Bitcoin's fall under $60,000 in early Could spooked the market and led to vital volatility amongst buying and selling merchandise. Nonetheless, regardless of the large volatility in derivatives, the spot market seems to have led most of this restoration, with volumes and inflows serving to to stabilize BTC at round $66,000 in mid-Could. After a number of uneven days the place BTC struggled to interrupt via $66,000, we noticed a surge on Could 20 that despatched it above $70,000, injecting much-needed optimism into the market. Whereas BTC settled to round $70,100 on Could 21, an necessary psychological degree remained breached.

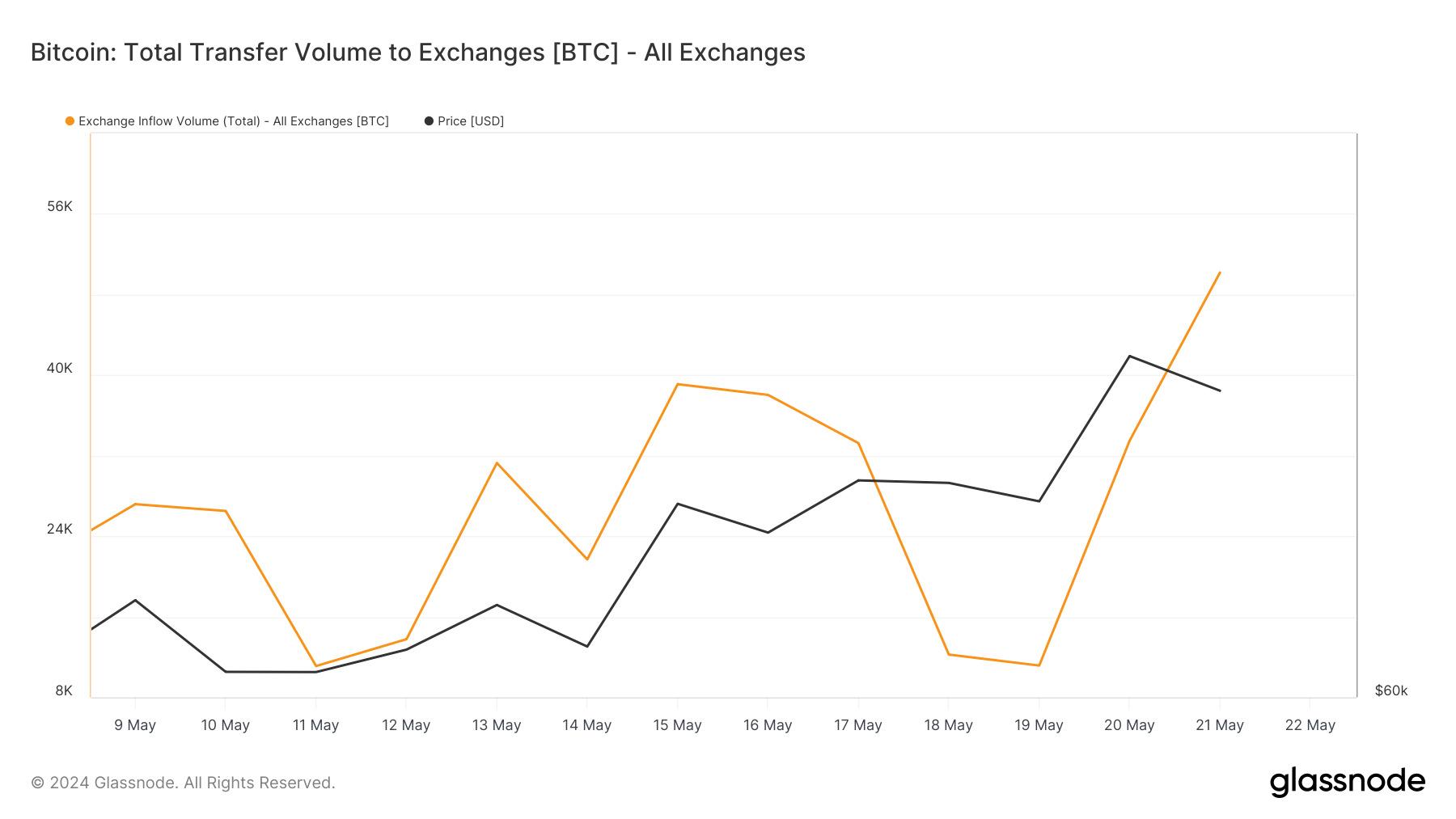

This optimism has led to a major improve in trade exercise, which is clear within the fast improve in inflows and volumes.

Between Could fifteenth and twenty first, we noticed various volatility within the volumes of transfers to exchanges. On Could fifteenth, 39,095 BTC had been transferred to exchanges, which decreased barely to 38,031 BTC on Could sixteenth. The amount additional fell to 33,242 BTC on Could 17, indicating a downward development in switch quantity. A dramatic drop occurred on Could 18, when solely 12,243 BTC had been transferred to exchanges, adopted by a fair decrease 11,156 BTC on Could 19. Nonetheless, this development reversed on Could 20 with a considerable improve to 33,484 BTC, culminating in a peak of fifty,186 BTC on Could 2. These swings present how small value adjustments result in vital investor exercise and sentiment swings.

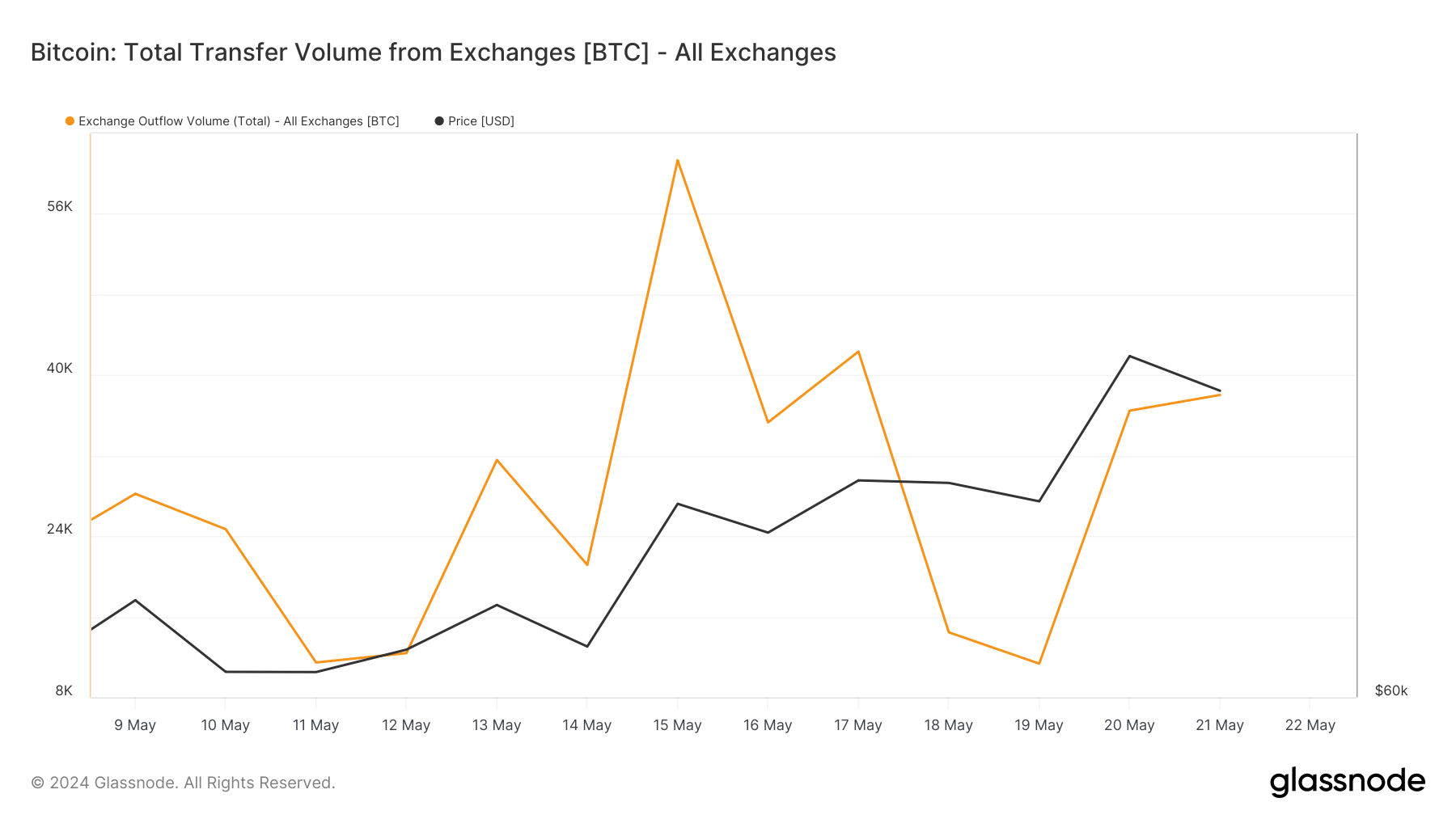

The volumes of transfers from exchanges confirmed related variations. Between Could 15 and Could 18, trade switch quantity dropped from 61,232 BTC to 14,454 BTC, adopted by one other drop to 11,347 BTC on Could 19. decreased to 38,027 BTC on Could 21.

