Japanese funding agency Metaplanet has made its biggest-ever bitcoin purchases after buying 107,913 BTC for round ¥1 billion (equal to $6.9 million), in line with a press release on October 1.

That is Metaplanet's eleventh bitcoin acquisition since its first buy on April 23, in line with information from Bitcoin Treasuries.

With this newest buy, the agency's whole Bitcoin holdings now stand at 506,745 BTC, value roughly $32.2 million. The corporate's latest disclosure reveals it spent 4.75 billion yen (round $31.9 million) on bitcoin purchases, with a mean acquisition price of 9.37 million yen (roughly $64,931) per BTC.

In the meantime, Simon Gerovich, CEO of Metaplanet, has hinted at additional Bitcoin acquisitions, revealing that the agency's subsequent objective is to build up 1,000 BTC. He mentioned:

“As we start our second week of claims, please assist us transfer up the checklist of the biggest company bitcoin holders. One other objective is to personal greater than 1000 bitcoins.

At the moment, Metaplanet is the second-largest institutional holder of bitcoin in Asia, behind solely Hong Kong's Meitu Inc., which holds 940.9 BTC, in line with Bitcoin Treasuries.

In the meantime, Michael Saylor-led MicroStrategy stays the world's largest company bitcoin holder with 252,220 BTC.

Metaplanet shares outperform

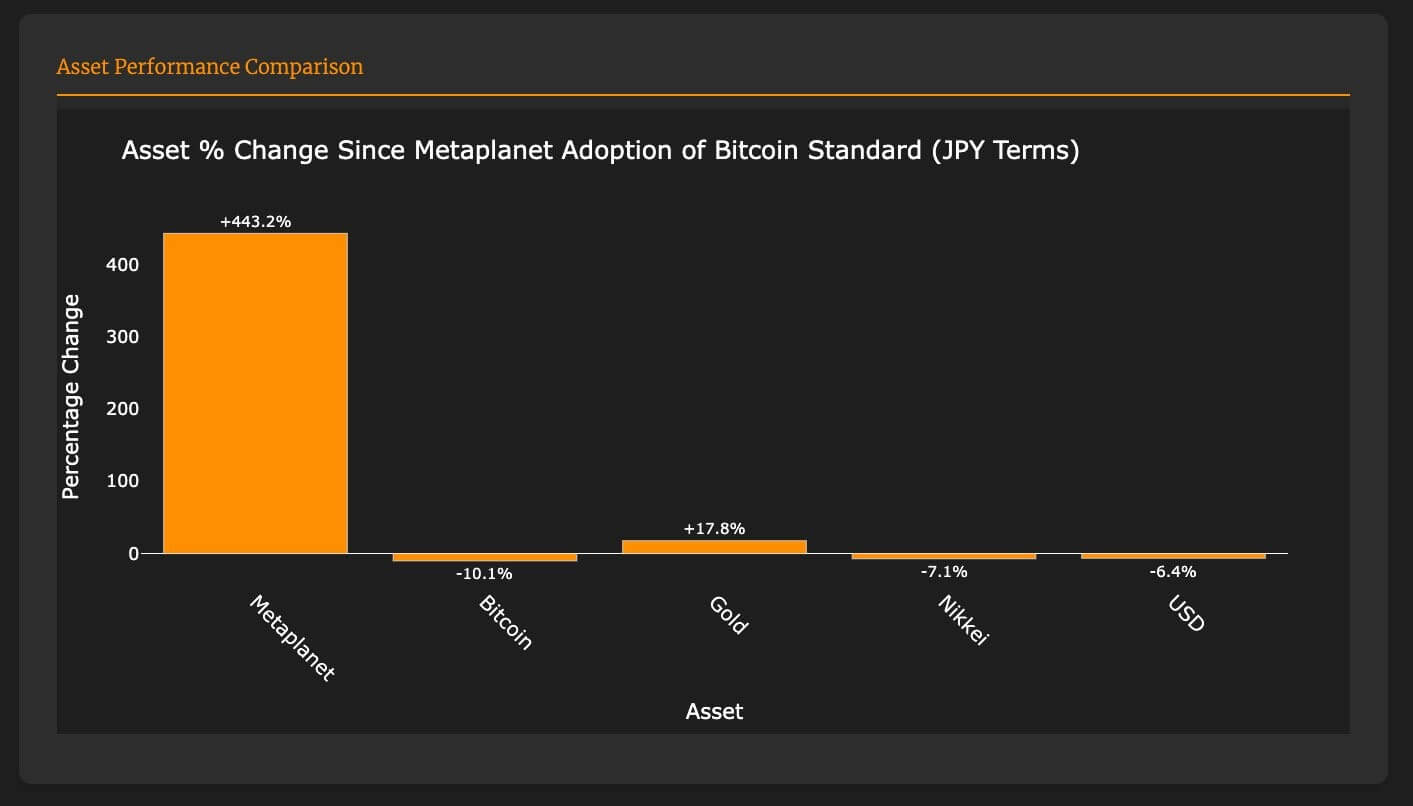

Metaplanet's transfer with Bitcoin has confirmed to be very profitable, serving to the corporate's inventory outperform conventional monetary property such because the US greenback, gold and Japan's Nikkei inventory index.

On September nineteenth, Gerovich shared that the corporate's inventory has risen 443% since adopting the Bitcoin commonplace. As compared, the Nikkei, the US greenback and Bitcoin itself noticed declines of seven.1%, 6.4% and 10.1% respectively. Nonetheless, gold is up 17% throughout this era.

Market watchers linked the robust efficiency to the agency's bitcoin-only technique it adopted in Might to hedge in opposition to volatility within the Japanese yen. Since then, Metaplanet has been commonly shopping for bitcoins and ranks among the many high 25 institutional bitcoin holders worldwide.