Bitcoin's excessive volatility has worn out a big quantity of unrealized features throughout the market this week.

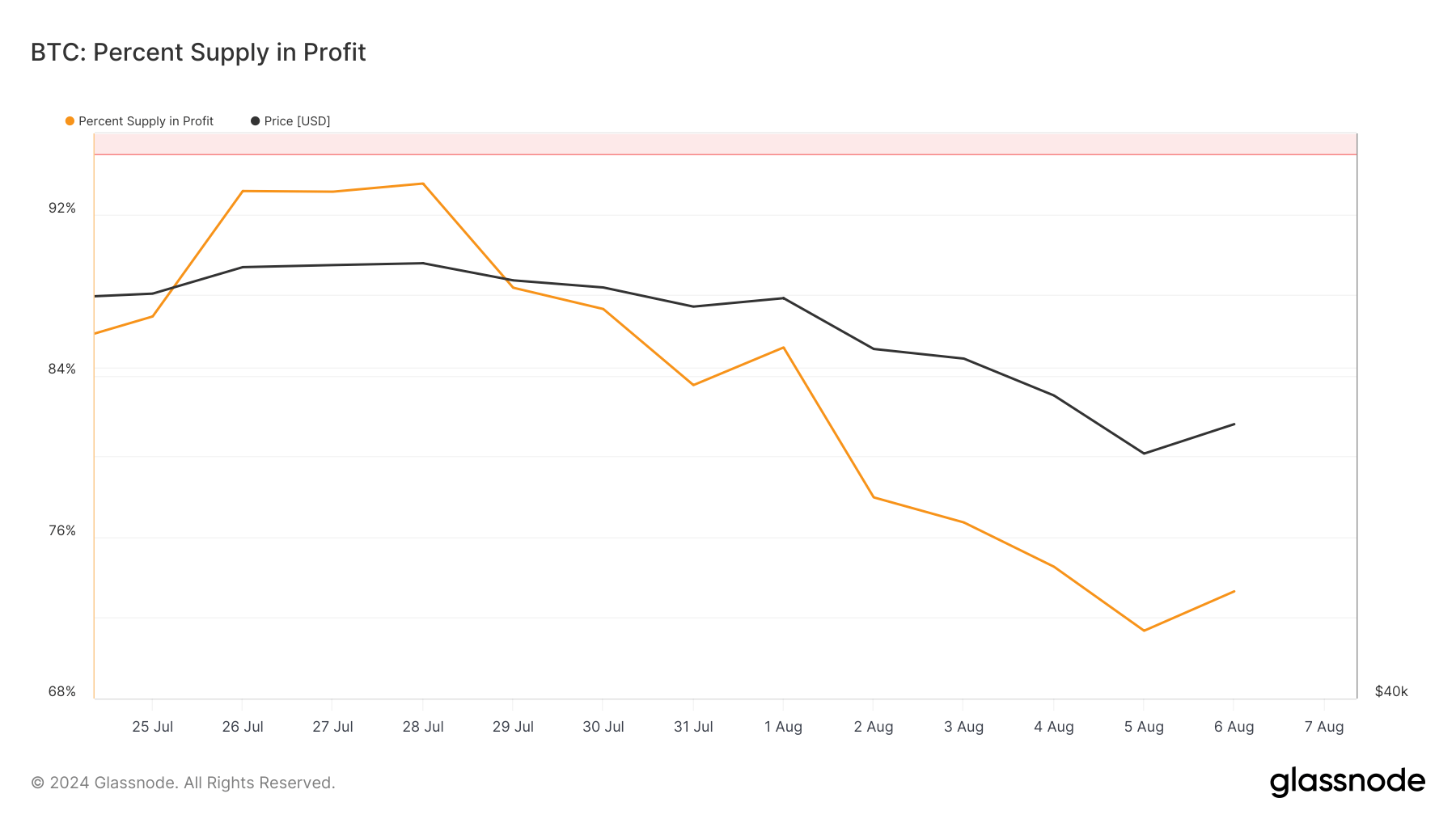

Knowledge from Glassnode confirmed that on August 1, greater than 85% of Bitcoin's circulating provide was in revenue, reflecting steady and chronic bullish sentiment as the value settled round $65,000. Nonetheless, as the value started to say no over the previous week, a lot of that profitability has been erased.