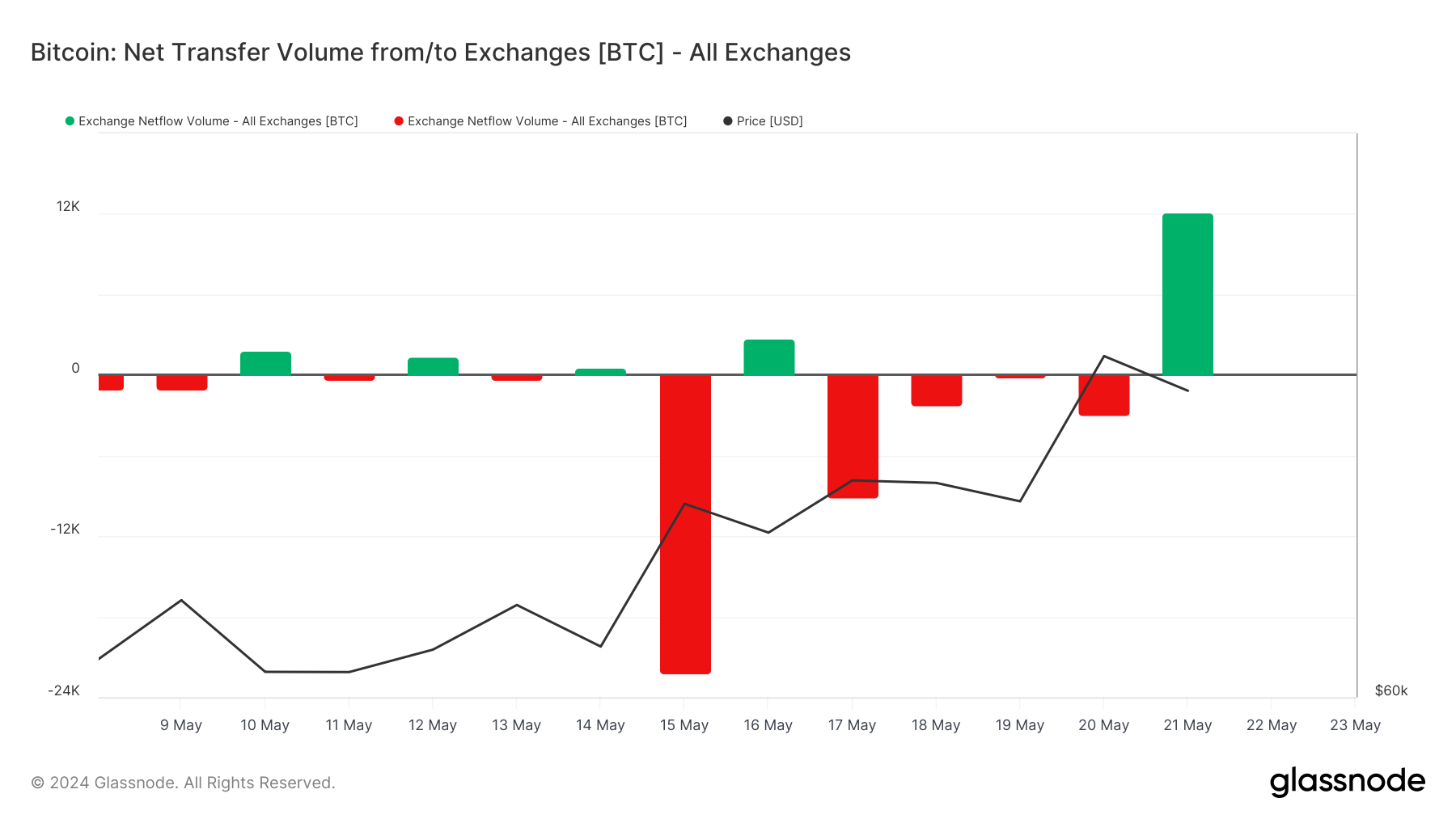

Earlier than the value leap, from Could 15 to Could 19, the value of Bitcoin remained comparatively steady with minor fluctuations. Throughout this era, the web quantity of transfers usually leaned towards outflows, indicating a reluctance of holders to maneuver property to the exchanges, probably anticipating an increase in costs. The rise in costs and its aftermath on Could 20 and 21 led to a major change in investor conduct.

On Could 20, the value of Bitcoin rose to $71,409, which led to an elevated quantity of transfers to exchanges (33,484 BTC) and a excessive quantity of spot purchases (72,971 BTC). Nonetheless, there was additionally a major outflow from exchanges (36,468 BTC), displaying that whereas some traders cashed in on the value improve by promoting, others continued to purchase, fueled by bullish sentiment. On Could 21, the development reversed with a web influx of 12,159 BTC.

