Liquid and illiquid Bitcoin reserves are very attention-grabbing and helpful metrics for understanding market tendencies. Liquid provide refers back to the quantity of Bitcoin available for buying and selling, which means it’s held in wallets that often have interaction in transactions. Extremely liquid provide, a subset, refers to bitcoin that strikes much more often, typically utilized by merchants and exchanges. Illiquid provide, then again, represents bitcoins held in wallets that not often transfer cash, suggesting long-term holding conduct.

Evaluation of those provides gives perception into market sentiment and potential future value actions. A rise in liquid provide often signifies larger buying and selling exercise and potential promoting strain, whereas a rise in illiquid provide signifies accumulation and a bullish outlook as holders count on costs to strengthen.

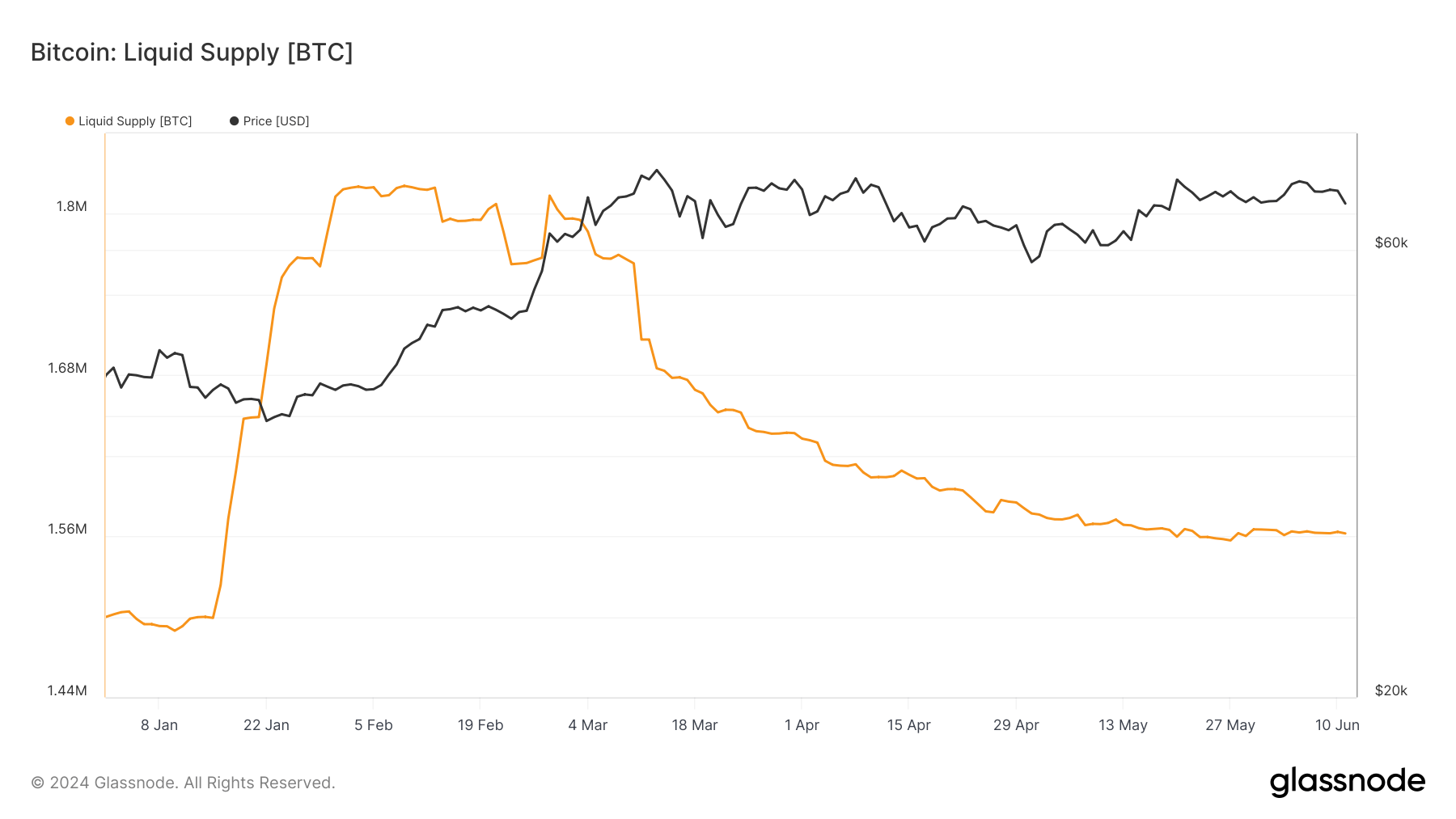

In the midst of this 12 months, we’ve got seen important fluctuations in these deliveries. The liquid provide was at 1.501 million BTC on January 1 and elevated to 1.813 million BTC by February 28. Nonetheless, there was a gradual decline since April, with the liquid provide falling to 1.562 million BTC by June 11. This discount alerts a drop in simply tradable Bitcoin, indicating lowered promoting strain as fewer cash can be found for fast trades.

