Bitget Pockets, a cryptocurrency pockets with native BWB token, is dedicated to offering a complete person expertise that prioritizes safety and ease of use. On this interview, we communicate with Alvin Kane, COO of Bitget Pockets, to dive into the challenges of creating a Web3 pockets and Bitget Pockets's method to overcoming them. He additionally discusses the upcoming Bitget Onchain Layer designed to simplify person interplay with the Web3 world.

- Contemplating the present state of the {industry}, what are crucial includes a pockets ought to have as a way to compete and reply to person wants?

After conducting in depth analysis on person wants, we concluded that there are 4 predominant issues that drive person engagement in Web3 and crypto: Asset administration, asset discovery, on-chain buying and selling, and earnings. Amongst them, on-chain buying and selling and incomes are essentially the most distinguished focal factors. To fulfill these wants, Bitget Pockets has invested closely in constructing a complete buying and selling platform that helps on the spot and cross-chain swaps throughout all kinds of blockchains. Bitget Swap, our native in-wallet swap function, is ready to combination liquidity throughout a whole lot of various blockchains to supply customers with essentially the most optimum buying and selling paths obtainable. On the identical time, we’ve additionally cultivated a sturdy incomes heart that gives customers with numerous alternatives to earn airdrops and rewards for interacting with chosen DApps. To convey much more worth to our customers, we’ve additionally created a local launchpad in our pockets that can even provide customers early entry to rising tasks, permitting customers to profit from their time on Web3.

All of those options are designed particularly to satisfy the person wants we've recognized, and we imagine that is what offers us the mandatory edge to distinguish ourselves from the competitors.

2. Going deeper into safety issues, what are the commonest safety considerations of web3 pockets customers? Are there any considerations that can’t be resolved but?

Web3 wallets are primarily divided into escrow and non-escrow varieties, every differing by way of management, comfort, safety and threat.

Wallets are managed by third events equivalent to exchanges or pockets service suppliers, that means that customers don’t instantly personal their personal keys. This setup has a number of benefits: customers wouldn’t have to again up and handle their personal keys themselves, making escrow wallets simpler to make use of. Moreover, these wallets assist restoration via id verification in case of entry loss, equivalent to forgotten passwords, and provide customer support help.

Nevertheless, escrow wallets carry sure dangers. The danger of centralization is a serious concern, as third-party platforms can undergo from hacking or different points main to personal key leaks and lack of person funds. Belief threat is one other issue that requires customers to belief {that a} third-party firm won’t misuse or lose their funds. Lastly, there’s regulatory threat as some nations might impose rules on escrow platforms and doubtlessly freeze or seize person funds.

Then again, non-escrow wallets give customers full management and administration of their very own personal keys, permitting them to securely handle their crypto belongings. This setup affords a number of benefits: higher privateness and safety, since solely the person can management his property. So long as the personal key stays safe, the assets are secure.

Nevertheless, rogue wallets additionally convey dangers. The administration threat is critical as a result of customers want a sure stage of technical data to guard their personal keys. If the personal secret’s misplaced or stolen, the belongings can’t be recovered. One other concern is the danger of phishing; customers might inadvertently reveal their personal keys or authorize transactions on phishing websites, that are frequent and current vital issues. As well as, the complexity of operations may be daunting for first-time customers, which may result in misplaced funds on account of operational errors.

All in all, no matter whether or not it’s an escrow or non-secure pockets, personal key safety is crucial concern for pockets customers. Customers ought to select the kind of pockets primarily based on their particular wants. Wallets are an integral part of blockchain know-how, so there aren’t any insurmountable points concerning asset file preserving.

3. Safety is thought to be one of many main preferences of decentralized wallets, whereas user-friendliness is commonly an obstacle for them. How do you handle to keep up sturdy safety whereas offering a quick and environment friendly person interface?

With most decentralized platforms, user-friendliness typically comes on the expense of safety. Nevertheless, there are nonetheless some methods that wallets can use to stability the 2. On the safety design aspect, multi-factor authentication helps be certain that even when one layer of safety is compromised, there’ll nonetheless be extra safety parameters to guard person belongings. Moreover, {hardware} pockets compatibility and biometric authentication (equivalent to fingerprint or facial recognition) can even assist present a sturdy safety framework with out compromising user-friendliness.

One other key space can be person schooling, as we imagine that customers additionally play a key function in preserving their belongings secure. At Bitget Pockets, we frequently create high-quality tutorials and studying supplies to maintain our customers updated with the most recent safety developments and options, together with a complete assist heart.

Environment friendly coding practices and writing optimized codes underneath the hood can be certain that the pockets works easily and shortly, enhancing the general person expertise. Using caching and prefetching strategies can even assist enhance response pace and scale back load instances.