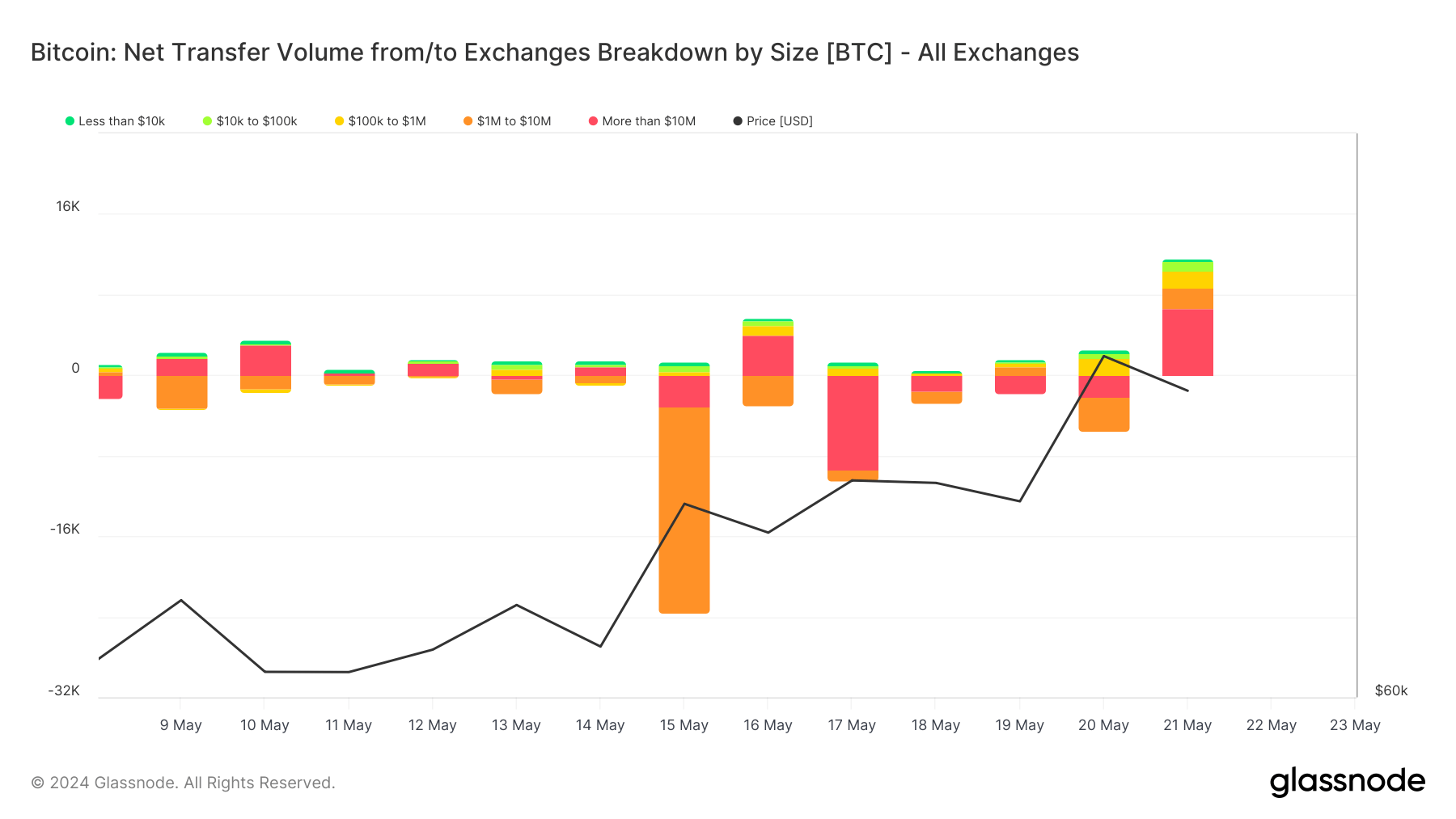

Breaking down switch volumes by measurement helps us higher perceive what merchants are driving the spot market. The comparatively small web influx in transfers of lower than $100,000 means that retail traders had been cautious however progressively elevated their holdings, reflecting rising confidence in value stability or the potential for future features. Constant inflows within the $100,000 to $1 million class on Could 20 and Could 21 present lively participation from bigger retail and smaller institutional traders who possible noticed the rise as a shopping for alternative.

A web outflow of -3,336 BTC within the $1 million to $10 million class on Could 20 means that some giant holders took benefit of the value peak to liquidate parts of their holdings. Nonetheless, the reversal to a web influx of two,109 BTC on Could 21 means that different giant traders or the identical entities reinvested, which can point out a brief interval of profit-taking adopted by renewed accumulation. A big web outflow of -2,183 BTC on transfers above $10 million on Could 20 contrasts sharply with a major influx of 6,604 BTC on Could 21. This dramatic shift highlights the strategic repositioning of very giant traders who initially offered on the value peak however rapidly moved again into the market, maybe signaling long-term bullish sentiment or utilizing subtle buying and selling methods to maximise income.

