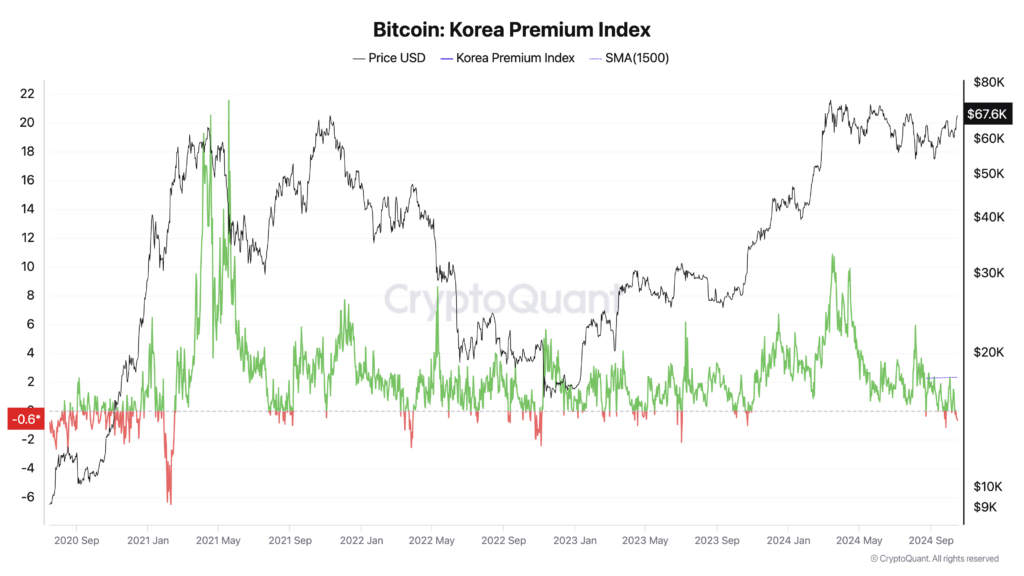

Bitcoin is buying and selling at a reduction on South Korean exchanges, reversing the standard “kimchi premium” that has traditionally signaled bullish market sentiment.

For Korea Instancesthe cryptocurrency is priced round 700,000 gained ($511.73) domestically in comparison with world exchanges, leading to a detrimental premium (low cost) of -0.74% as of Thursday afternoon.

The shift appears to point a bearish outlook amongst South Korean traders. A better kimchi premium often signifies robust native demand and constructive sentiment, usually leading to bitcoin costs outperforming world charges. Conversely, a decrease or detrimental premium displays waning enthusiasm and diminished shopping for strain, which can sign a market correction or alignment with world valuations.

Analysts attribute the bizarre discrepancy to subdued investor sentiment in South Korea and better demand for digital property on overseas platforms. KP Jang, head of Xangle Analysis, instructed the Korea Instances that the restrictions are stopping overseas and institutional traders from accessing home exchanges, amplifying the affect of falling demand from retail traders.

The market can be influencing the shift in merchants' preferences in direction of altcoins. As Bitcoin surged globally, Korean merchants started piling up undervalued various cryptocurrencies, anticipating a strong rally within the fourth quarter, in response to Enterprise Insider. These altcoins, together with Tao, Sei Community, Aptos, Sui, NEAR Protocol and The Graph, are seen as providing larger returns and probably diverting consideration away from Bitcoin.

Declan Kim, a analysis analyst at DeSpread, additionally instructed the Korea Instances that the altcoin market, which incorporates a good portion of home buying and selling, continues to wrestle amid the transition phases of recent rules. The implementation of the Digital Asset Person Safety Act impacts market forces. Many altcoins stay unlisted on home exchanges in comparison with overseas ones, and the ban on market making makes it troublesome to make sure liquidity.

The kimchi premium has traditionally been a trademark of the South Korean crypto market. When bitcoin broke the 100 million gained mark domestically in March, the premium briefly jumped as excessive as 10%. A better premium usually signifies robust native demand and bullish sentiment, which frequently coincides with or precedes bitcoin worth will increase. Conversely, a decrease or detrimental premium signifies bearish sentiment and diminished shopping for strain.

The info signifies a big drop in buying and selling quantity for Bitcoin and Korean Gained (BTC/KRW) over the previous 40 days, reflecting a shift in investor focus.

Analysts count on the reverse kimchi premium to be non permanent. Jang anticipates that the discrepancy can be resolved quickly, as such premiums hardly ever persist for lengthy. He talked about that ongoing discussions on laws permitting company funding in digital property might enhance liquidity on home exchanges and step by step scale back the value hole with overseas markets.

Present buying and selling circumstances replicate a fancy interaction of home rules, investor habits and world market developments, signaling vital shifts in South Korea's crypto panorama. The detrimental kimchi premium, whereas uncommon, might finally result in a extra balanced and mature market as it’s extra consistent with the worldwide valuation of digital property.

The final time Kimchi Premium dipped into the detrimental was in October 2023, simply earlier than the ETF-driven bitcoin bull run.