At Bitget Pockets, we additionally conduct common safety audits with industry-leading safety corporations, in addition to open-source our core core codes, permitting the group to assessment and contribute to our general protection. These are some examples of constructing a sturdy safety framework with out compromising person expertise.

4. What’s pockets exercise after the BTC halving occasion? Are you seeing plenty of deposits and withdrawals or are wallets sitting idle?

On April 20, 2024, BTC accomplished its fourth halving. Within the month from the halving:

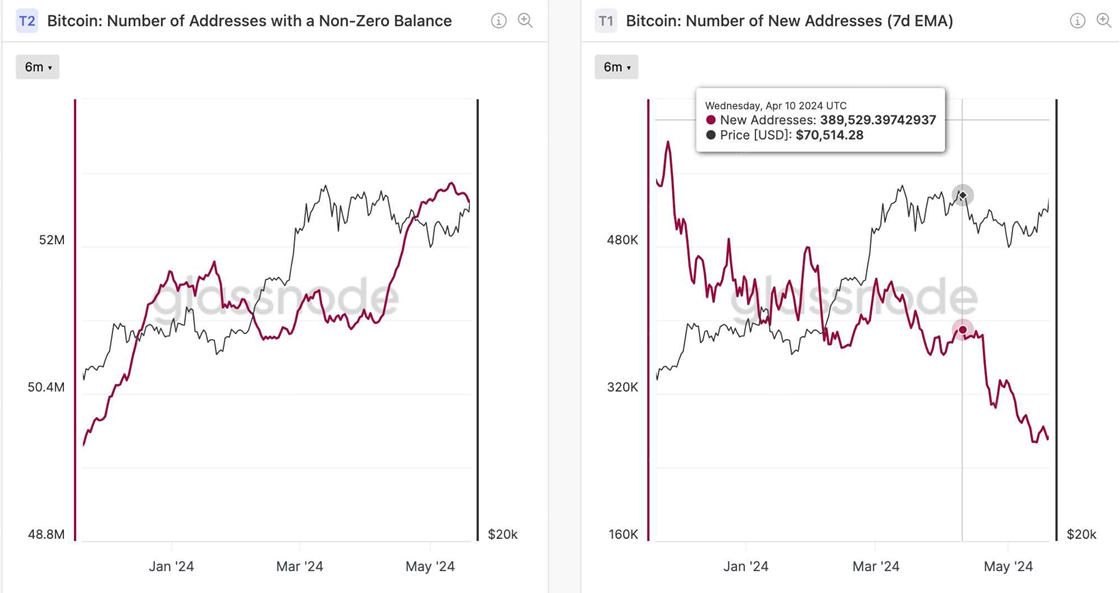

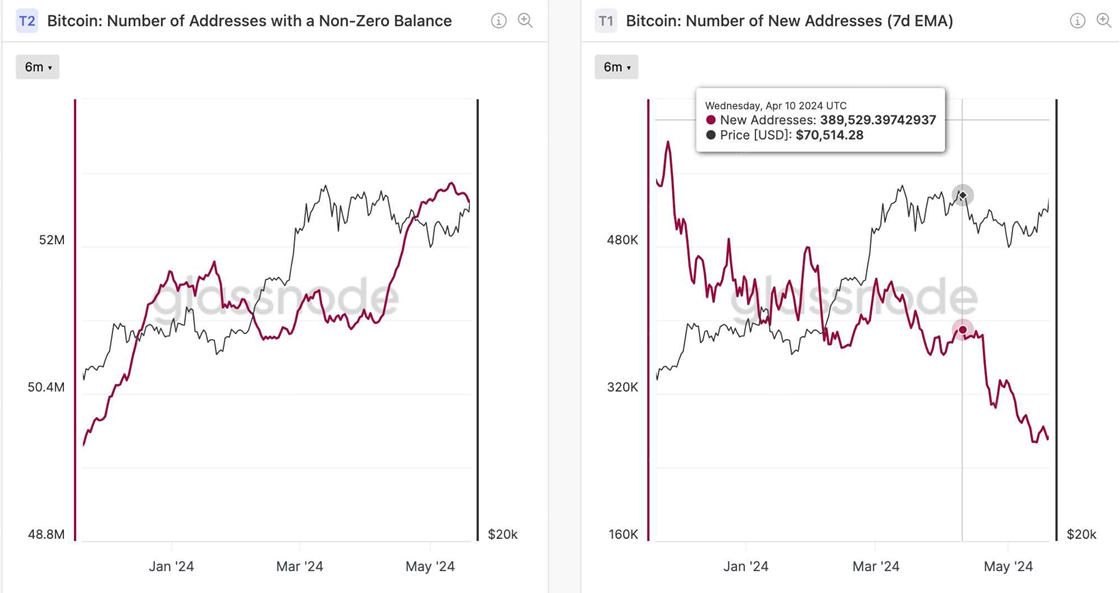

4.1 The variety of energetic addresses within the BTC community first elevated after which decreased. This may be associated to numerous on-chain actions equivalent to bootstrapping, minting, and token hypothesis.