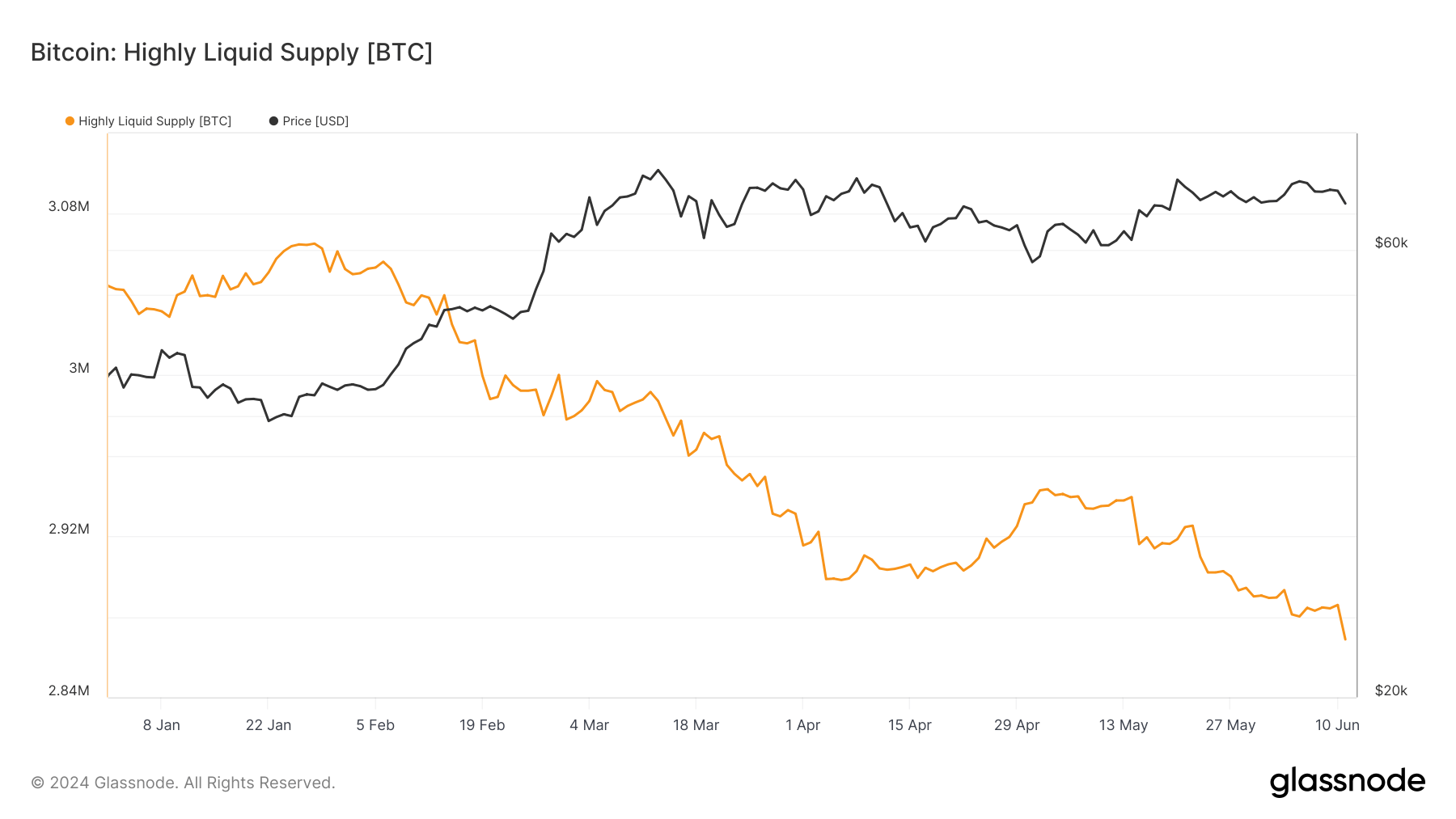

The extremely liquid provide additionally fell, beginning at 3.044 million BTC on January 1st and reaching 2.868 million BTC by June eleventh. This constant decline over a number of months highlights a discount in essentially the most available bitcoin, which might imply that lively merchants and exchanges are holding much less probably on account of a shift to holding or lowered buying and selling exercise.

