Unspent Transaction Outputs (UTXOs) are an integral a part of Bitcoin's construction and basically function the constructing blocks of the blockchain. As its identify suggests, every unspent transaction output represents a single unspent unit of Bitcoin originating from the completion of a earlier transaction. They kind the premise of the Bitcoin ledger and observe particular transaction outputs till they’re utilized in a brand new one.

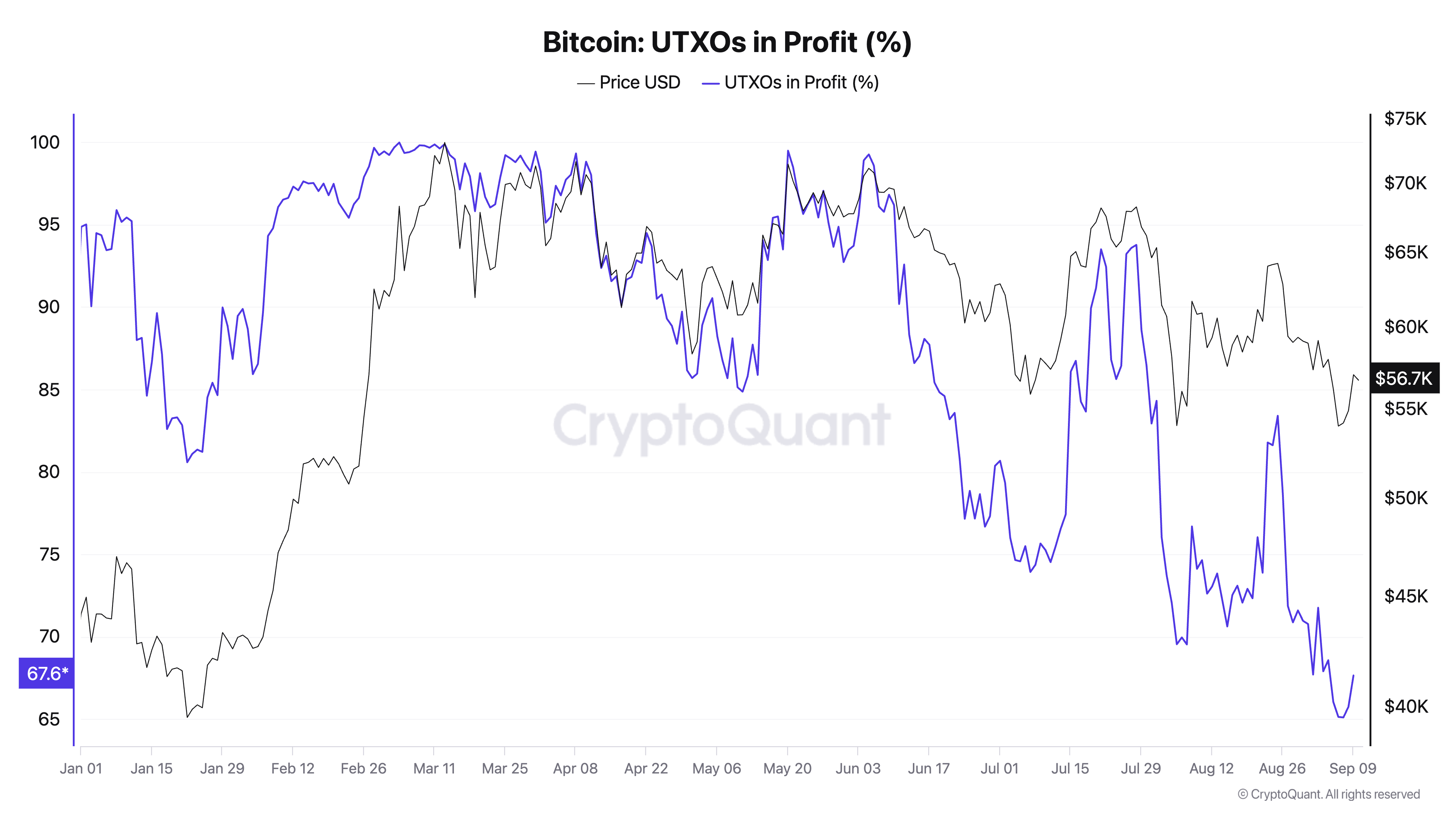

UTXO evaluation often entails seeing if they’re in revenue, which means that the BTC related to them had been acquired at a worth decrease than their present worth. Thus, the share of UTXO in revenue is an important indicator of market sentiment and the general profitability of Bitcoin holders. A excessive proportion indicators a powerful market the place most buyers are seeing positive factors, whereas a decrease proportion signifies losses and displays a extra bearish atmosphere.