When Bitcoin fell beneath $50,000 on August 5, the bid-for-profit proportion fell to 71%, the bottom since October of final yr. Though the value recovered to round $56,000 on August 6, the take revenue stays simply above 73%.

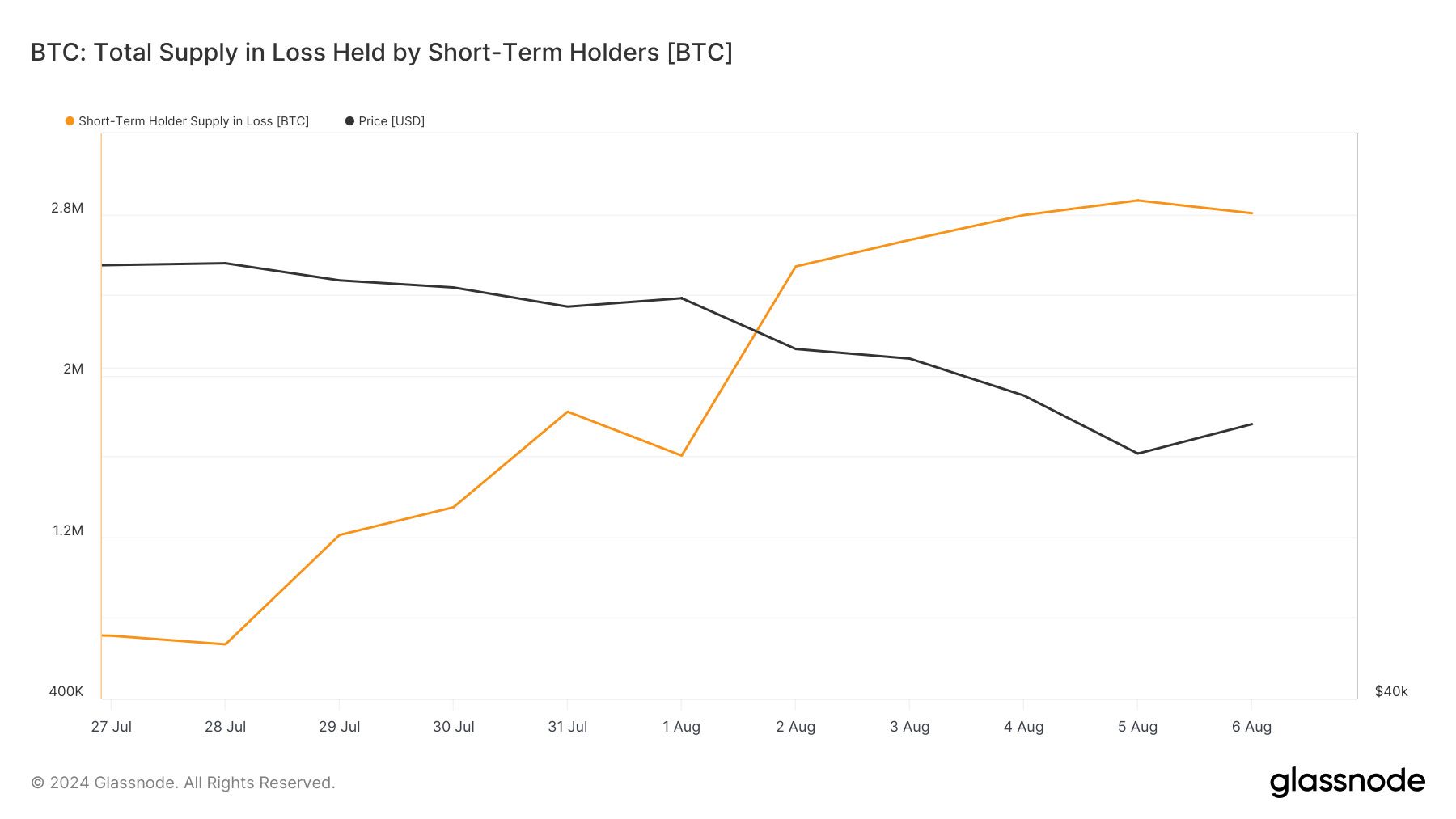

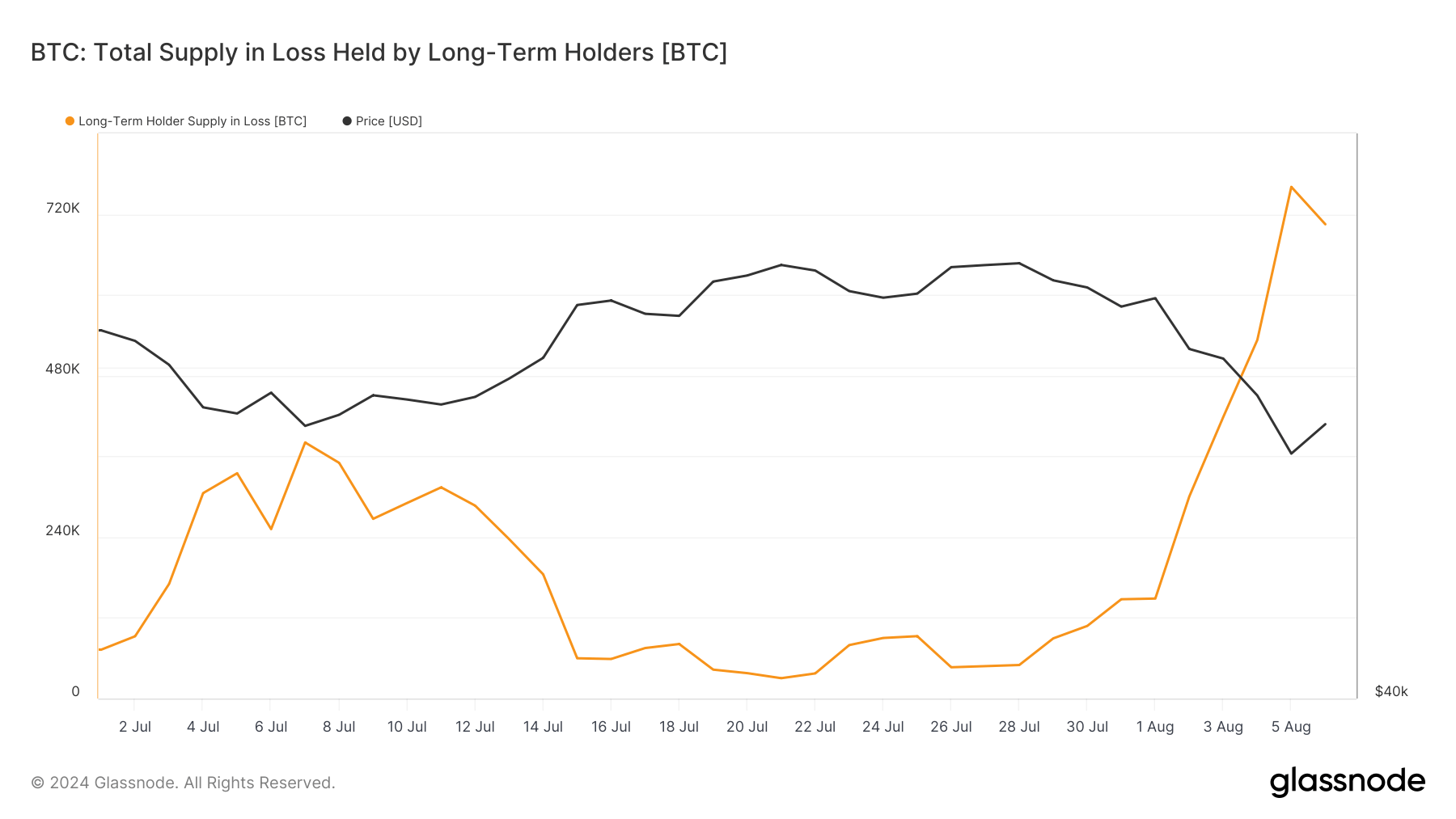

Each lengthy and quick holders noticed a pointy improve of their provide held at a loss.

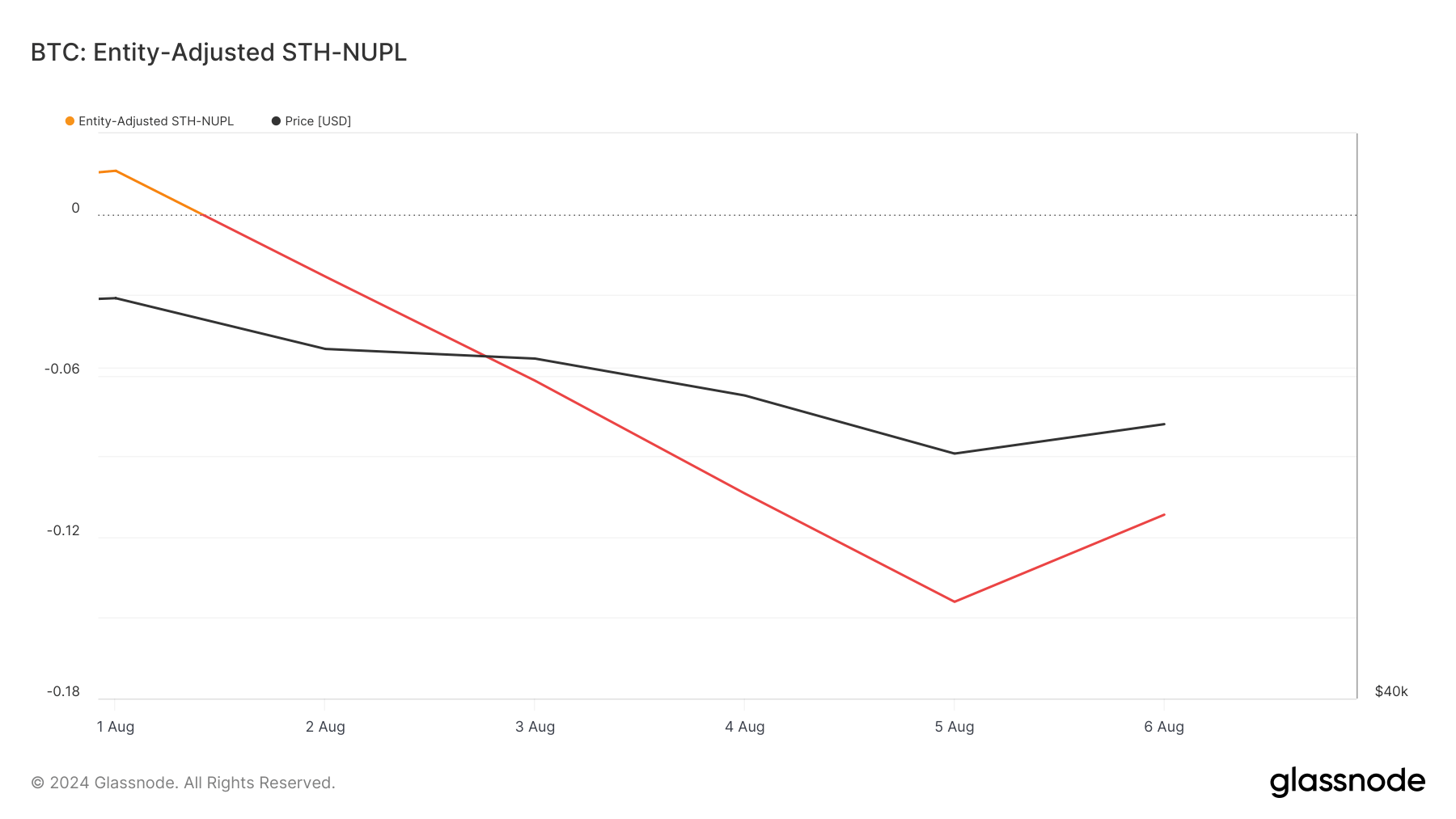

On August 1, STH had a lack of 1.603 million BTC, however this quantity elevated to 2.868 million on August 5, earlier than lowering barely to 2.804 million BTC the next day. This reveals that over 1.2 million BTC have been purchased at costs larger than present market costs and STH is sitting on a big quantity of unrealized losses.

