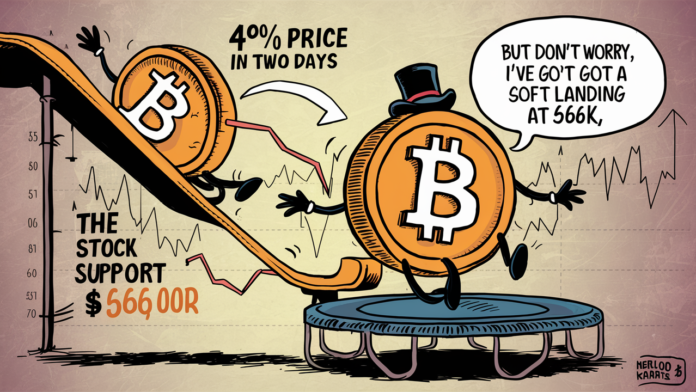

Bitcoin BTC -0.92% the market skilled a major downtrend because it reached $70,300 on Could 27. At the moment priced close to $67,500, Bitcoin has seen a 4% drop in simply two days. Regardless of this decline, the $66,000 help degree held since Could 17 gives some reassurance for bullish traders who aren’t but involved about this correction.

Nevertheless, doubtlessly troubling information comes from the Bitcoin derivatives markets. As of Could 29, the variety of bitcoin-equivalent leveraged bets, generally known as open curiosity, rose to a 16-month excessive. This raises questions on market stability, particularly since open curiosity typically displays leveraged betting positions that may result in sharp declines throughout corrections.

Buyers are transferring away from mounted revenue positions and favoring the efficiency of Bitcoin. Macro tendencies have closely influenced Bitcoin.

The S&P 500 is presently simply 1.2% under its all-time excessive of 5,342 on Could 23, suggesting a sturdy inventory market. Moreover, the yield on the 5-year Treasury notice rose to 4.63% from 4.34% two weeks in the past, suggesting merchants are transferring away from fixed-income positions. The shift was notably evident after weak demand on the Could 28 Treasury public sale pushed the benchmark's yield to ranges which will fear fairness traders.

On Could 29, whole open curiosity in Bitcoin futures reached 516,000 BTC, probably the most since January 2023 and a 6% enhance over the previous week.

Chicago Mercantile Alternate (CME) leads the market with a 30% share, adopted by Binance with 22% and Bybit with 15%. This substantial open curiosity, equal to $34.8 billion, represents a double-edged sword for the market. Excessive open curiosity could point out bullish sentiment that reveals a robust urge for food for Bitcoin futures. Nevertheless, the over-reliance on leverage amongst bulls signifies that a typical 10% market correction might set off cascading liquidations and exacerbate the value decline.

Notably, the value of Bitcoin has proven resilience as regulatory pressures eased in the US. Constructive regulatory developments embody the approval of a spot Ethereum exchange-traded fund (ETF), the Senate's vote to repeal the Securities and Alternate Fee's proposed accounting rule SAB 121, and Congress approving FIT 21 reform, which permits most cryptocurrencies to be handled as commodities. and controlled by the Commodity Futures Buying and selling Fee (CFTC). Collectively, these components favor Bitcoin bulls.