Modifications in futures and choices open curiosity present perception into market sentiment, liquidity and potential value actions. Futures and choices reveal how merchants place themselves and present their expectations for future value motion. Open curiosity measures the move of cash and exhibits whether or not new capital is coming into or leaving the market.

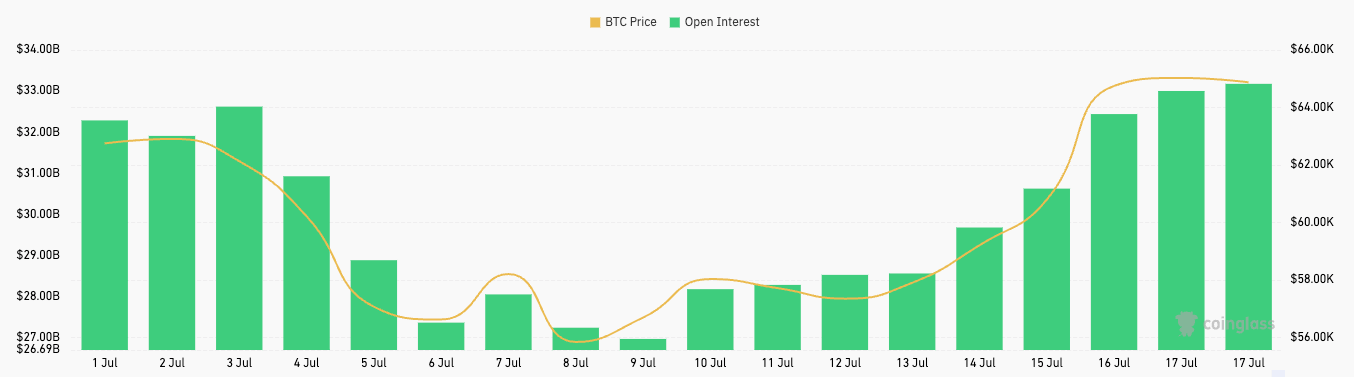

Taking a look at open curiosity, we are able to see that Bitcoin's latest rally has breathed new life into the derivatives market, which skilled a comparatively quiet and uneventful July. This stability mirrored the weeks of sideways value motion the market had seen. The sideways development turned optimistic final week as Bitcoin opened at $56,680 on July ninth. The worth progress began slowly however began to select up tempo from July 14th when the value rose from $59,205 to $65,025 on July seventeenth.

Open curiosity in futures precisely mirrored this value motion. On July ninth, open curiosity was $26.97 billion and has been steadily rising, reaching $33.25 billion by July seventeenth. This fast enhance in OI exhibits that merchants had been opening extra contracts as Bitcoin broke $60,000, more than likely anticipating additional value progress.

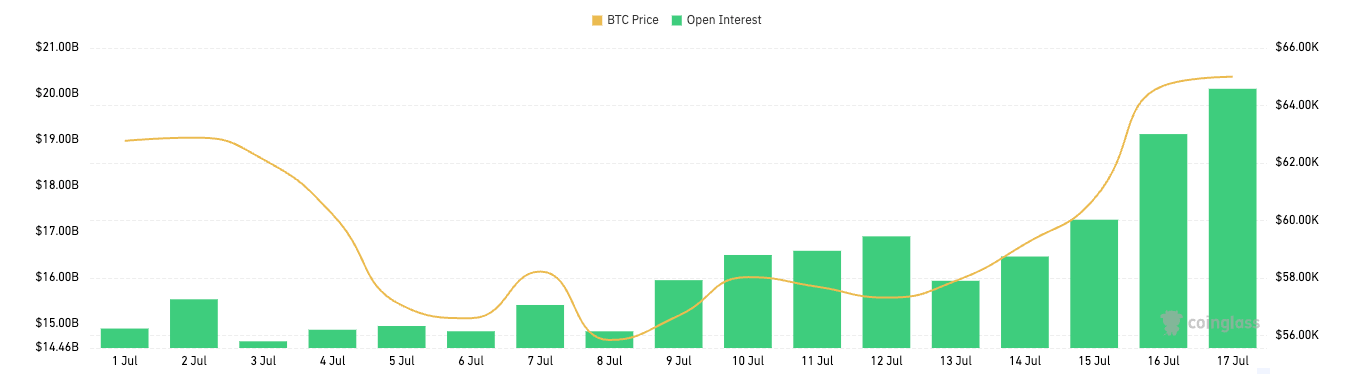

The choices market adopted the identical development. On July 9, open curiosity was $15.94 billion. It rose steadily over the next week, reaching $20.11 billion by July 17. As within the futures market, a major enhance in open curiosity in choices has been noticed since July 15, reflecting the rise within the value of Bitcoin. This enhance additionally exhibits a major enhance within the exercise of merchants who rushed to make the most of the value actions.

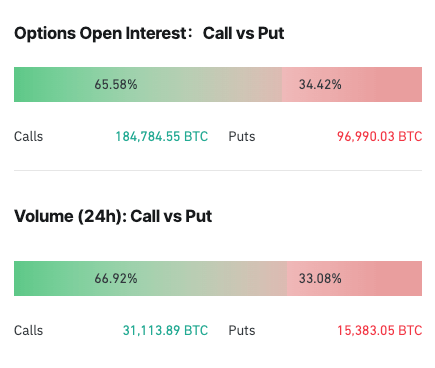

The breakdown of calls and places exhibits that greater than 65% of open curiosity and quantity is calls. Because of this a smaller share of merchants are hedging towards draw back dangers and ready for additional value progress to revenue from. Choices present merchants with a mechanism to leverage their positions with managed danger, which is especially engaging in periods of value volatility.

The synchronized enhance in each futures and choices open curiosity together with the value enhance exhibits how built-in the Bitcoin market is. Because the spot value will increase, it attracts extra futures contracts and triggers elevated choices exercise, indicating a fancy market response utilizing complicated buying and selling instruments.

Moreover, the correlation between open curiosity and value exhibits that the derivatives market loves optimistic value motion. Lateral value motion results in considerably decrease open curiosity in futures and choices, whereas rising costs appeal to new cash into the derivatives market.

The put up Bitcoin rally reignites derivatives market appeared first on fromcrypto.