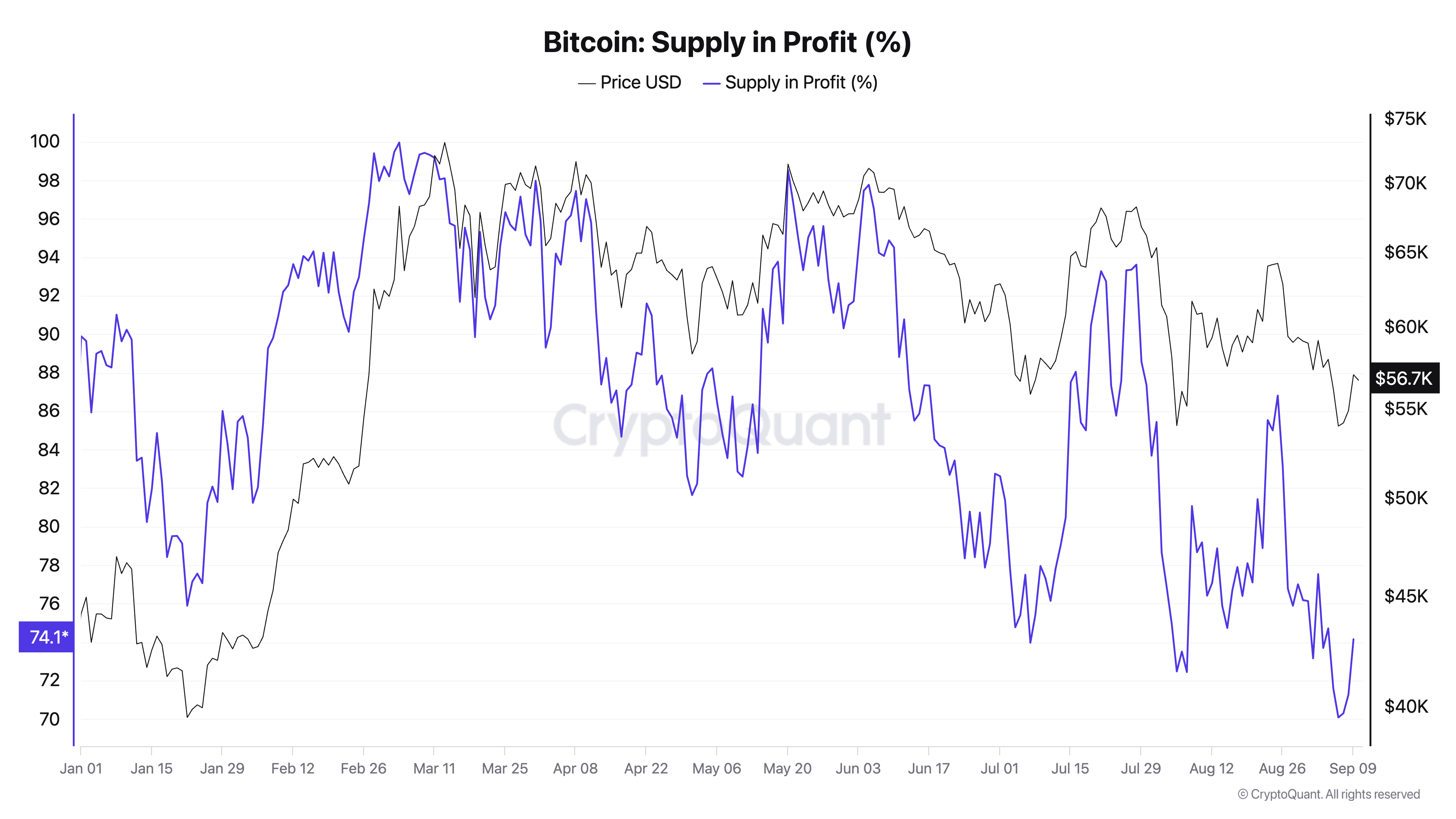

UTXOs differ from the entire Bitcoin provide in a crucial method. Whereas the UTXO proportion in revenue tracks particular person transaction outputs, the Bitcoin provide proportion in revenue seems on the complete provide of bitcoins and whether or not the cash are presently above or under their buy worth. UTXO could be many and mirror totally different sizes of bitcoins held, from small fractions to bigger quantities.

