Latest knowledge on bitcoin liquidations and leverage ranges point out distinctive value discovery exercise as longs and shorts have been swept out of the market. A lot of leveraged positions have been shaken final week as Bitcoin noticed unstable value motion within the US market open.

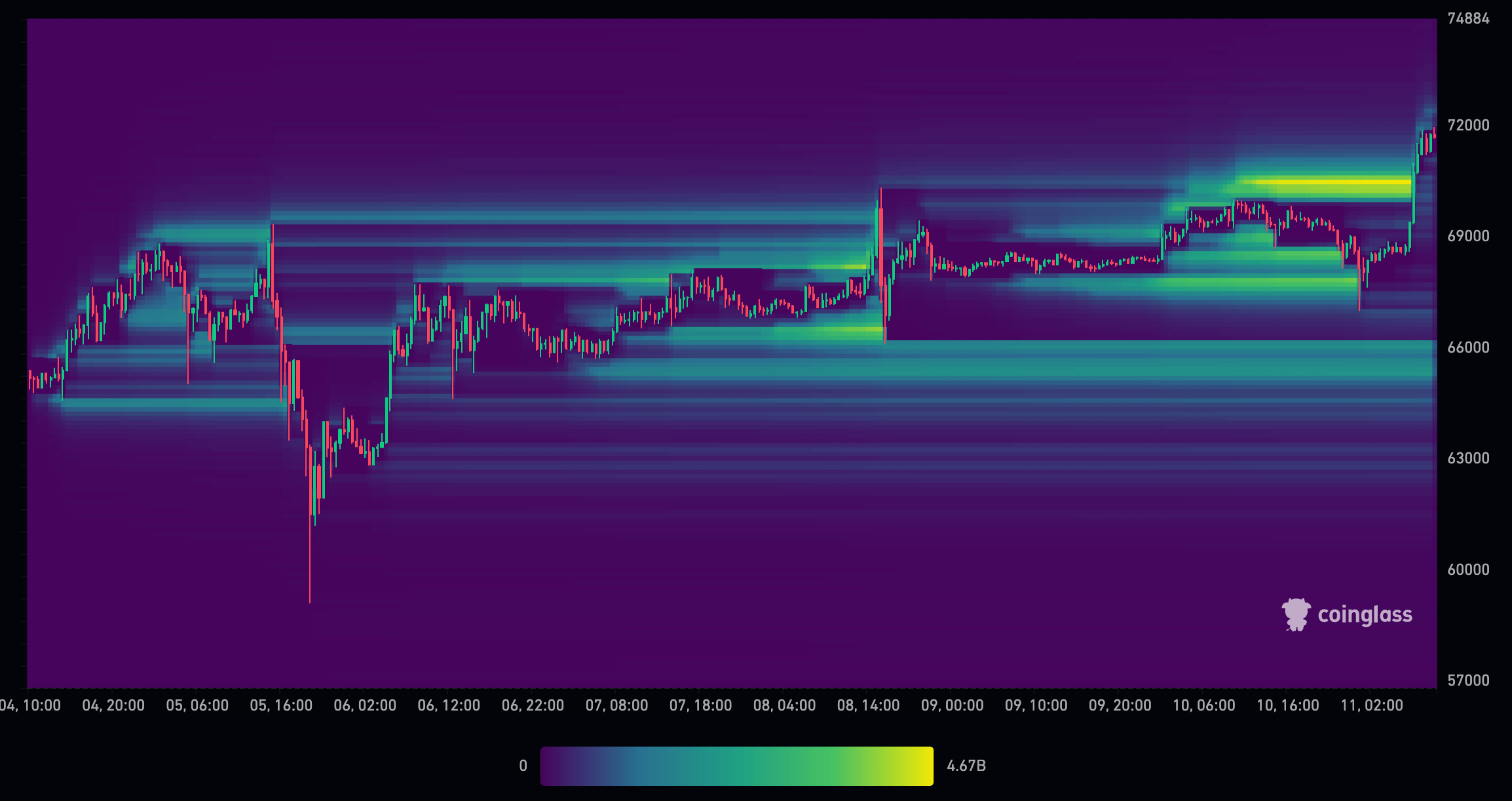

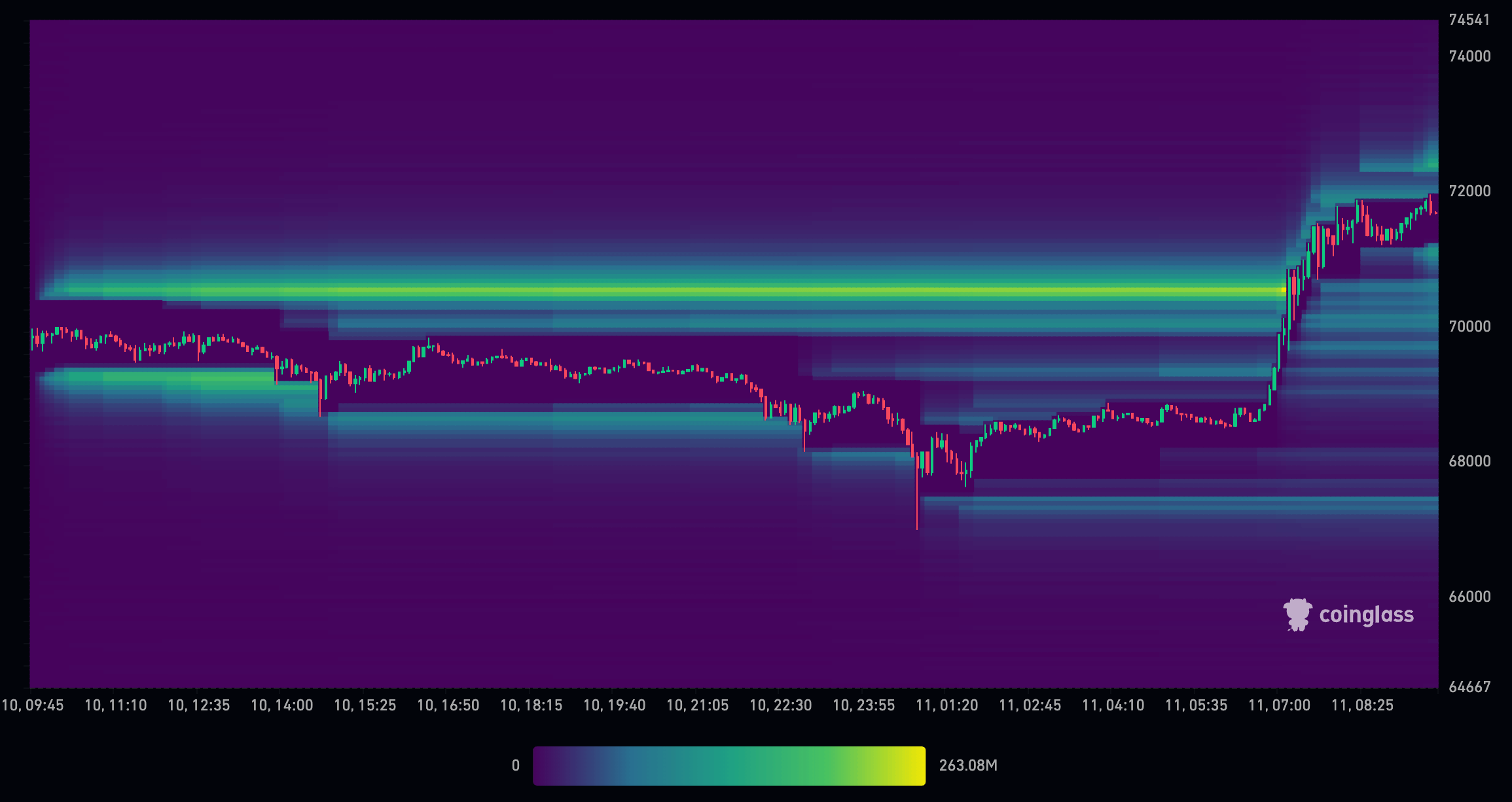

The liquidation chart from CoinGlass beneath exhibits how buying and selling exercise on March fifth and eighth round 14:30 GMT (US market open) resulted in heavy liquidations of each lengthy and quick positions. A roughly 2% achieve was adopted by a decline of greater than 10% on March 5, which overwhelmed the order books and flushed all leverage all the way down to $60,000.

The following fast restoration within the V form noticed additional leveraged positions created round $70,000 and $66,000. The market open on March 8 shook them, leaving little or no leverage above $66,000.

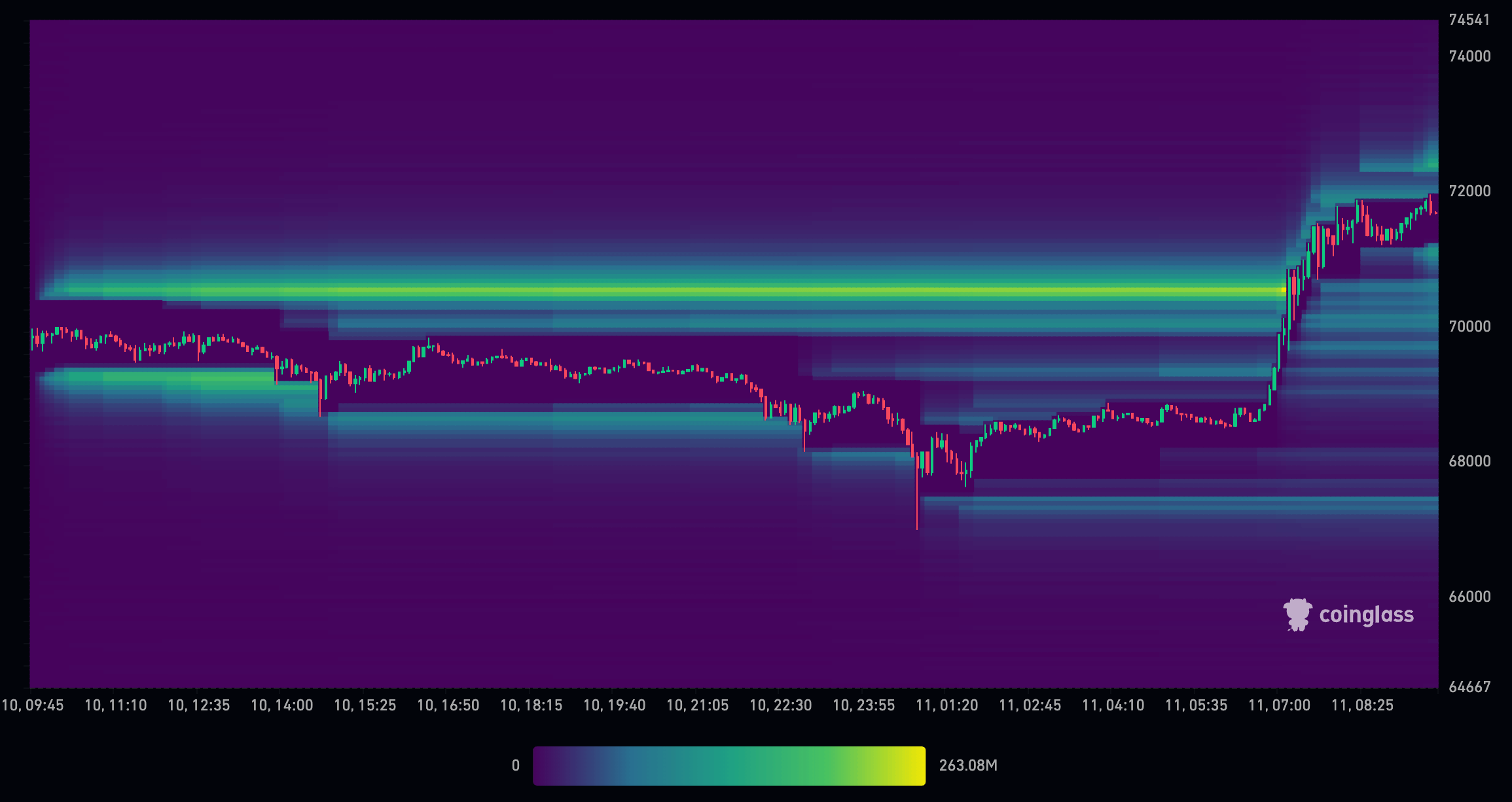

Since March 11, a drop to $67,000, adopted by a pointy rise to new highs round $71,500, as soon as once more eradicated many of the leveraged positions above $66,000 and arrange a agency backside. On account of these strikes, Bitcoin now has free reign to naturally discover the value above $66,000.

In contrast to the 2021 bull market, which was closely influenced by extremely leveraged positions, the present cycle seems to be shaking off leverage earlier than it has an opportunity to trigger vital volatility. Moreover, key institutional gamers and market makers can have a hand in clearing the way in which for Bitcoin value discovery via in depth buying and selling actions.

The function of market makers in value discovery

Market makers and, now, ETF-permitted individuals strongly affect monetary markets, conducting buy circulate and promote orders with accuracy a are liable for offering liquiditywhich is the sap of life any asset market. Steady citations bid and ask coststhey purpose revenue from unfold however their the function is increasing far past the mere making a revenue.

During times of excessive volatility, market makers interact in a strategic maneuver generally known as “sweeping” the order guide. This entails putting many orders at totally different value ranges to discover the depth of the market and decide the true steadiness between provide and demand. This massive-scale motion is a probe into the present state of the market and a catalyst for value discovery, revealing the degrees at which market individuals are prepared to commerce in vital volumes.

The current leverage change from the Bitcoin market has profoundly affected pricing situations. With the removing of leveraged promote orders, the market witnessed a discount in downward stress, permitting for a extra natural value discovery course of. That is characterised by a market much less influenced by leveraged merchants’ amplified bets and extra by the precise sentiment and valuation of its individuals.

Because the market adjusts to a brand new equilibrium with out the load of leveraged positions, the value of Bitcoin is extra more likely to mirror its true market worth. This doesn’t imply that the trail will likely be linear or with out volatility; the crypto market is thought for its fast value swings. Nonetheless, the present panorama means that situations are ripe for a extra sustained uptrend.