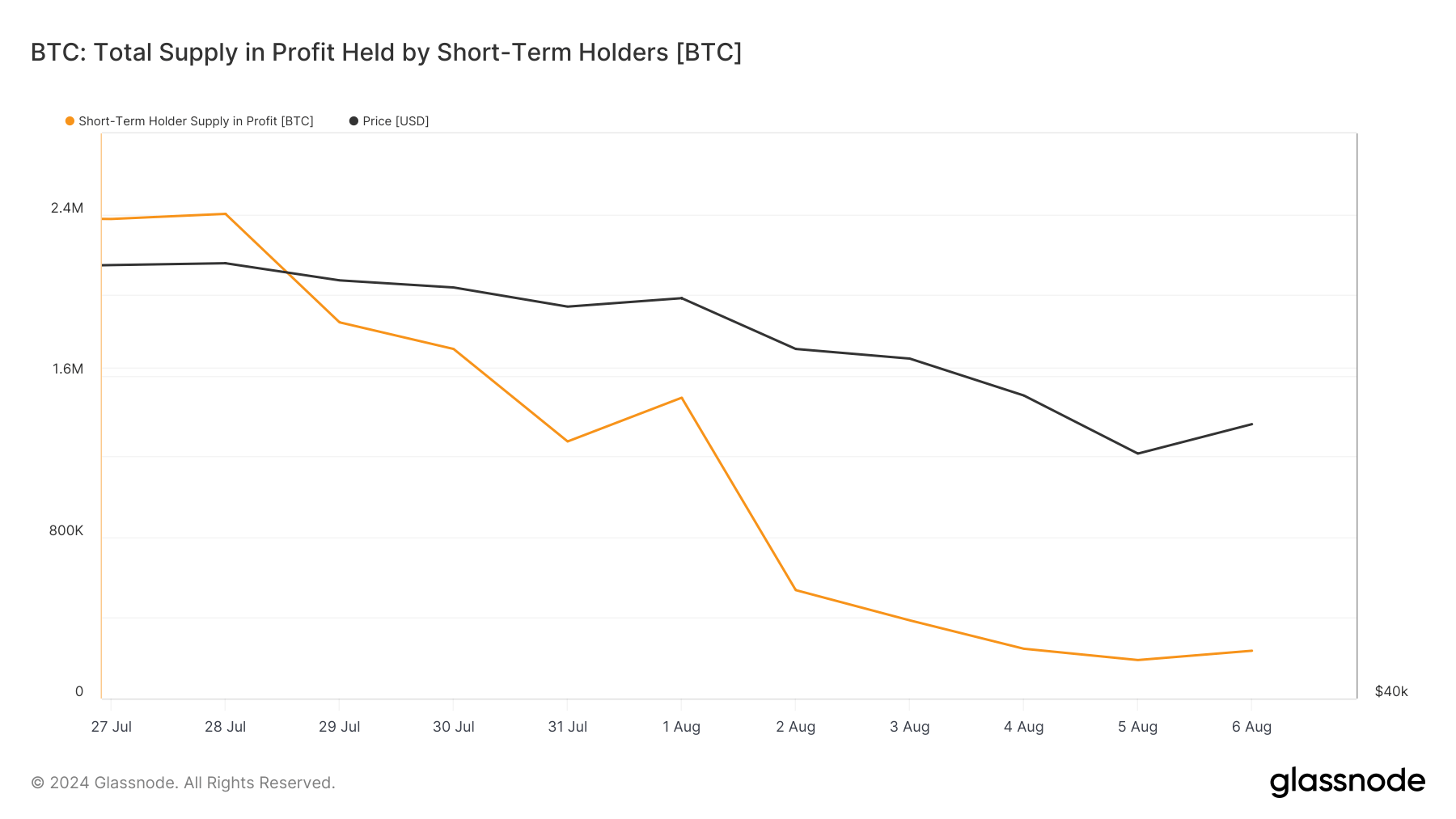

Brief-term provide in revenue additionally fell. Between August 1st and August fifth, STH provide dropped from 1.490 million BTC in revenue to simply 190,724 BTC, recovering barely to 236,790 BTC on August sixth.

