BlackRock's iShares Bitcoin Belief (IBIT) has outperformed all exchange-traded funds (ETFs) launched up to now decade by way of whole property.

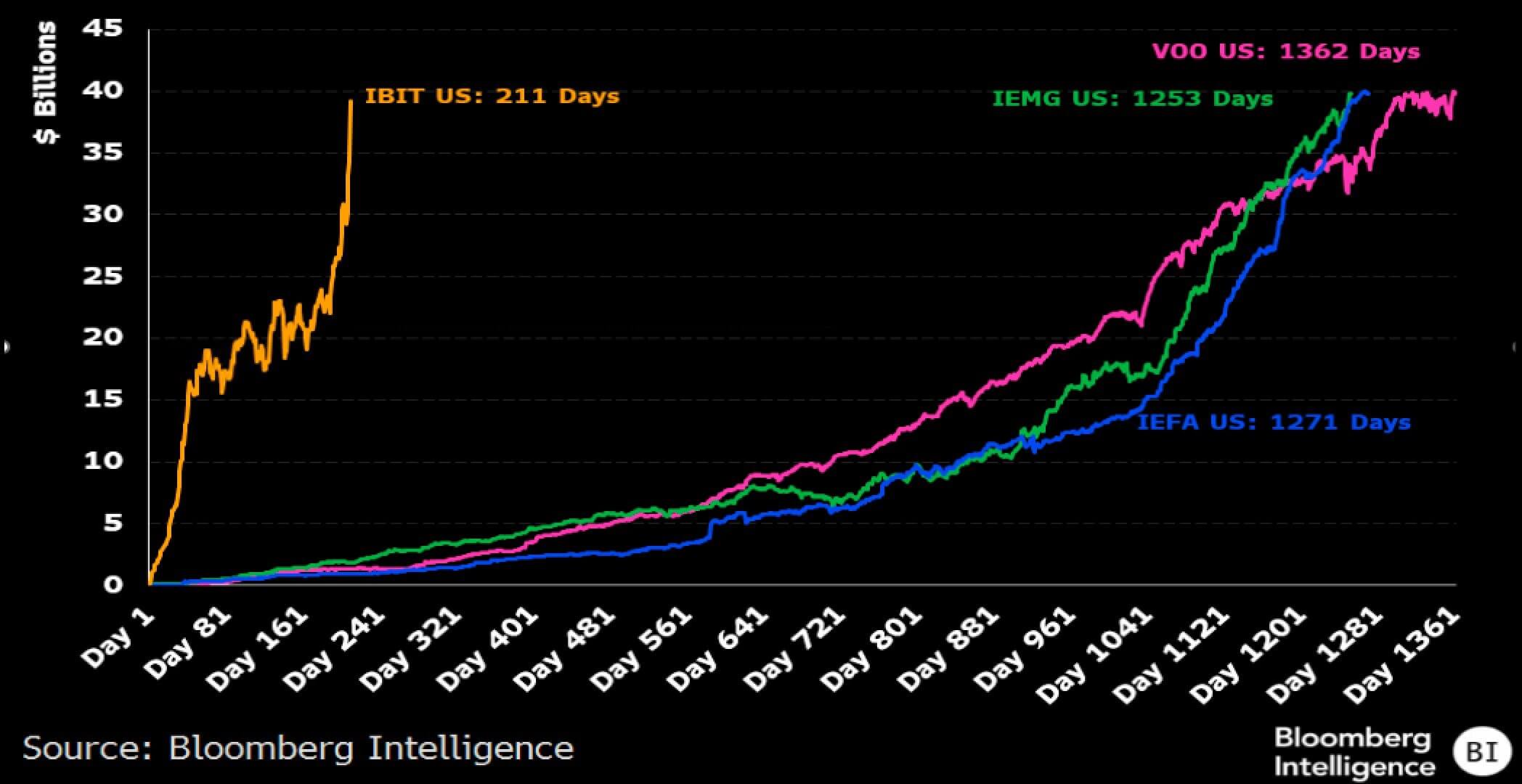

On Nov. 13, Bloomberg ETF analyst Eric Balchunas reported that IBIT reached $40 billion in property — simply two weeks after it hit $30 billion. This achievement got here in a report 211 days, which is sort of 6x lower than the earlier report of 1,253 days set by the iShares Core MSCI Rising Markets ETF (IEMG).

At simply 10 months outdated, IBIT has already develop into one of many prime 1% ETFs by property. It has surpassed the overall property of all 2,800 ETFs launched over the previous decade, a exceptional achievement given that almost all ETFs take years to build up substantial worth.

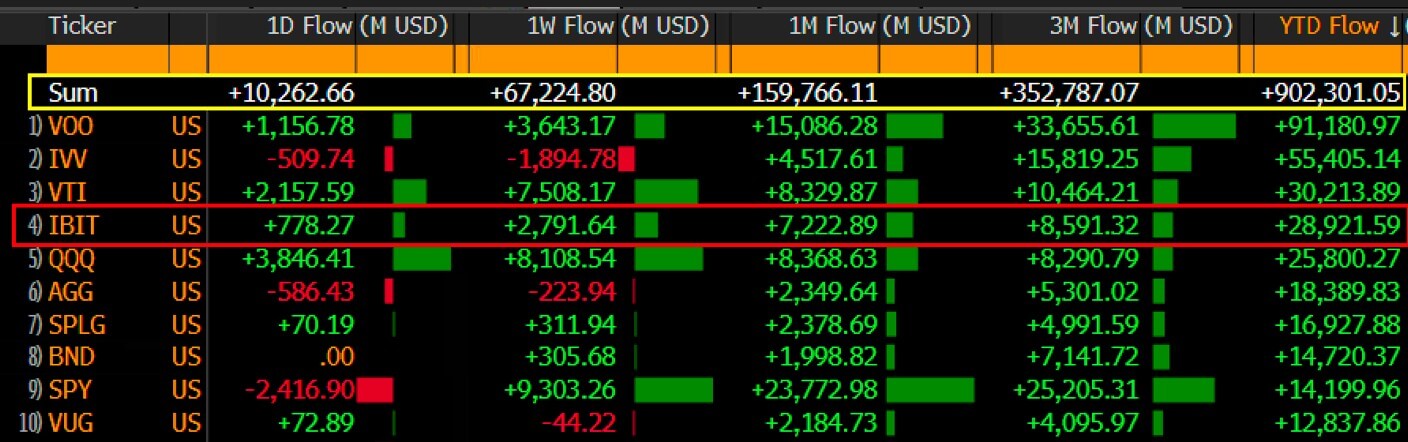

In the meantime, IBIT can be fourth amongst US ETFs for 2024 inflows, attracting greater than US$28 billion up to now. It’s the solely crypto-related ETF within the prime 10.

These spectacular numbers spotlight the rising demand for bitcoin publicity in mainstream funding portfolios. Its success additionally suggests the sturdy momentum behind digital asset ETFs might develop into a everlasting fixture in conventional finance.

The submit BlackRock's Bitcoin ETF Climbs to High 1% in Report 211 Days appeared first on fromcrypto.