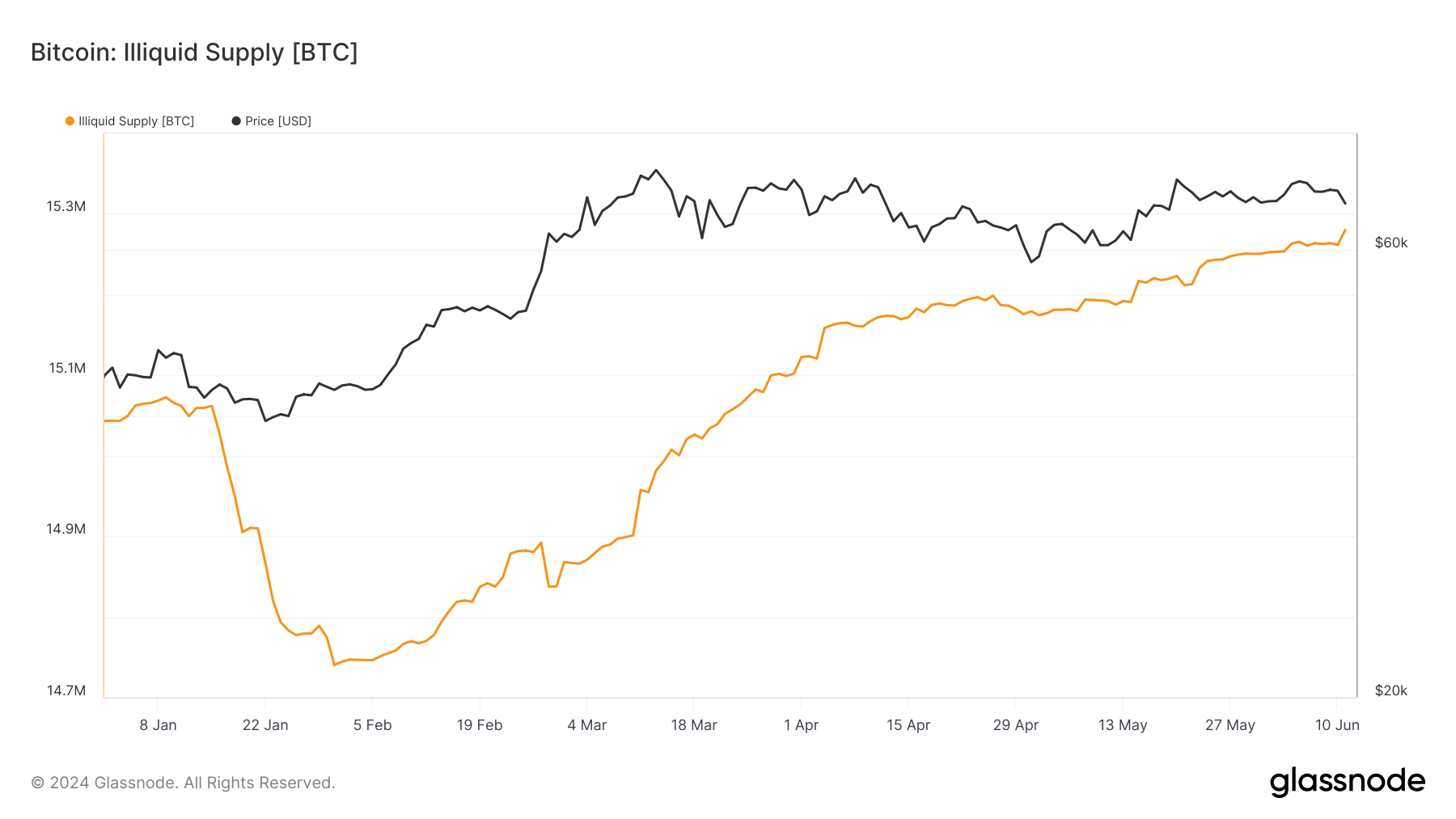

Quite the opposite, the illiquid provide confirmed a everlasting improve. It began at 15.043 million BTC on January 1st and grew to fifteen.280 million BTC by June eleventh. This development of accelerating illiquid provide signifies that extra Bitcoins are shifting into long-term storage, indicating confidence sooner or later worth of Bitcoin and a lower within the fast availability of the coin for buying and selling.

