BTIG has raised its worth goal for cryptocurrency miners Core Scientific Inc (NASDAQ: ) to $15 from $10, citing new information middle contracts and development potential within the mining business.

BTIG's BTC mining basket, which incorporates 14 corporations, has an combination hash fee of about 138 EH, which is 23% of the worldwide hash fee. The hash fee is predicted to extend to 153 EH by 2025, because of new units that enhance fleet effectivity.

The value of Bitcoin is at the moment round $62,000, up 45% year-to-date, with miners' margins benefiting from increased costs. The worldwide hash fee averaged 582 EH in June, down from 600 EH in Could, however up 57% from final 12 months. Community problem is steadily rising, up 60% year-over-year and up 16% year-over-year.

In the meantime, Core Scientific introduced a 200 MW high-performance computing (HPC) contract with CoreWeave, adopted by one other 70 MW of knowledge middle contracts. The information despatched Core Scientific shares down almost 90% in latest weeks. BTIG identified that the transfer to multi-year, fixed-price contracts has allowed some miners to decouple from bitcoin costs, which have fallen 11% because the begin of June.

“The shift to multi-year fixed-price contracts noticed CORZ and a few miners decouple from the worth of BTC, with Terawulf up over 100% and Iris up round 70% throughout this era,” BTIG mentioned.

The race for entry to energy has intensified amongst publicly listed BTC miners as a consequence of rising demand from information middle corporations. “For each 100MW of energy transformed or turned on for HPC, that's 5-6 EH much less for the worldwide hash,” BTIG famous.

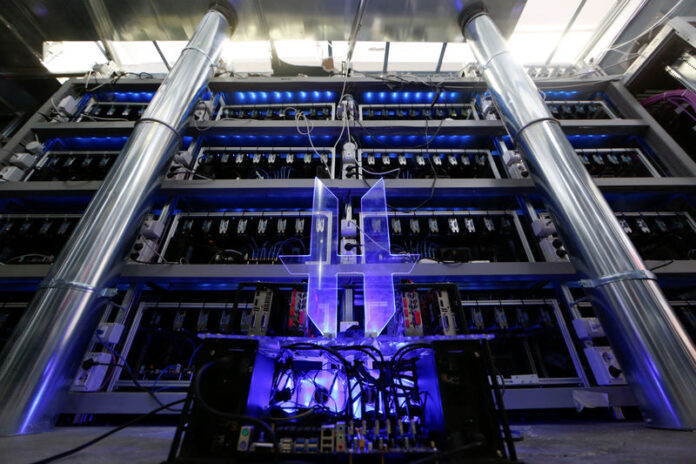

Throughout website visits to Riot's Corsicana facility, which is concentrating on round 1 GW, and Core Scientific's Denton facility, BTIG discovered that the industrialization of BTC mining has occurred. Riot's facility in Corsicana is predicted to succeed in 31 EH by the top of this 12 months and 41 EH by 2025.

The report make clear Bitdeer's investor discussions, which revealed a deal with designing mining rigs and changing present rigs for HPC computing. “The low-hanging fruit is its Washington manufacturing unit close to a Microsoft (NASDAQ: ) information middle with potential conversions in Ohio and Norway,” BTIG mentioned.

BTIG values Core Scientific's 286MW mounted HPC contracts at $9-10 per share, assuming 15x EBITDA. “Information middle reits are buying and selling at round 20 instances EBITDA in 2025,” BTIG added. With a goal of 500MW for HPC by 2028, BTIG expects a further $5 per share, justifying a brand new worth goal of $15.