4.2 The variety of non-zero stability addresses on the BTC community has additionally elevated, whereas the variety of new each day addresses on the BTC community has decreased. Each metrics observe cyclical developments and don’t seem to have undergone vital modifications throughout the halving interval, suggesting that the halving might not have an effect on these indicators.

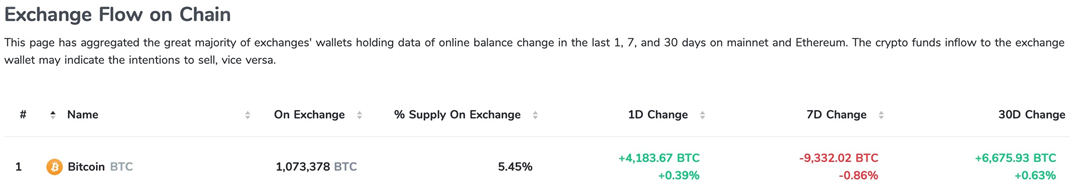

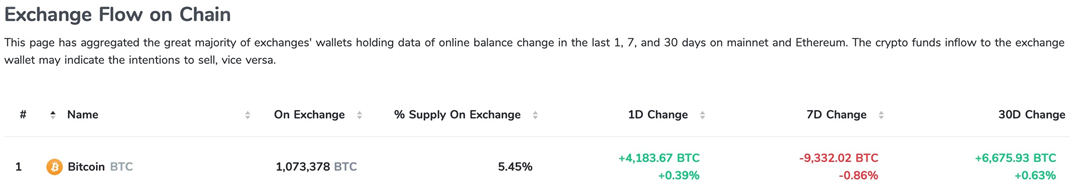

4.3 Analyzing internet influx/outflow of BTC from chain to CEX:

- Within the month following the halving, there was a internet influx of 6.6,000 BTC into CEX.

- There was a internet outflow of 9,000 BTC from CEX within the final seven days.

- This matches BTC's decline in worth and volatility over the previous month and its latest surge over the previous seven days.

4.4 Taking a look at a broader timeline: The info exhibits that since 2018, the variety of traders keen to promote BTC has been reducing. Many long-term holders have stopped promoting their tokens and proceed to be bullish and hoard BTC.

5. There may be plenty of information about BWB. What precisely is it and what are your targets? What’s the worth of the token to the person?

Because the official platform token for Bitget Pockets, BWB not solely brings with it a lot of significant use circumstances for customers, but additionally symbolizes an necessary milestone within the growth of Bitget Pockets. For starters, BWB token holders can count on advantages equivalent to group administration, staking, multi-chain gasoline fee, entry to the Bitget Pockets Launchpad and Bitget platform occasions, and extra.

Moreover, BWB can be obtainable for subscription on our launchpad. Through the BWB Launchpad subscription, 1,000,000 BWB, or 0.1% of the whole provide, can be supplied. Subscriptions can be divided into whitelist and public rounds, with customers who’ve accomplished at the very least one Bitget Swap transaction within the final three months eligible for the latter. Every BWB token is obtainable at a subscription worth of $0.1 and is distributed on a first-come, first-served foundation.

6. Are you able to share a roadmap trailer? What UI smoothing options are deliberate?

Our plan for the long run is to create the Bitget Onchain Layer – an intermediate layer that removes the complexities for customers when interacting with the Web3 world. This can be our key initiative to create a very seamless person interface to facilitate mass onboarding. To realize this purpose, we launched the mixing of Modular Function DApps (MFDs) as a part of the Bitget Onchain Layer. These specialised DApps can perform as stand-alone DApps in addition to native capabilities built-in instantly into Bitget Pockets. The primary purpose of those MFDs is to function native gateways for customers to discover a variety of Web3 DeFi providers, instantly from the consolation of their Bitget Pockets app, leveraging distinctive advantages equivalent to elevated safety, elevated liquidity and an unparalleled person expertise.

Constructing collectively has at all times been a core precept for us at Bitget Pockets, and we lengthen this to the Bitget Onchain Layer as effectively. We now have established a USD 10 million BWB Ecosystem Fund to incubate and spend money on rising tasks primarily based on the Bitget Onchain Layer, masking a variety of DeFi sub-sectors, together with Telegram Tot, Pre-Market and On-Chain Derivatives Market. By working with {industry} builders to create environment friendly and purposeful MFDs, we envision the Bitget Onchain Layer to be not solely our subsequent huge step in revolutionizing the general person expertise for our customers, but additionally a mannequin of Web3 innovation for the complete Bitget ecosystem.

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shall not be answerable for any losses incurred on account of using stated content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.