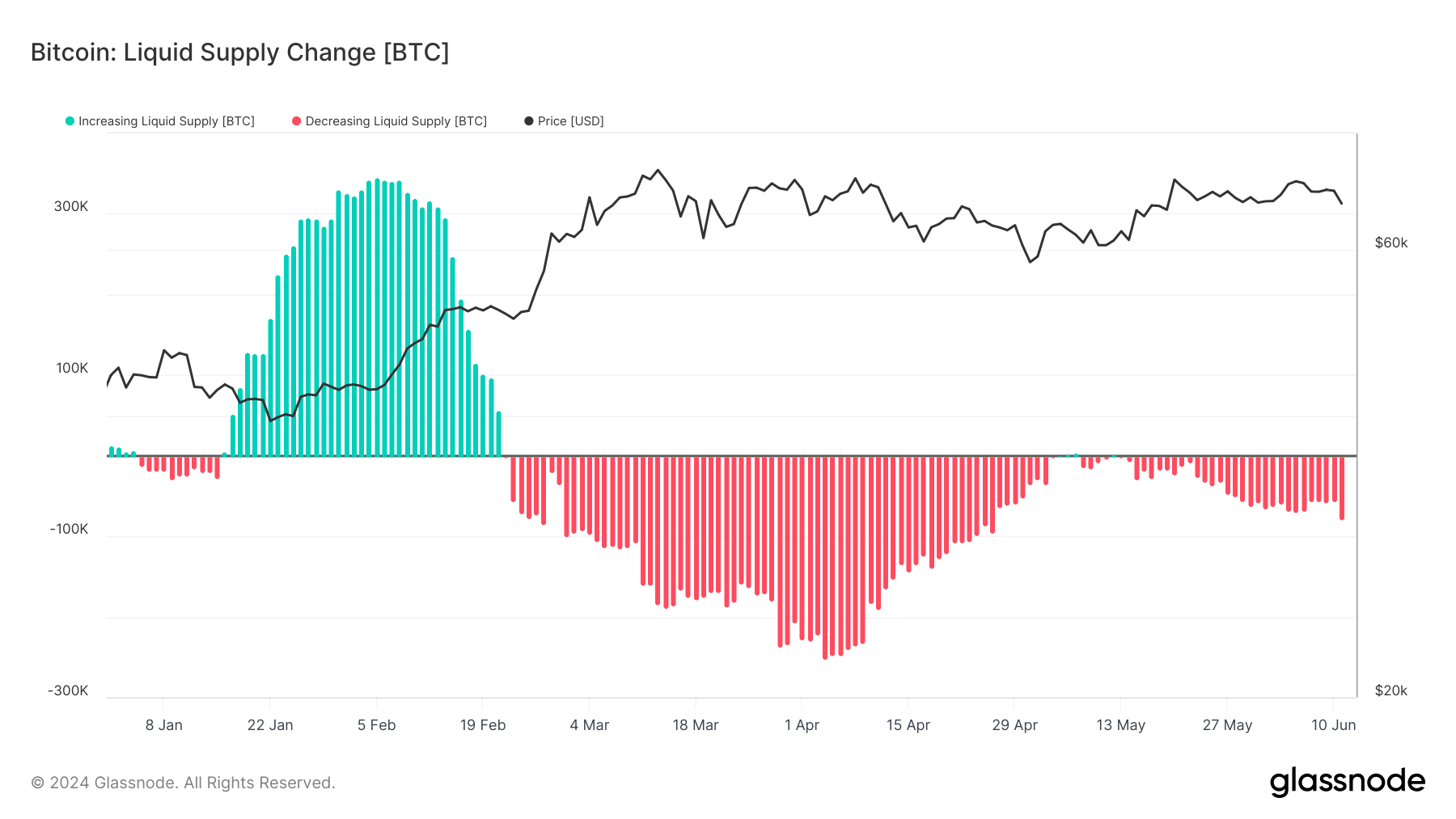

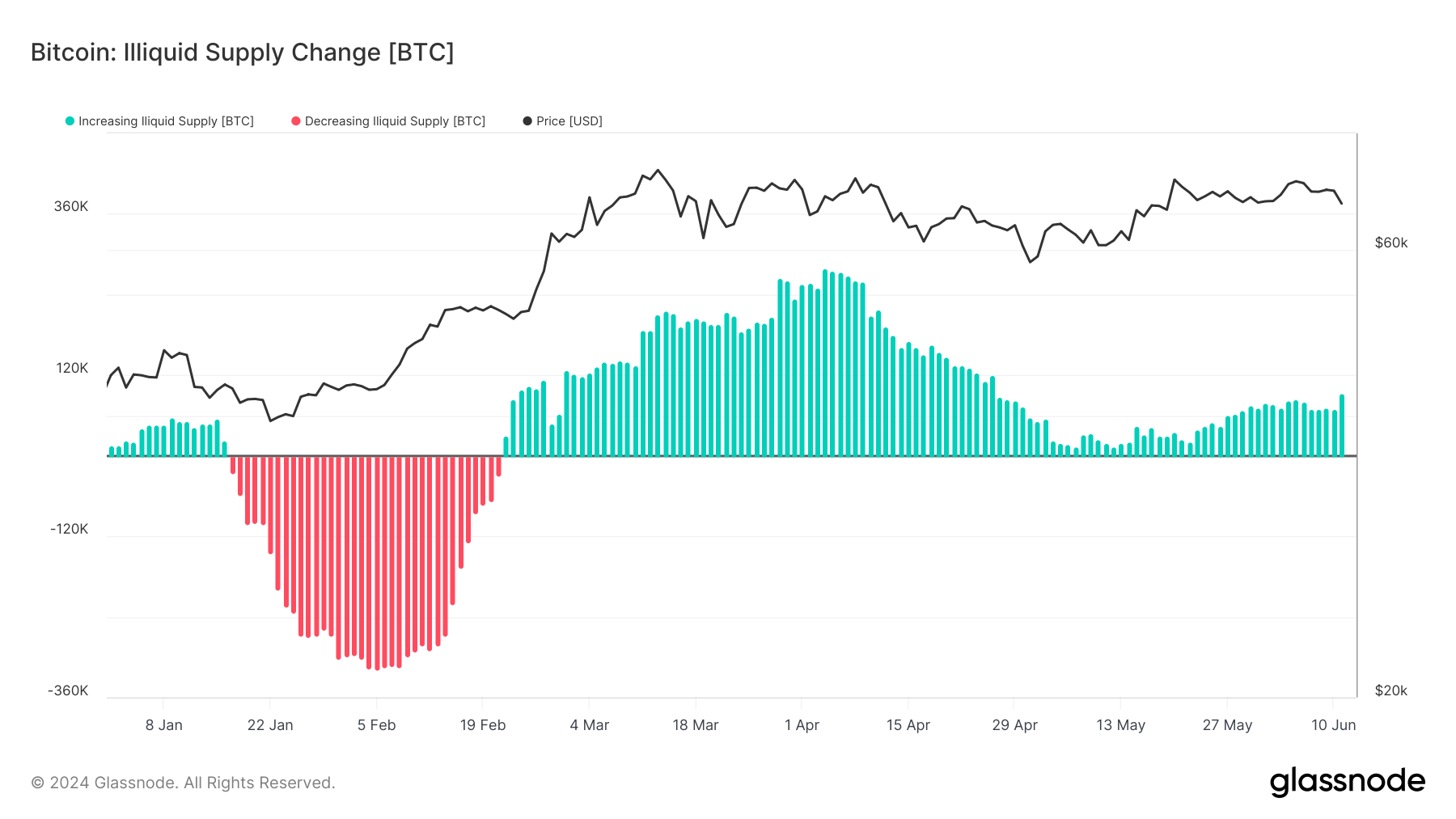

The 30-day internet change knowledge additional help these observations. Liquid and extremely liquid shares have been persistently unfavourable since February twenty second, with essentially the most important drop of 252,000 BTC on April 4th. As of June eleventh, the online change stays unfavourable at -79,306 BTC. This persistent unfavourable change reinforces the concept that Bitcoin is continually shifting out of liquid and extremely liquid wallets, lowering market provide.

However, the 30-day internet change in illiquid provide has been constructive since February twenty second, with a peak improve of 279,587 BTC on April 4th. As of June eleventh, this internet change is +92,834 BTC, indicating a sturdy and ongoing accumulation development amongst long-term holders.

Patterns stay constant when evaluating the broader annual development to final month. Each liquid and extremely liquid inventories proceed to say no, albeit at a slower tempo, whereas illiquid inventories proceed to rise. This continued divergence between liquid and illiquid provides factors to a market wherein extra members are inclined to carry slightly than commerce, reflecting bullish sentiment.

The put up Bitcoin Liquid Provide Drops Whereas Illiquid Confidence Rises appeared first on fromcrypto.