- BlackRock's BUIDL Fund moved $3.35 million in USDC to a number of addresses.

- Ondo Finance obtained a outstanding switch of 1.102 million USDC.

- Injective has launched a tokenized index for the BUIDL fund, providing on-chain entry to leveraged US Treasuries.

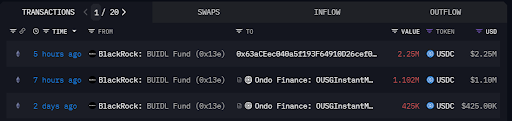

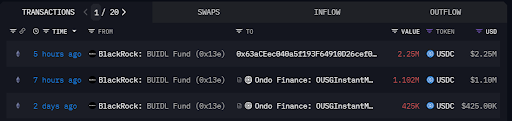

BlackRock's BUIDL Fund continued its rising involvement within the cryptocurrency area, most lately transferring 3.35 million USDC to a number of addresses, together with Ondo Finance, based on Arkham information. The transfer builds on BlackRock's rising exercise in decentralized finance (DeFi), notably its transfer into tokenization of actual belongings (RWA) earlier this 12 months.

Current BUIDL fund transactions embody the switch of 1.102 million USDC to Ondo Finance, a platform specializing in tokenized monetary companies. Quickly after, one other 2.25 million USDC went to the newly recognized handle.

The transfers are the most recent in a sequence of serious fund strikes over the previous few weeks, indicating BlackRock's rising dedication to DeFi.

Strategic positioning and tokenized finance

Whereas the precise goal of those transfers shouldn’t be but public, they level to BlackRock's strategic place inside the decentralized monetary ecosystem. Ondo Finance has turn into a big recipient of fund transfers, highlighting its rising significance within the tokenized monetary sector.

Along with these developments, Injective has launched a tokenized index for the BUIDL fund, which helps BlackRock's DeFi ambitions. This new product allows customers to entry leveraged US Treasuries instantly on-chain and strengthens BlackRock's function in bridging conventional finance and DeFi.

Past USDC transfers, BlackRock's foray into cryptocurrency continues to draw consideration, notably with its spot bitcoin ETF. Stories indicated that the ETF obtained a big allocation of BTC from Coinbase Prime.

BlackRock additionally up to date its custodial settlement with Coinbase, including a 12-hour window for Bitcoin ETF withdrawals. This transformation goals to streamline transaction processing for cryptocurrency ETFs.

As well as, BlackRock operates its personal blockchain node that verifies its BTC balances and gives transparency to its shoppers. This permits BlackRock to verify each day that the Bitcoins held in its ETFs are actual and never simply “paper BTC”.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shall not be responsible for any losses incurred on account of the usage of mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.