ATH was extraordinarily quick and was shortly adopted by a pointy 14% correction that pushed its value all the way down to $59,300. Early on the morning of March 6, BTC regained a few of its misplaced floor however struggled to stabilize at $66,000.

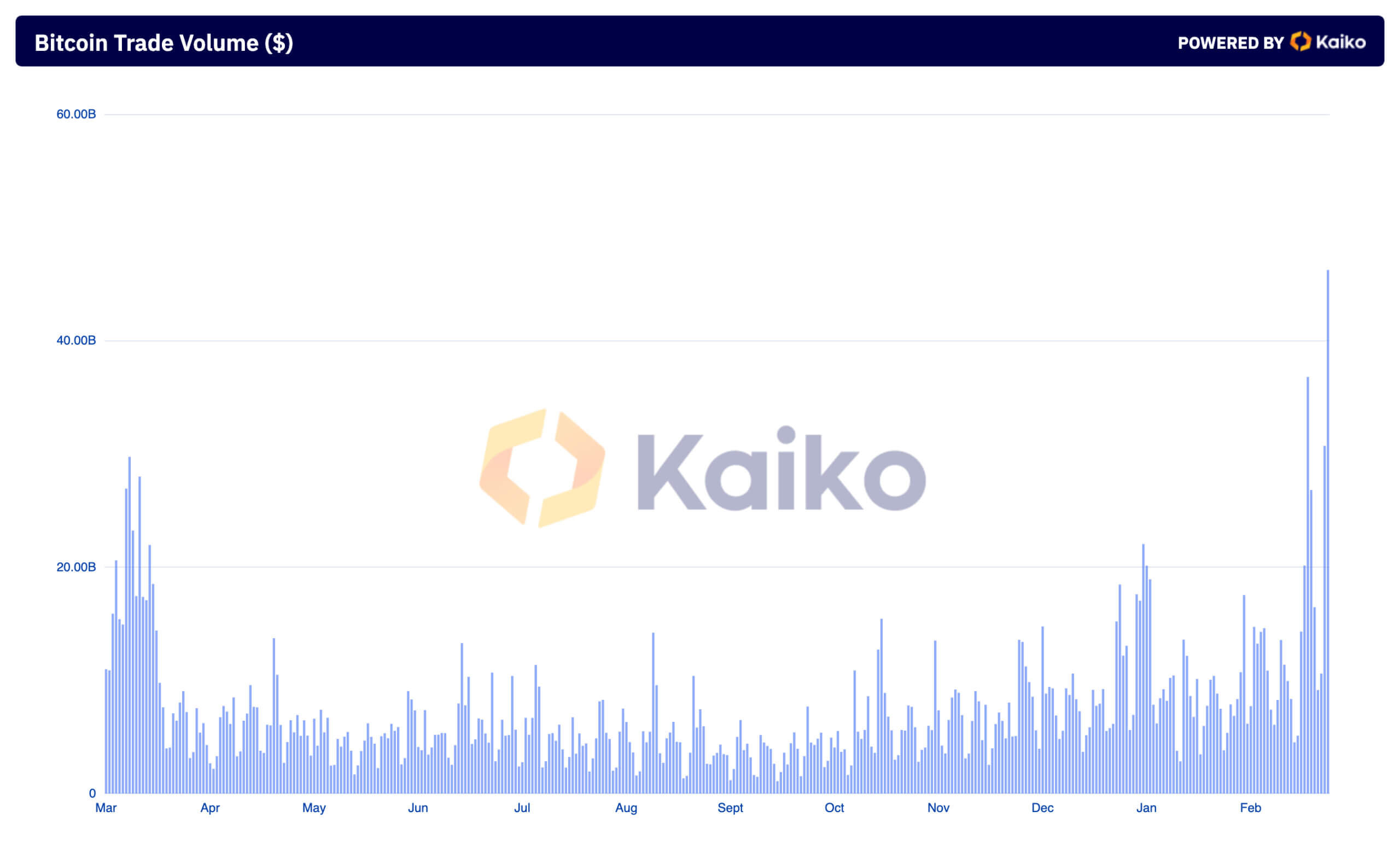

Intense market value volatility on Tuesday, March 5 was mirrored in report buying and selling volumes on centralized exchanges. With little knowledge on quantity recorded on OTC boards and delays in knowledge availability from spot ETFs, CEX quantity serves as the very best barometer for market exercise on the subject of Bitcoin.

An evaluation of fromcrypto’s Kaiko knowledge revealed a 405% enhance in commerce quantity between March 2 and 5 – rising from $9.15 billion to $46.25 billion. This surge adopted Bitcoin’s risky value motion and confirmed merchants’ aggressive response to cost fluctuations.

The rise in deal quantity was mirrored within the enhance within the variety of offers, which escalated from 10.12 million to 32.79 million over the identical interval. This means elevated engagement available in the market and presumably a better inflow of retail and institutional traders.