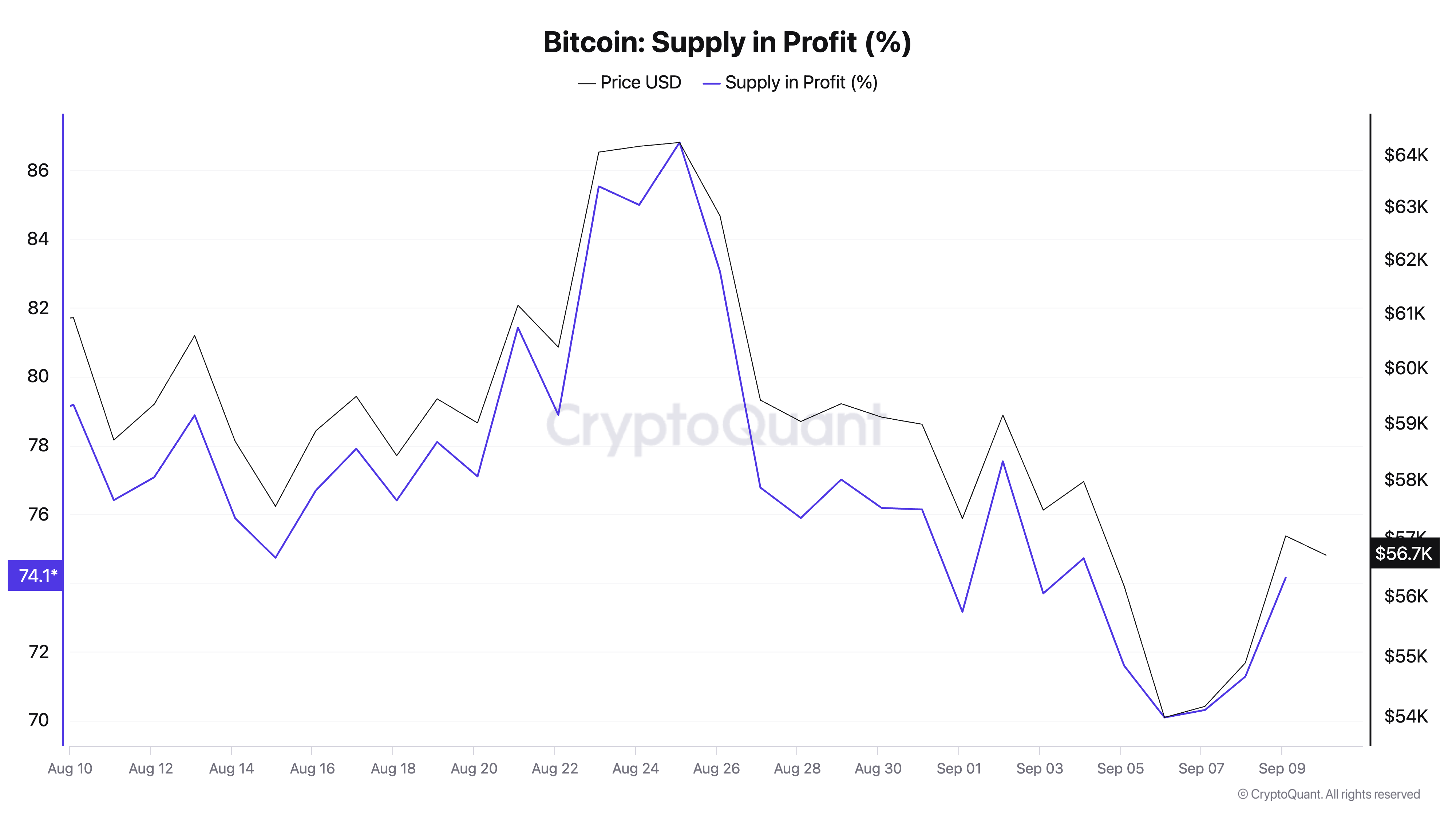

Conversely, when measuring provide in revenue, we give attention to the entire quantity of bitcoins, taking the entire provide as an entire relatively than particular person components of the blockchain ledger. This distinction explains why the share of UTXO in revenue can differ from the share of provide in revenue – UTXO being smaller items could be skewed by the exercise of smaller merchants. In distinction, a suggestion in revenue supplies a broader image of the general state of the market.

For instance, when the value of Bitcoin surged in early March, each worthwhile UTXO and worthwhile provide reached their annual highs, with each metrics approaching 100%. At this level, virtually all Bitcoins, no matter how they had been distributed amongst UTXOs or to the entire provide, had been in revenue, reflecting the bullish atmosphere that got here with Bitcoin approaching $73,000. This era represents the optimum state for holders with minimal losses and most market confidence.