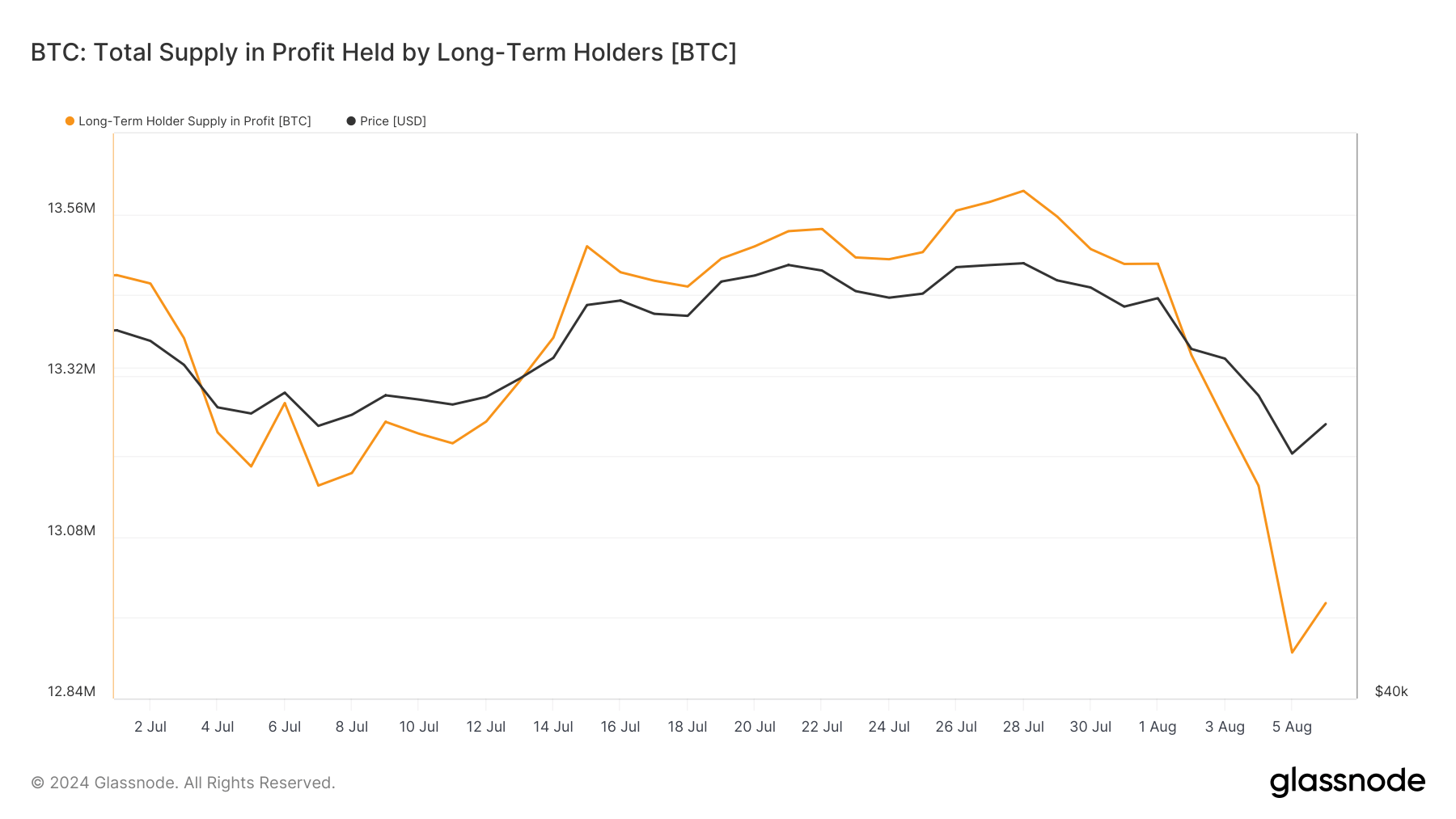

Lengthy-term holders additionally noticed losses, albeit considerably lower than their STH counterparts. The availability of long-term holders in revenue decreased from 13.486 million BTC to 12.908 million BTC between August 1st and August fifth.

In the meantime, the availability of long-term holders in loss elevated by 148,601 BTC on August 1st to 760,521 BTC on August fifth and fell barely to 704,926 BTC on August sixth. This gradual improve means that even LTHs should not utterly insulated from market volatility, though their wider time horizon gives some cushion.