Modifications noticed in common commerce measurement additional affirm this. Between March 2 and March 5, the typical commerce measurement elevated by greater than 55%, leaping from $904 to $1,410, indicating bigger capital actions available in the market as merchants rushed to reap the benefits of value volatility.

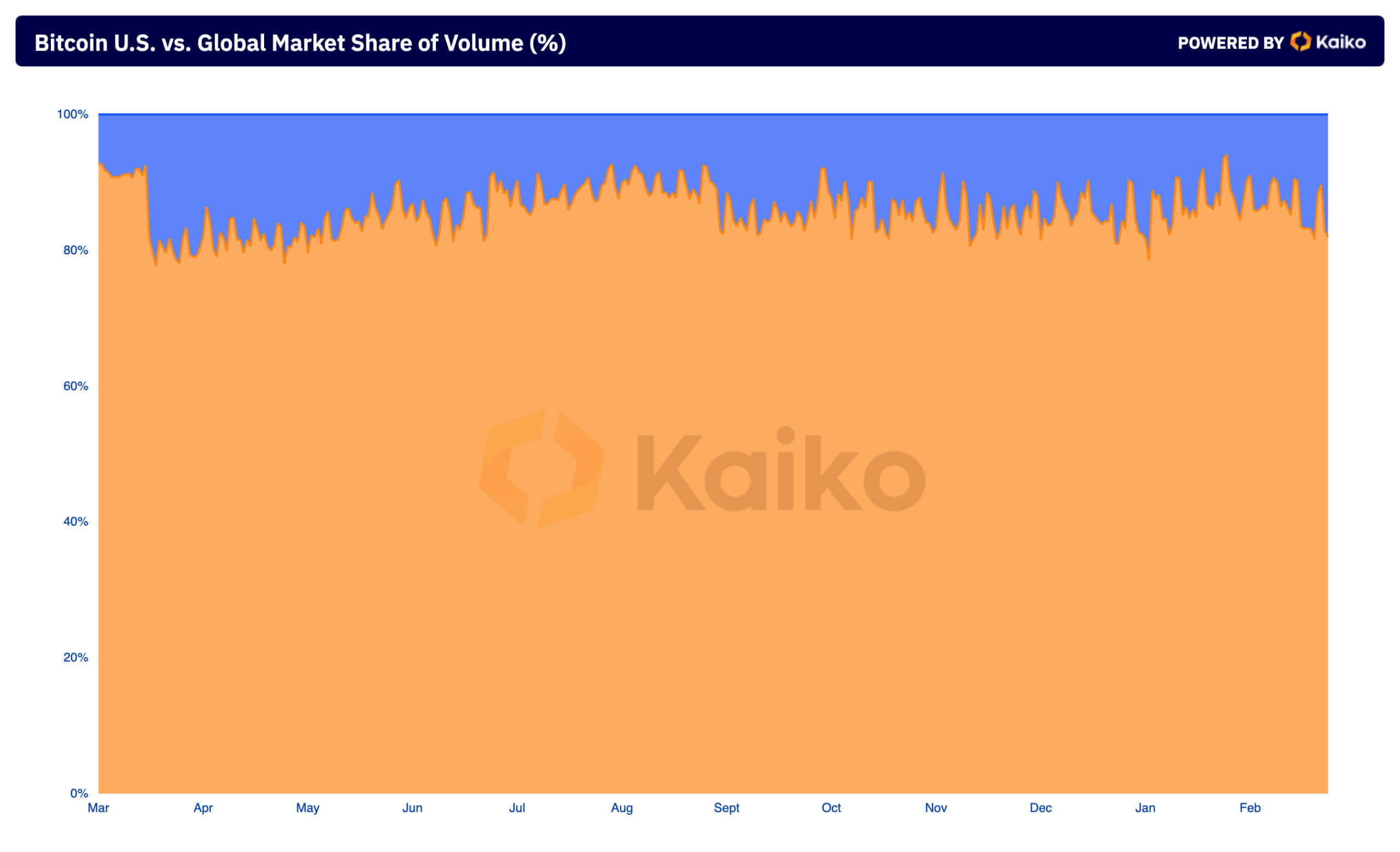

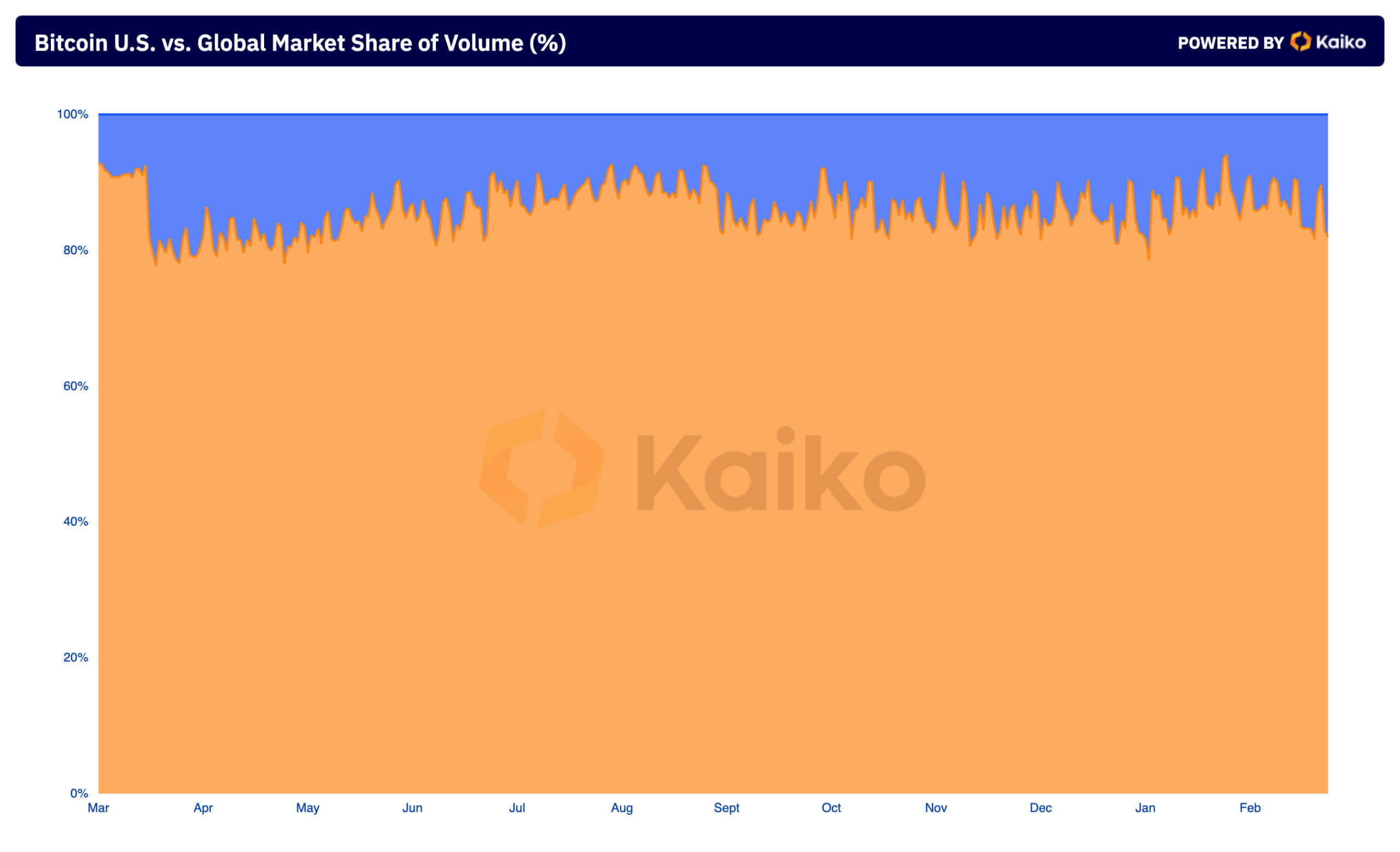

An evaluation of the distribution of buying and selling quantity between the US and world markets reveals the place most of that quantity got here from. The worldwide market persistently dominates Bitcoin buying and selling quantity, as beforehand lined by fromcrypto. Nevertheless, the US market’s share of quantity elevated from 11.6% on March 2 to 18.05% by March 5, indicating a big enhance in curiosity from US-based traders throughout this risky interval.

Binance saved up with the long-term development and managed a big majority of the worldwide buying and selling quantity with 51.54%, whereas Coinbase led the US alternate market with a share of 57.89%. The dominance of Binance and Coinbase over the crypto market has been well-known for years, and the 2 exchanges persistently account for a good portion of world buying and selling exercise. The excessive focus of buying and selling on these two exchanges, particularly throughout this week’s excessive volatility, reveals that merchants desire to stay to high-liquidity, big-name platforms.

Coinbase’s current points with account balances have affected the variety of trades made by the platform, resulting in a big outflow of BTC from the alternate. Nevertheless, the influence on the alternate’s general buying and selling quantity seems to have been minimal, as evidenced by Coinbase’s dominance of the US market.

The extraordinary value volatility seen throughout the week attracted important buying and selling exercise and attracted each current and new market members. The rise in quantity, variety of trades and commerce sizes reveals that merchants have been aggressively speaking with the market and responding to the rise in Bitcoin with bigger commerce volumes. This motion demonstrates the essential position of centralized exchanges in facilitating liquidity and offering value discovery, particularly throughout important market actions.