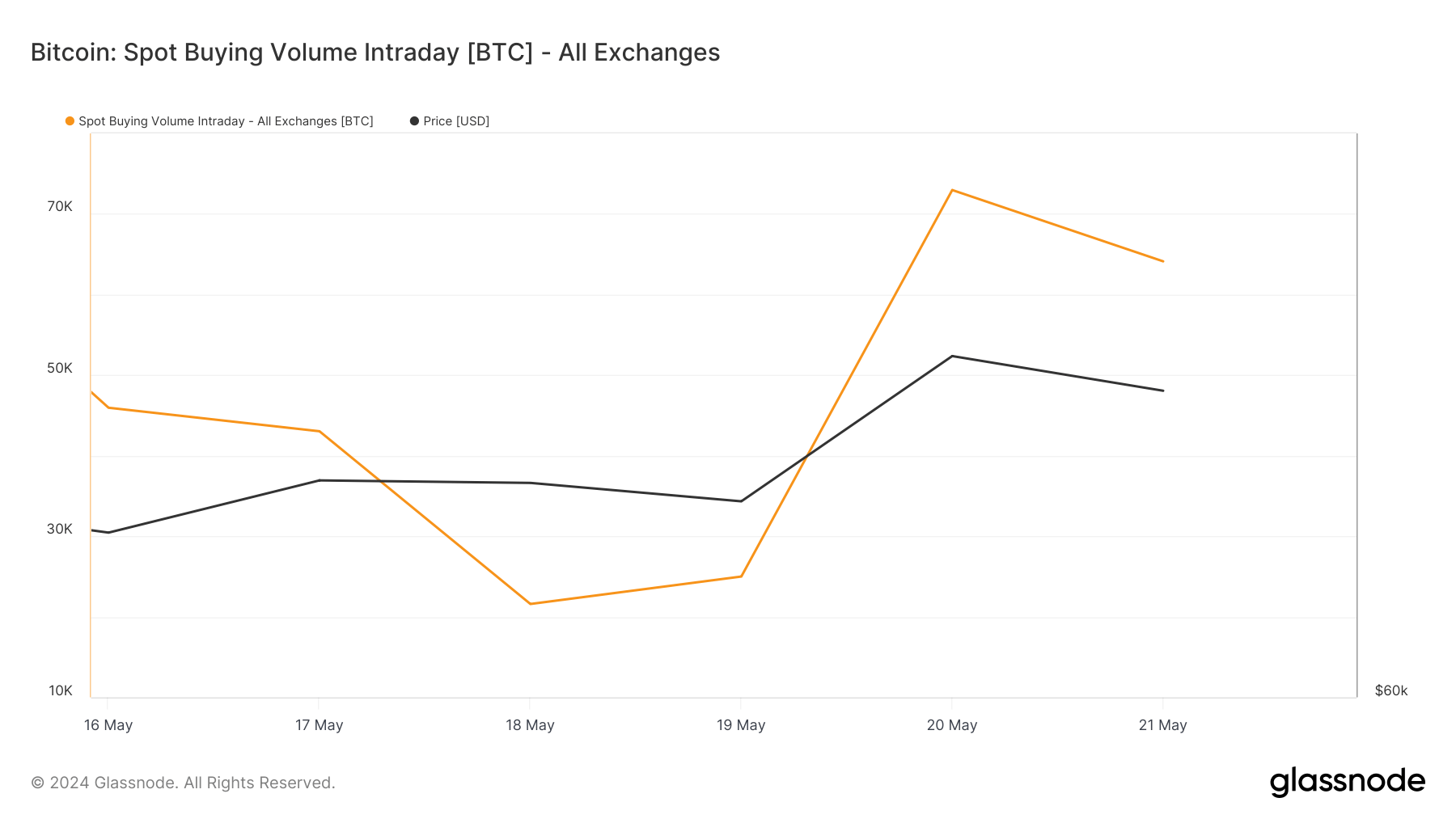

Market reactions to those flows are evident in intraday spot shopping for and promoting volumes. On Could 15, the quantity of spot purchases was 69,519 BTC, on Could 18, it decreased to 21,585 BTC. A big improve occurred on Could 20, with spot shopping for quantity peaking at 72,971 BTC earlier than easing barely to 61,119 BTC on Could 21.

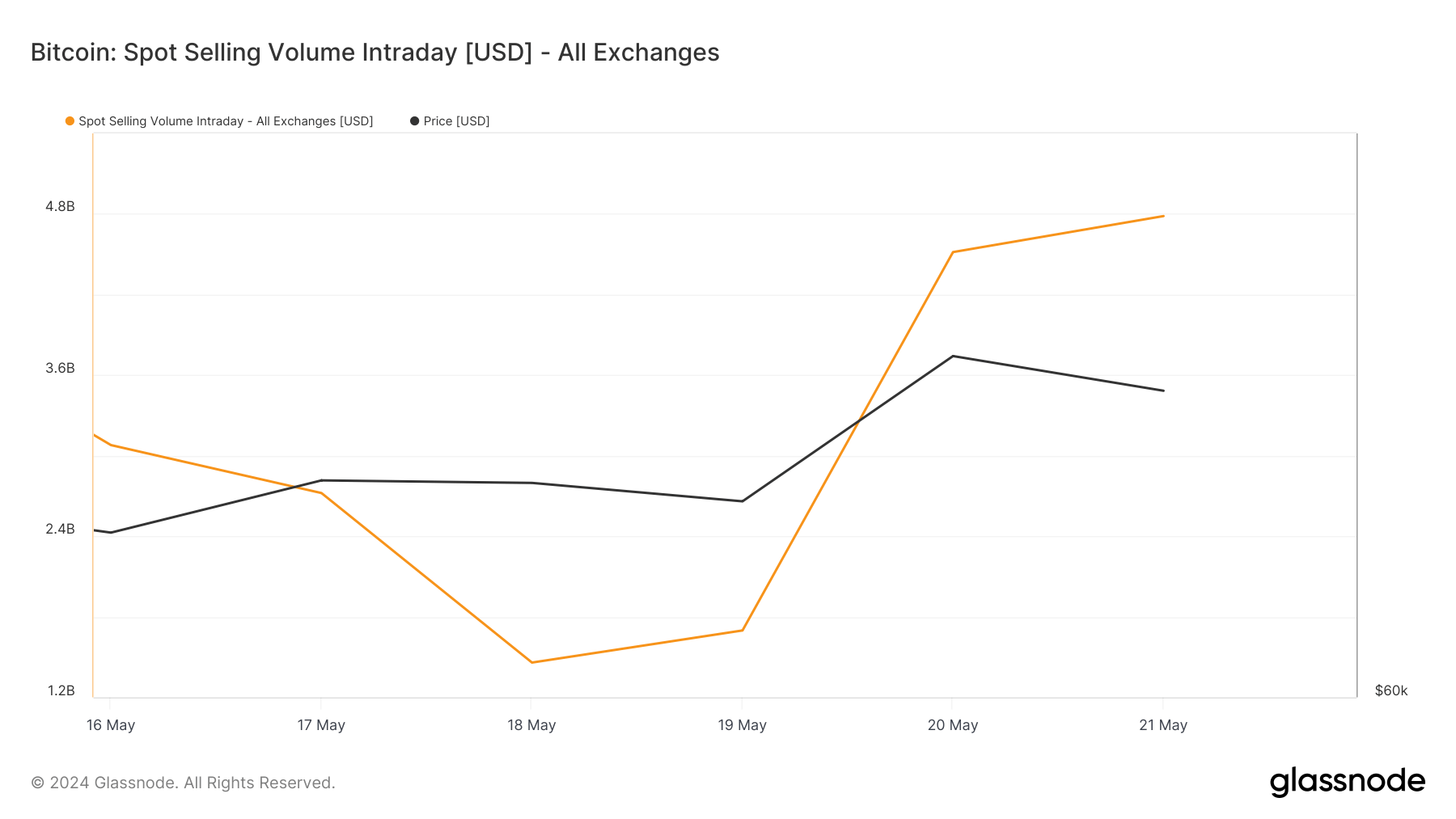

Spot gross sales volumes fell from simply over $4 billion on Could 15 to $1.458 billion on Could 18. By Could 20, the quantity of spot gross sales elevated considerably to $4.516 billion and additional to $4.784 billion on Could 21. Whereas elevated spot shopping for quantity displays a rise in bullish sentiment, correspondingly excessive promoting volumes present that a good portion of the market has capitalized on the value improve.

Glassnode knowledge reveals that the market is tight and able to react rapidly to small adjustments within the value of Bitcoin. Whereas this response is typical of the derivatives market, we have now begun to see a equally aggressive response within the spot market as effectively. The fast return to the market from giant holders reveals that little upside volatility is required to revive religion in Bitcoin's potential. The cautious accumulation of retail traders factors to a gradual constructing of confidence, probably setting the stage for a extra sustained value transfer sooner or later.

The put up Bitcoin Surge Above $70,000 Sparks Alternate Inflows appeared first on fromcrypto.