There are various other ways to quantify market sentiment. Taking a look at value motion gives a really crude however efficient measure of market sentiment – if value is falling, the market is probably going bearish and vice versa. Nonetheless, future sentiment evaluation may be very complicated, particularly in terms of Bitcoin, and on-chain knowledge helps us discover the numerous layers of market sentiment.

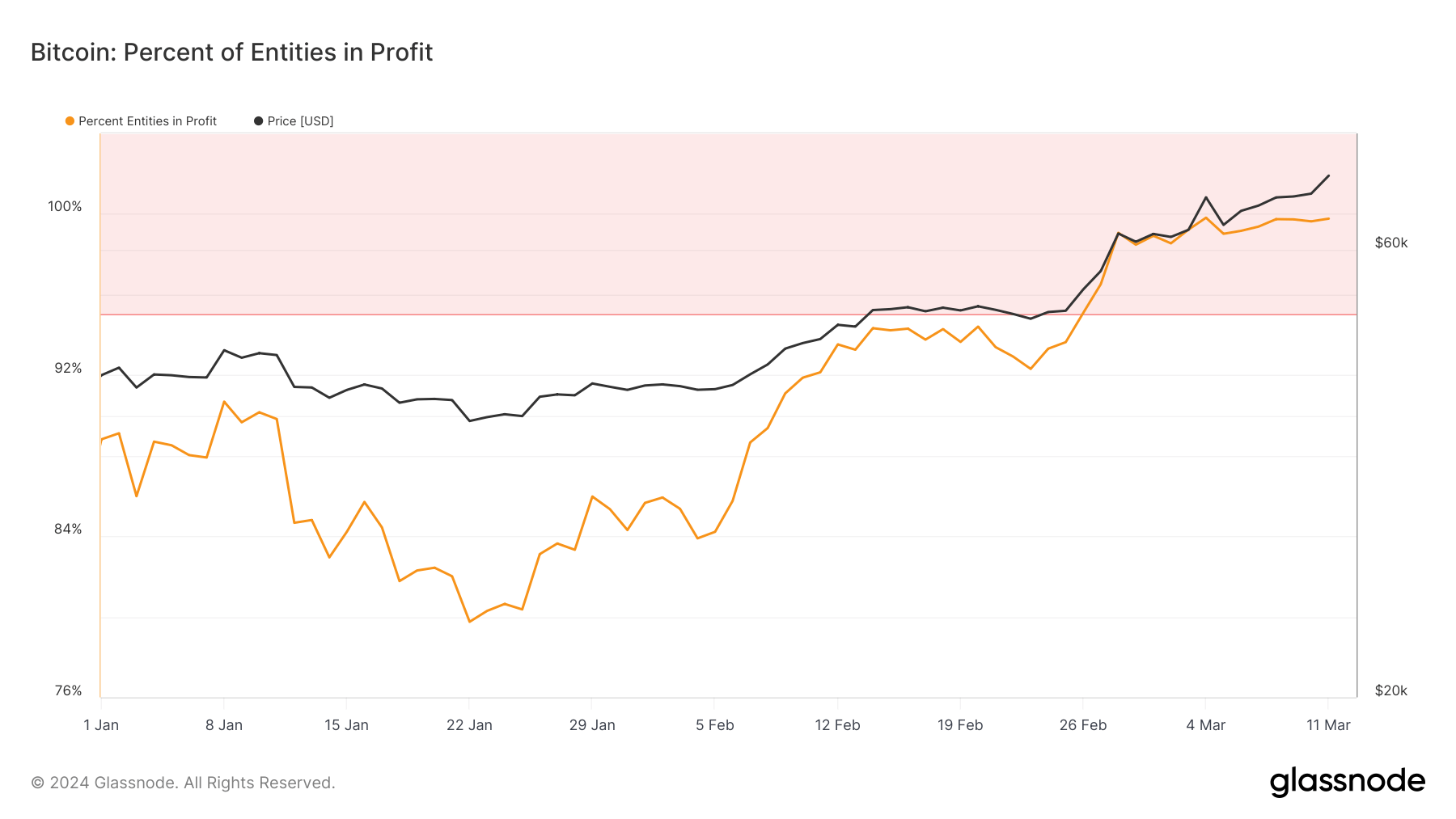

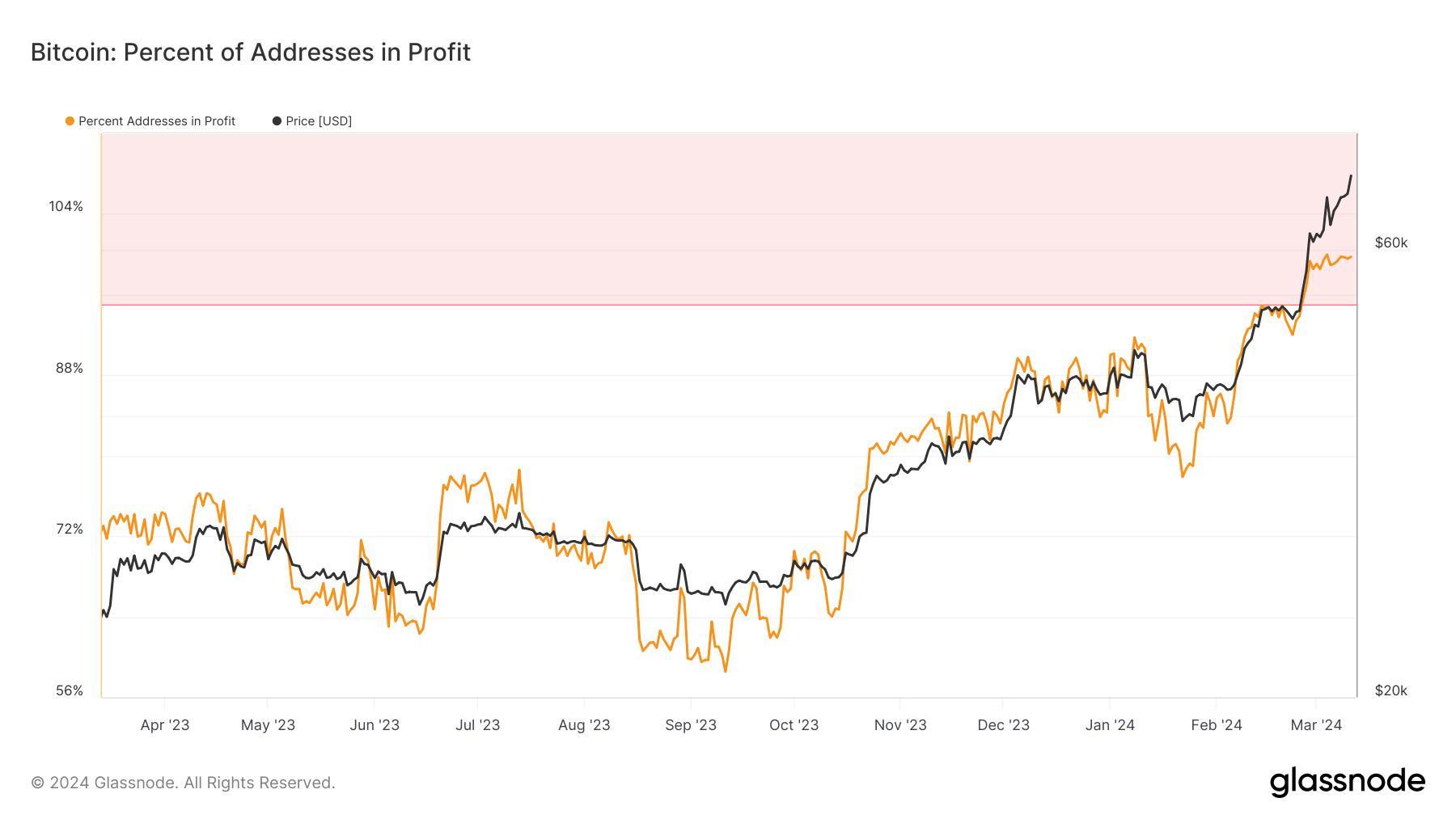

Few on-chain metrics measure market sentiment higher than share of worthwhile addresses and topics. These metrics monitor the share of distinctive addresses and entities whose funds have a median buy value decrease than the present Bitcoin value. Glassnode defines “buy value” as the value on the time cash have been transferred to an deal with or entity.

The excellence between entities and addresses helps us present extra detailed market evaluation. Entities that may management a number of addresses present a extra correct image of investor sentiment and habits, as specializing in particular person addresses doesn’t present an entire image of market profitability.

In keeping with knowledge from Glassnode, there have by no means been extra addresses and entities in revenue within the historical past of Bitcoin. This morning, with the value of Bitcoin simply above $72,000, 99.76% of topics and 99.74% of addresses have been in revenue. The US Market Open as soon as once more created some volatility, erasing leverage and inflicting Bitcoin to commerce between $72,920 and $70,145.

