A preferred cryptoanalyst defined how the Bitcoin value may very well be liable to additional draw back based mostly on the present distribution of BTC provide across the value.

This Bitcoin value vary has a crucial provide barrier

In a current publish on the X platform, distinguished cryptocurrency skilled Ali Martinez mentioned how the worth of Bitcoin may endure additional declines. The rationale for this bearish projection revolves across the common price base of a number of BTC buyers.

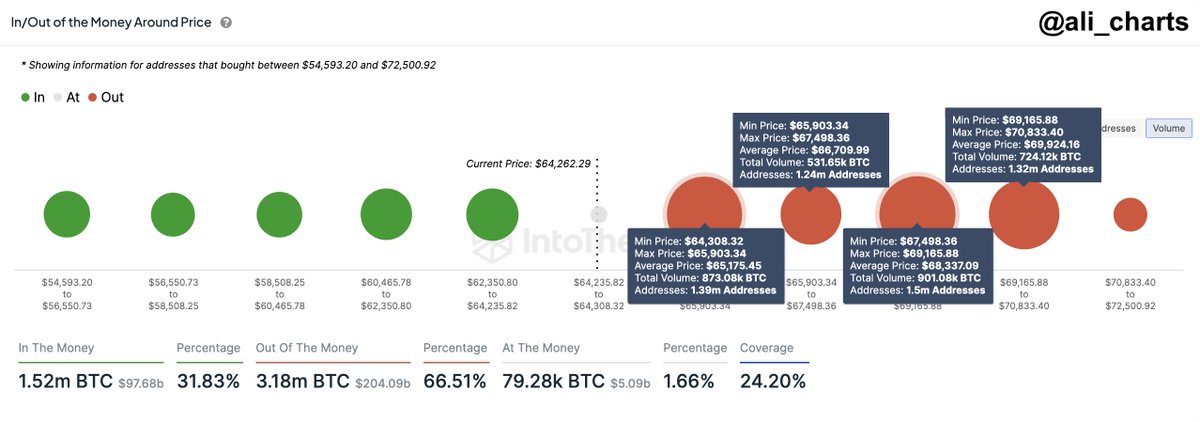

Knowledge from IntoTheBlock exhibits that roughly 5.45 million addresses bought roughly 3.03 million BTC in a value vary of $64,300 and $70,800. As Martinez identified, this led to the creation of a significant provide barrier inside this value vary.

For context, a provide barrier refers back to the value vary the place a considerable amount of cryptocurrency has been acquired. From the dimensions of the dots within the chart beneath, it seems that Bitcoin presently has a big provide barrier above it.

A graph exhibiting the distribution of BTC provide round varied value ranges | Supply: Ali_charts/X

This value vary turns into particularly related when the worth of Bitcoin falls beneath this stage, as BTC holders inside the provide barrier might begin promoting to chop their losses. This might result in elevated promoting strain and doubtlessly a steeper value correction for the main cryptocurrency.

As well as, widespread overstocking and continued value declines may negatively have an effect on market sentiment and set off panic promoting amongst different buyers. If the promoting strain is critical, this might enhance the downward strain on the worth of BTC.

On the time of writing, Bitcoin is hovering round $64,460, reflecting only a 0.2% enhance over the previous 24 hours.

Bitcoin miners capitulate

Typical buyers might not be the one class of individuals contributing to the promoting strain presently going through the worth of Bitcoin. The most recent on-chain revelation exhibits that Bitcoin miners have additionally been lively out there in current weeks.

In line with information from IntoTheBlock, Bitcoin miners have unloaded greater than 30,000 BTC (value about $2 billion since June). This represents the quickest price of decline in BTC miners' reserves in over a 12 months.

Blockchain analysts have linked this selloff to the decreased profitability of miners after the current halving occasion. The fourth halving occasion, which occurred in April 2024, noticed the miner reward drop from 6.25 BTC to three.125 BTC.

The value of Bitcoin makes an attempt to cross $65,000 on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView