- Bitcoin briefly assessments $49,000 earlier than rebounding to $51,000 amid a $270 billion crypto market selloff.

- Fears of a US recession and a Japanese price hike are triggering market turbulence.

- FBI warns of rising crypto scams amid heightened market volatility.

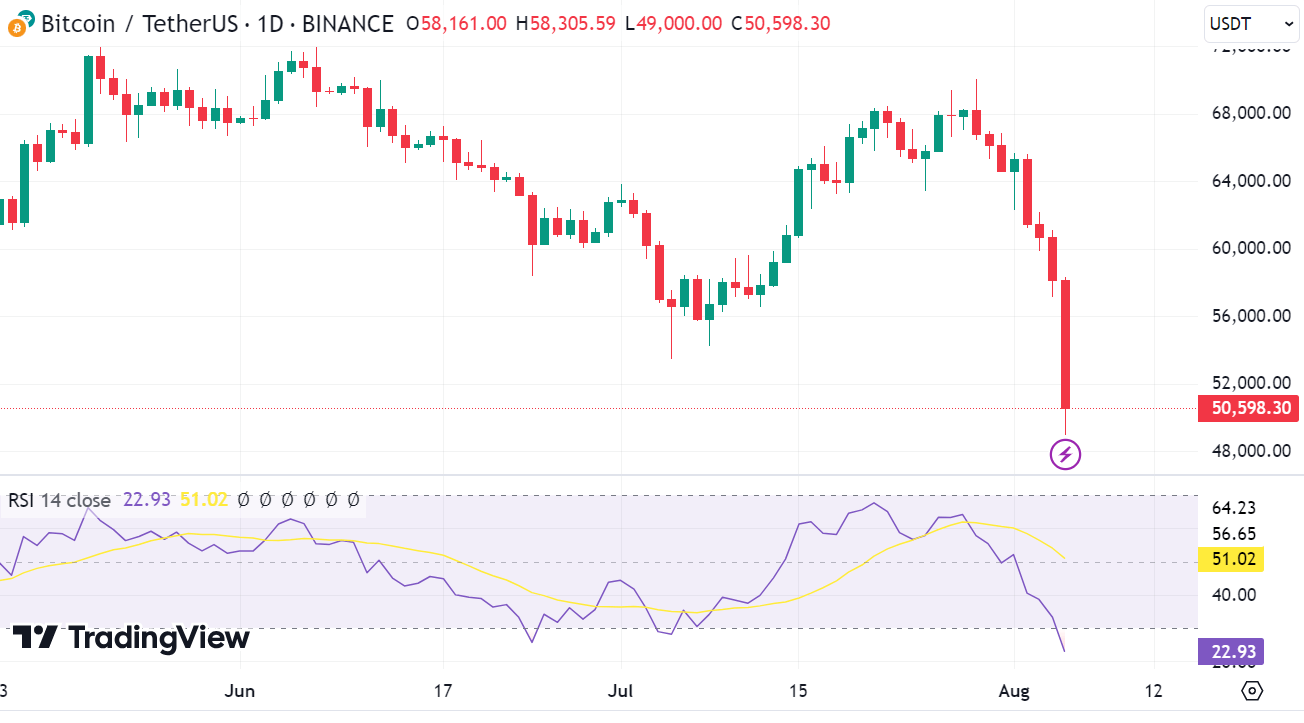

The cryptocurrency market skilled a big drop in the present day, dropping roughly $270 billion in worth in 24 hours, in accordance with information from CoinGecko. On the head of the decline, bitcoin fell practically 20% to $49,121, its lowest stage since February at $53,091.

Ether additionally suffered a considerable 21% drop to $2,300, erasing its beneficial properties for the yr. Different cryptocurrencies corresponding to Binance's BNB and Solana additionally suffered important losses.

Financial institution of Japan will increase base rate of interest

This dramatic plunge within the crypto market coincided with a broader sell-off in shares, significantly in Asia-Pacific markets, exacerbated by a drop of as much as 7% in Japan's Nikkei 225.

The Financial institution of Japan's choice to lift its benchmark rate of interest to its highest stage in 16 years triggered the sell-off and despatched shock waves by means of monetary markets.

The surge in JPY/USD is inflicting large unwinding of yen buying and selling positions and contributing to the sharp decline in US shares. For many who don't perceive the way it works, a brief clarification

1) Many merchants borrowed Jap Yen (JPY) at low rates of interest,… pic.twitter.com/sfi0Hva56M

— Adam Khoo (@adamkhootrader) August 5, 2024

The U.S. Nasdaq additionally slipped into correction territory, posting its worst three-week stretch since September 2022, additional contributing to decrease threat property, together with cryptocurrencies.

Market response was influenced by Japan's tightening of financial coverage and up to date actions by the US Federal Reserve.

Though the Fed determined to maintain its benchmark price regular, it didn’t sign the speed lower in September that many market consultants had anticipated.

This uncertainty added to market anxiousness and triggered merchants to cost in a 100% likelihood of decrease US key charges in September.

Considerations a few attainable American recession

The sell-off displays rising considerations a few potential US recession, fueled by softer financial information and rising geopolitical tensions.

Tony Sycamore, a market analyst at IG, emphasised that Bitcoin and different cryptocurrencies are dangerous property and are extremely prone to market volatility. He famous that Bitcoin is presently testing key help ranges and should maintain the $53,000 mark to stop additional declines.

Nevertheless, at press time, Bitcoin was buying and selling at $51,657, properly beneath this help stage regardless of having rebounded from round $49,000.

The FBI points a warning

The volatility of the cryptocurrency market has additionally raised safety considerations. The FBI has issued a warning about scammers making the most of the market crash to steal customers' funds.

The FBI suggested customers to be cautious of unsolicited messages or calls suggesting account issues and inspired them to confirm any points by means of official channels. The company's warning comes amid a big improve in cryptocurrency-related fraud and hacking incidents.

Within the first half of 2024, hackers stole practically $1.4 billion price of cryptocurrencies, greater than double the quantity stolen in the identical interval in 2023.

This improve is attributed to the rising worth of assorted tokens, together with Bitcoin, Ethereum and Solana. Ari Redbord, world head of coverage at TRM Labs, famous that whereas the safety of the cryptocurrency ecosystem has not essentially modified, the upper worth of tokens has made them extra engaging targets for criminals.

As Bitcoin and different cryptocurrencies undergo these turbulent instances, traders and customers ought to stay vigilant about market situations and potential safety threats.