- The technique holds $ 499,096, price $ 40.9 billion, with a median worth of $ 66,357.

- Since November 2024, the technique has added 246 876 BTC, which confronted a lack of $ 3b.

- The technique has accomplished the supply of convertible notes of $ 2 and added 20,356 BTC in 2025.

Dominance within the Bitcoins market stays a technique, former Microsthega Michael Saylor.

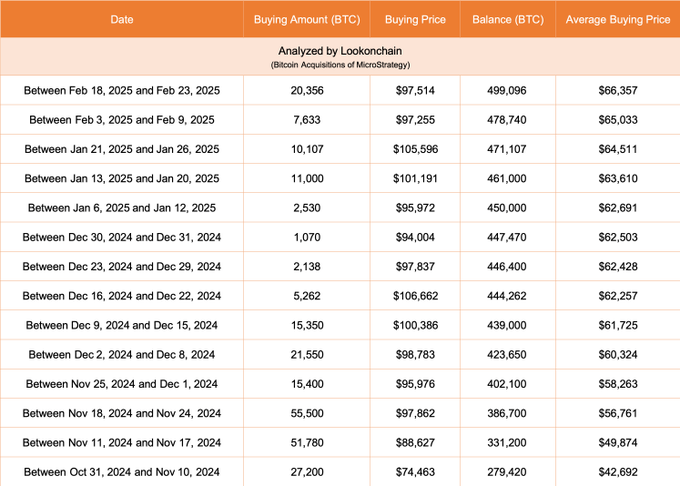

The most recent Lookonchain information present that since February 2025 the corporate has organized 499 096 BTC. This bitcoin cache is awarded roughly $ 40.9 billion.

Common Bitcoin Purchase-in Technique: 66 357 $-SUPPLY PURCHASE NOW UNDER WATER

The common buy worth of this reserve is a median of $ 66,357 for bitcoin. Regardless of this general common, the technique is presently going through the lack of paper on the final acquisitions.

This case raises questions on her technique and the longer term outlook of her bitcoins.

Associated: Investor's warning: Change of tax rule threatens a $ 46 billion technique

Lack of paper of $ 3 billion per bitcoin purchases since November 2024

Since November 2024, the technique has been aggressively increasing its bitcoin possession. The corporate added $ 246,876 BTC for a median worth of $ 94,035 per coin. This acquisition value $ 23.2 billion.

Nevertheless, inherent volatility of bitcoin costs meant that these newly bought property have decreased the worth. They’re presently price $ 20.2 billion. This worth reduces the lack of paper round $ 3 billion.

Spree Spree: 55 500 BTC added in a single week for $ 97,862

Probably the most intense purchases occurred between November 18 to November 24, 2024. Throughout this week the technique obtained 55,500 BTC at a median worth of $ 97,862 per coin. This step additional elevated the entire bitcoin reserves to 386 700 BTC.

A gradual guess of technique on bitcoins regardless of market fluctuations

The acquisition of bitcoins of methods has seen ascension and falls. The common costs differ over time. Specifically, the most important acquisition of the corporate occurred between 18 and 23 February 2025. On this single week it added 20,356 BTC at a median worth of $ 97,514.

Regardless of the current decline available in the market worth of bitcoins, the technique continued so as to add to its reserves. Bitcoin possession continues to be rising. This ongoing accumulation displays its lengthy -term cryptocurrency technique.

Funding within the quantity of $ 2 billion helps different bitcoin acquisitions

The technique added to its acquisition energy and simply accomplished the supply of convertible notes of $ 2 billion.

This infusion additional strengthens its monetary scenario. This new financing allowed the corporate so as to add 20,356 BTCs for roughly $ 1.99 billion. This buy additional strengthened the corporate's general acquisition in 2025 and generated a yr -on -year BTC with 6.9%.

Associated: Microstrategy Rebrands as “Technique”, doubles on Bitcoin

Since February 23, 2025, the technique has gathered 499 096 BTC. These shares had been obtained for roughly $ 33.1 billion at a median worth of $ 66,357 for bitcoins. Even in the previous couple of weeks, the corporate stays probably the most essential holders of company bitcoins.

Renunciation of accountability: The data on this article is just for info and academic functions. The article doesn’t symbolize monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses resulting from using content material, services or products. It is suggested that the readers ought to proceed with warning earlier than taking any measures with the corporate.