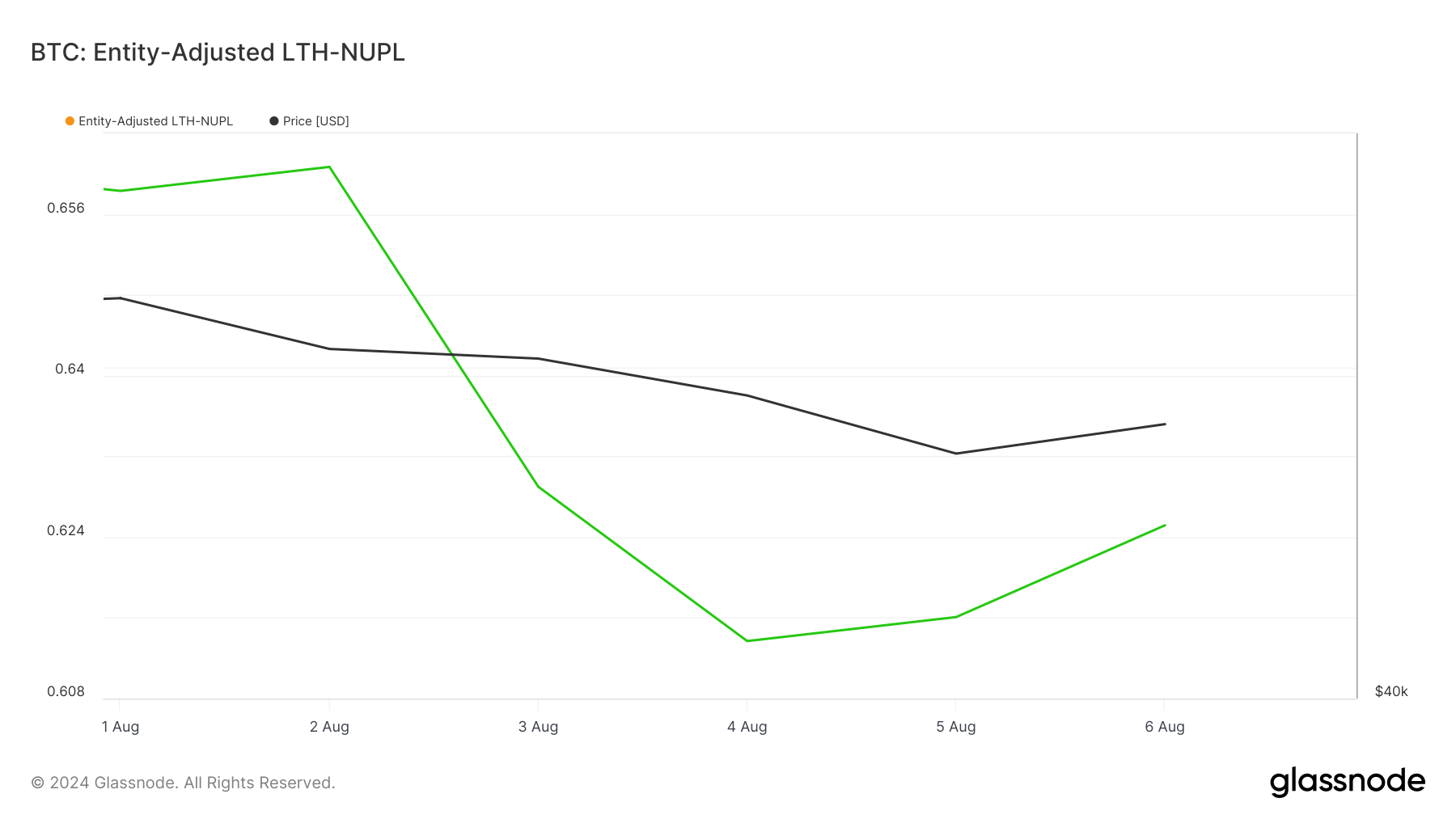

Taking a look at NUPL entities for lengthy and quick holders supplies a clearer and extra nuanced understanding of true market features and losses. Earlier fromcrypto The evaluation discovered that entity-tailored metrics, notably NUPL, filter out non-economic transactions that contain inner transfers throughout the similar entity.

These inner actions can distort conventional metrics by making a misunderstanding of elevated market exercise or profit-taking, resulting in an inaccurate illustration of market sentiment.

Present information reveals that entity-adjusted LTH-NUPL has remained constantly above 0.5 all year long, reflecting continued perception amongst long-term holders in Bitcoin's upward trajectory.

As of August 6, LTH-NUPL is at 0.625, indicating that long-term holders nonetheless have important unrealized features regardless of current value swings.

Then again, the entity-adjusted STH-NUPL skilled considerably extra volatility, falling into the unfavorable in response to the decline within the value of Bitcoin. As of August 6, STH-NUPL is at -0.111.

Whereas short-term holders confronted important unrealized losses and reacted extra dramatically to cost declines, long-term holders maintained a comparatively steady outlook.

The publish Bitcoin Volatility Slashes Unrealized Income, STH Hit the Most appeared first on fromcrypto.