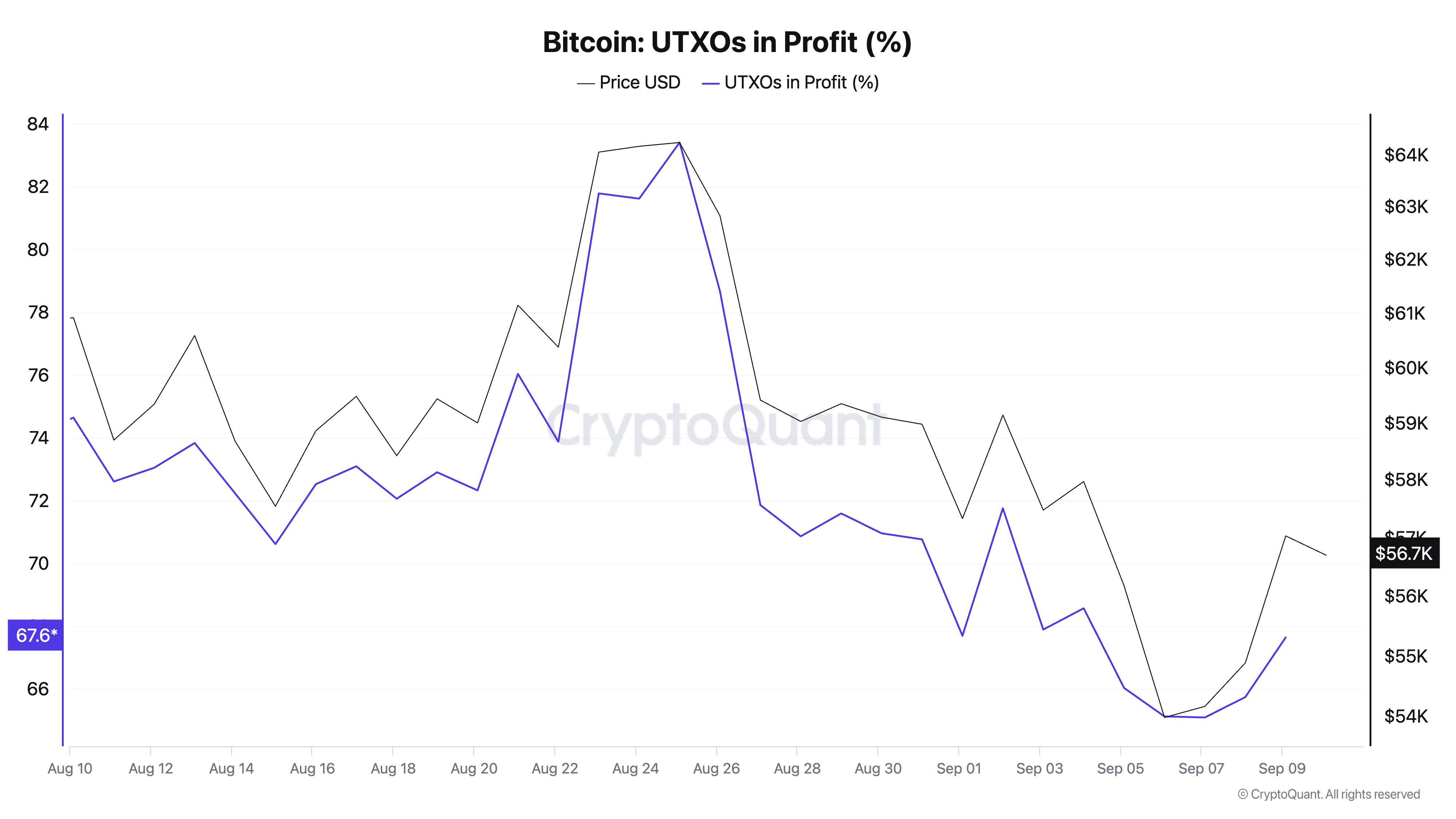

In the meantime, declines within the worth of Bitcoin led to a lower within the proportion of UTXO and provide in revenue. UTXO's P/P hit a YTD low of 65.09% on September seventh when Bitcoin fell to $54,170 whereas provide was barely greater at simply above 70%.

The distinction between the 2 metrics during times of worth volatility is telling. On account of their sensitivity to transaction dimension and frequency of motion in smaller quantities, UTXOs fluctuate extra dramatically.

As costs fall, smaller holders or frequent merchants who’ve acquired Bitcoin at numerous ranges are more likely to see their UTXOs shortly fall out of revenue. Then again, general provide within the revenue metric stays considerably extra steady as bigger long-term holders who acquired Bitcoin through the earlier phases of the cycle should still see their positions in revenue. This distinction highlights the distinction between short-term market exercise and the broader view of Bitcoin's general appreciation.

Over the course of the 12 months, each metrics have carefully adopted Bitcoin's worth motion, peaking when costs are excessive and falling sharply throughout pullbacks. The decline to annual lows on September 7, when UTXO proportion in revenue and provide in revenue hit important lows, displays a shift in market sentiment.

The sharp decline indicators elevated stress out there, with a considerable portion of latest patrons now dealing with losses. This might point out an atmosphere the place capitulation turns into extra probably as holders who purchased through the peak of the value rally might begin promoting to chop their losses. On the identical time, the decrease proportion of UTXO in revenue signifies elevated volatility as smaller holders are extra vulnerable to promoting strain.

Present readings for UTXO in revenue, provide in revenue and Bitcoin worth paint a nuanced image of the market. With UTXO up 67.64% and bid in revenue 74.15% as of September tenth, coupled with a Bitcoin worth of $57,035, the market seems to be in a part of cautious consolidation. These readings point out that whereas a considerable portion of Bitcoin holders are nonetheless in revenue, many latest patrons, particularly those that entered the market within the later phases of the value rally, are actually underwater or near it.