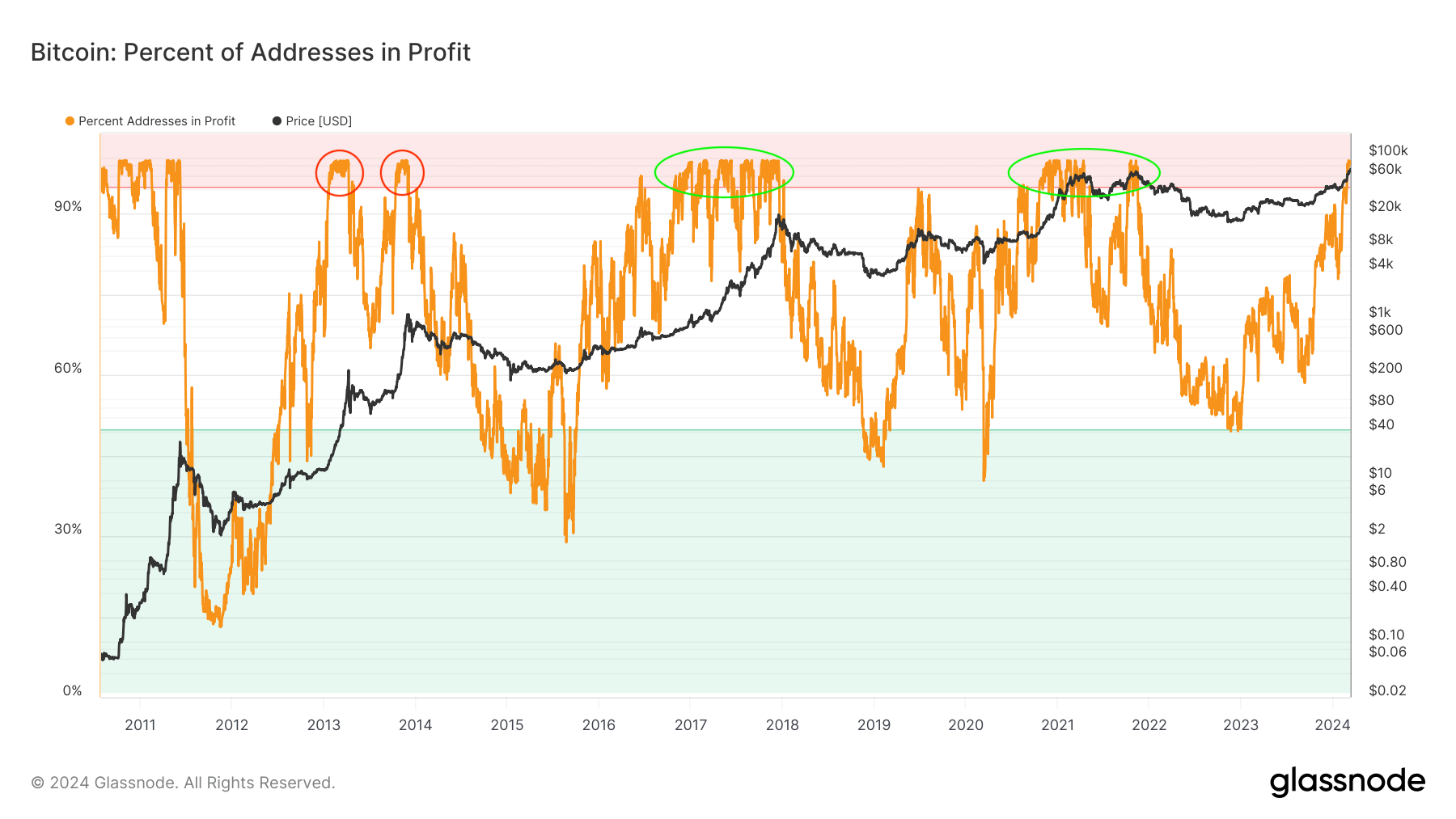

Traditionally, when the share of worthwhile topics and addresses exceeded 95%, it marked the start of a mature section of the bull cycle, when the overwhelming majority of market members accrued earnings. Historic knowledge from Glassnode reveals that this margin of profitability was sometimes maintained for a few month earlier than a correction occurred. This means a sample the place most profitability precedes the market pullback, which is per the standard bull market drawdown. Corrections usually comply with durations of speedy value appreciation as they normally push a big variety of buyers to understand their earnings, growing promoting strain.

Nonetheless, zooming out and searching on the two earlier bull cycles reveals that the share of worthwhile addresses and topics remained above 95% for a few yr regardless of corrections. These prolonged durations of profitability probably helped create a stronger perception in bitcoin’s long-term worth and inspired merchants and buyers to carry onto their cash regardless of short-term volatility.

The present state of the market, with a file excessive share of worthwhile entities and addresses, reveals that there is no such thing as a scarcity of bullish sentiment. On condition that it has been roughly three weeks since profitability has hovered above 95%, there’s additionally room for warning. Historic patterns present that these ranges of profitability can by no means be sustained for lengthy with out corrections.

Whether or not the present cycle will mirror the prolonged durations of profitability seen within the final two bull cycles or return to shorter spreads stays to be seen. Nonetheless, the maturity of the market, mixed with the elevated institutional adoption of Bitcoin as a result of spot Bitcoin ETFs, might probably disrupt historic patterns.

Bitcoin’s rise to $73,000 introduced revenue to 99.76% of topics, signaling a mature section of the bull market appeared first on fromcrypto.