De-leveraging and sweeping the order guide since December

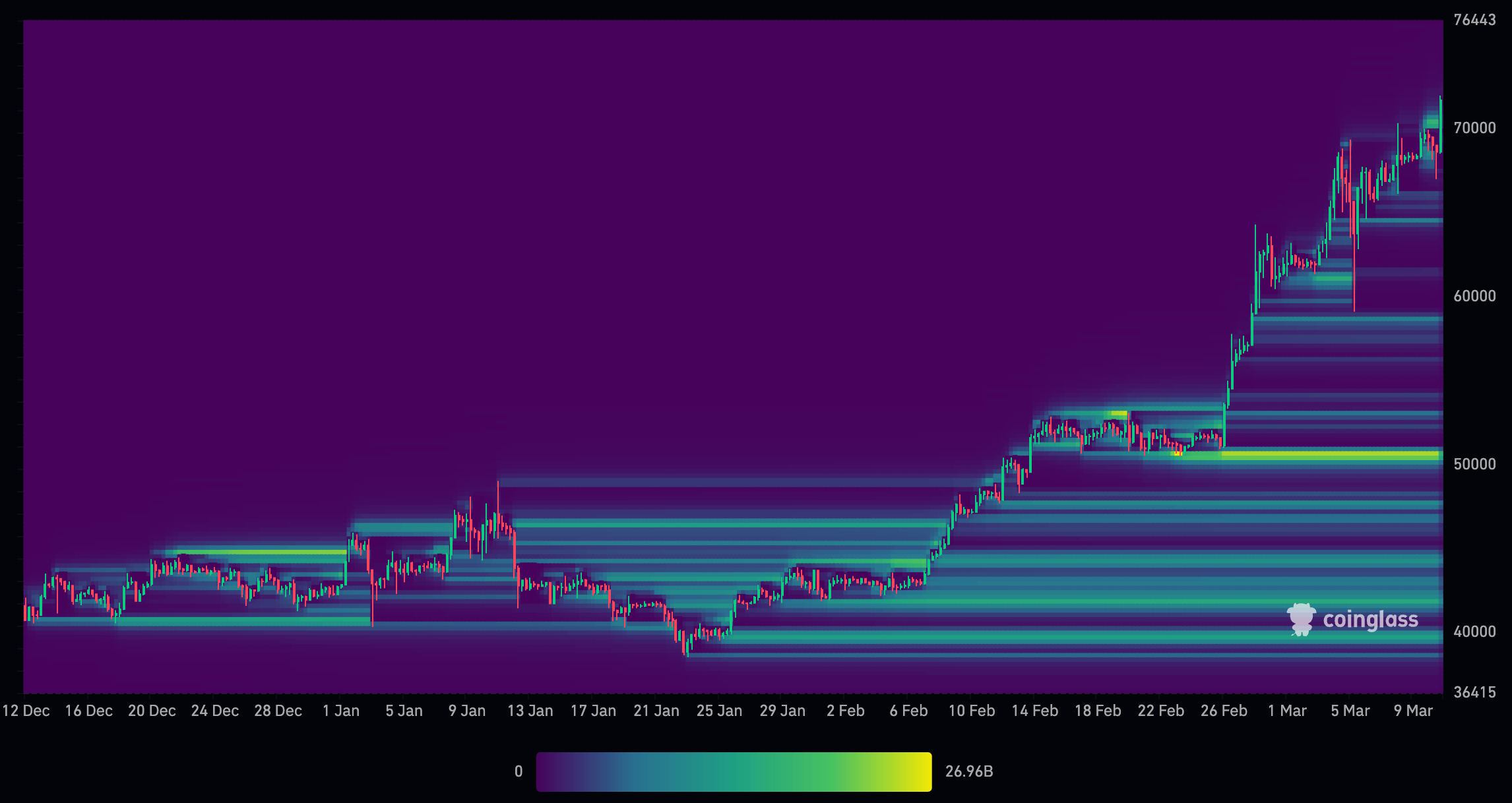

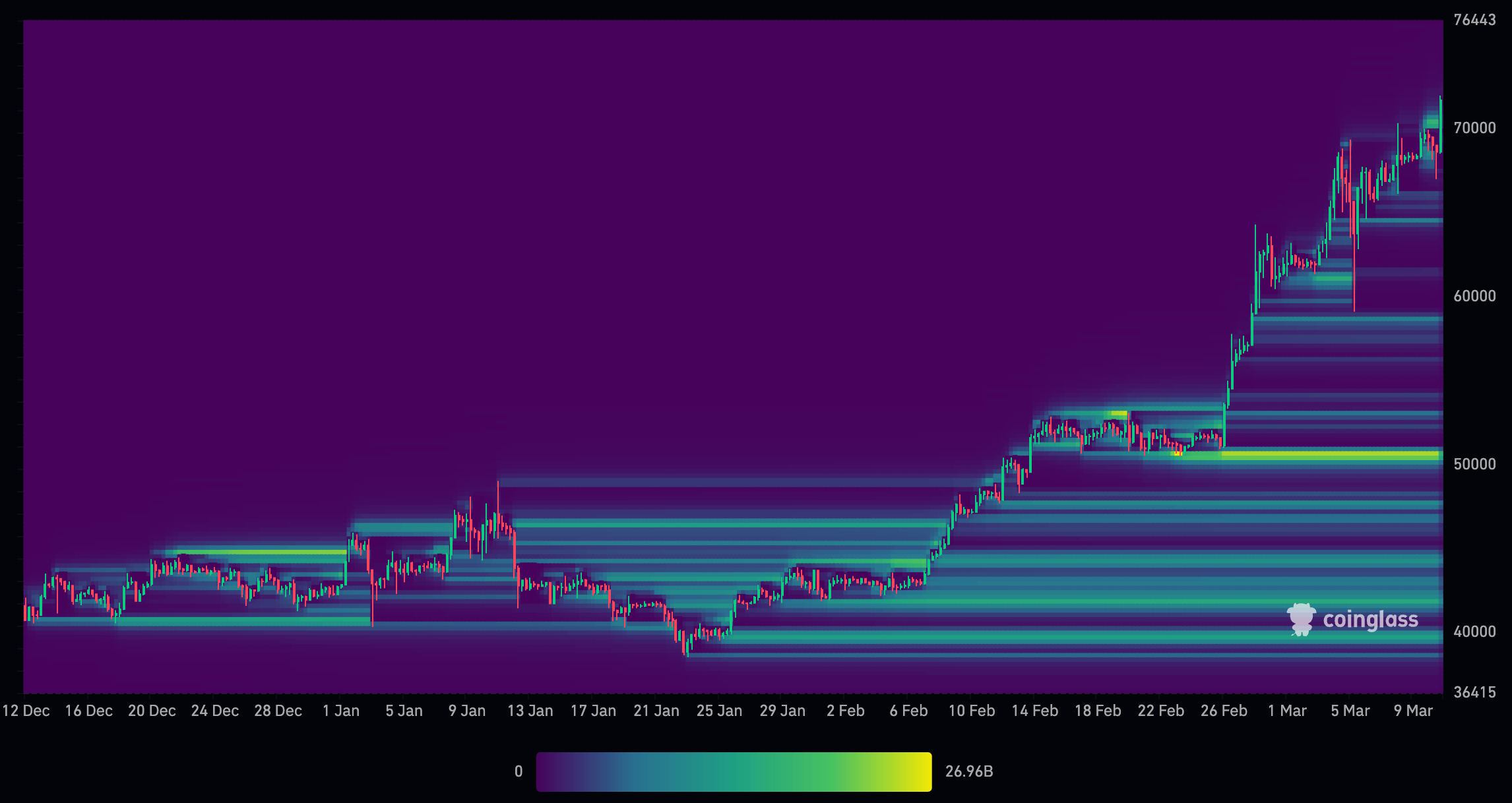

A more in-depth have a look at market forces from December 2022 to March 2023 explains the trail to additional value discovery and a brand new low of $50,000.

In December, the market noticed vital liquidation of leveraged positions, with many longs being liquidated simply above the $41,000 degree and shorts being liquidated round $45,000. As Bitcoin neared ETF approval on January 11, many shorts have been opened across the $45,000 degree, which endured as the value dropped to round $40,000. Curiously, there weren’t many longs at this degree, suggesting that the value was supported by holders and common value discovery quite than leveraged positions.

As Bitcoin bounced again from $40,000 and climbed to $45,000 in early February, a number of shorts have been liquidated alongside the way in which. As Bitcoin continued its upward trajectory, longs have been positioned between $40,000 and $50,000. By the point Bitcoin reached $50,000, there have been vital leveraged positions totaling roughly $27 billion. Nonetheless, as the value elevated, the quantity of leveraged positions above $50,000 decreased considerably.

The value motion in early March noticed Bitcoin rise to $70,000 after which fall to $59,000 in a single candle, successfully wiping out nearly all leveraged positions available in the market. Though there was some leverage round $70,000, most leveraged positions at the moment are concentrated beneath $50,000.

The elimination of leveraged positions has led to a extra clear market construction with a extra balanced distribution of lengthy and quick positions. This growth might pave the way in which for a extra natural value discovery course of pushed by precise market demand quite than hypothesis.

Latest liquidations and deleveraging within the Bitcoin market point out a possible shift in the direction of a extra essentially pushed market. With many of the leveraged positions now concentrated at cheaper price ranges, there’s room for the market to really feel upward stress as actual demand and acceptance pushes costs up.

The removing of extreme leverage has paved the way in which for more healthy market dynamics the place value discovery is pushed by underlying elements akin to rising mainstream acceptance, regulatory readability and technological developments within the blockchain area.

Latest knowledge on liquidations and leverage make a compelling case for a possible uptrend pushed by natural value discovery.