The disparity between UTXO in revenue and provide in revenue provides perception into how totally different teams of market members are doing. When the take-profit bid is greater, it signifies that bigger or longer-term holders, who probably purchased at decrease costs, are higher positioned in comparison with smaller or newer patrons.

UTXOs, that are extra delicate to smaller transactions, present that newer or extra frequent market members face losses. Because of this there was a latest shift in market sentiment, with short-term merchants or smaller buyers feeling strain to drag Bitcoin off its highs.

With the value of Bitcoin now greater than its latest low of $54,170 on September 7, however each UTXO revenue and revenue bid remaining comparatively low in comparison with the start of the 12 months, the information means that the market is in a restoration part, however not but. he gained full confidence. The decrease percentages mirror that whereas the value of Bitcoin has rebounded barely, the harm brought on by earlier worth declines remains to be evident out there construction.

This mixture of things often factors to a market in consolidation, with some members ready for extra apparent indicators of sustained worth restoration earlier than re-entering or committing to carry their positions. The market appears to be in a transition part – now not in a full bull market, however not within the zone of complete give up both.

If costs stabilize or rise from present ranges, the UTXO proportion and bid-for-profit ought to start to extend, signaling renewed confidence. Nevertheless, if the value of Bitcoin falls additional, particularly under key psychological ranges, this might push extra holders into loss territory, growing the danger of additional sell-offs.

The put up Bitcoin Value Stabilizes, However Profitability Hole Reveals Uncertainty appeared first on fromcrypto.