The worth of Bitcoins was caught within the vary of $ 81,000 to $ 86,000 final week, displaying a excessive stage of indecision between bulls and bears. Whereas most indicators on the chain paint a bear picture for the premiere of cryptocurrencies, the most recent information recommend that the bull run doesn’t have to finish but.

BTC buyers should not but in full panic mode: Blockchain

In a brand new contribution on the X Blockchain Analytics platform, Glassnode revealed {that a} particular Bitcoin holder referred to as “quick -term holders” (STH) faces a rising market strain. This chain commentary is predicated on the worth of unrealized losses of this investor's cohort.

For readability, the unrealized loss applies to the one that’s nonetheless on paper as a result of the investor continues to be holding and promoting asset (with reducing worth). The loss turns into “actual” or “realized” when the holder sells an asset for a worth decrease than the acquisition value.

In line with Glassnode, in latest weeks, unrealized losses of bitcoin buyers have climbed in latest weeks, which has particularly pushed quick -term holders to a big +2σ Prague. STH relative unrealized loss metric, which hit the edge of maximum +2σ, was prior to now related to elevated gross sales strain.

Glassnode, nevertheless, famous that the dimensions of sth losses nonetheless falls throughout the extent that’s normally noticed on the bull market. Particularly, the dimensions of those losses will lighten in comparison with the market sale, which was witnessed in 2021, suggesting that the bull cycle could not but be made.

Supply: @glassnode on X

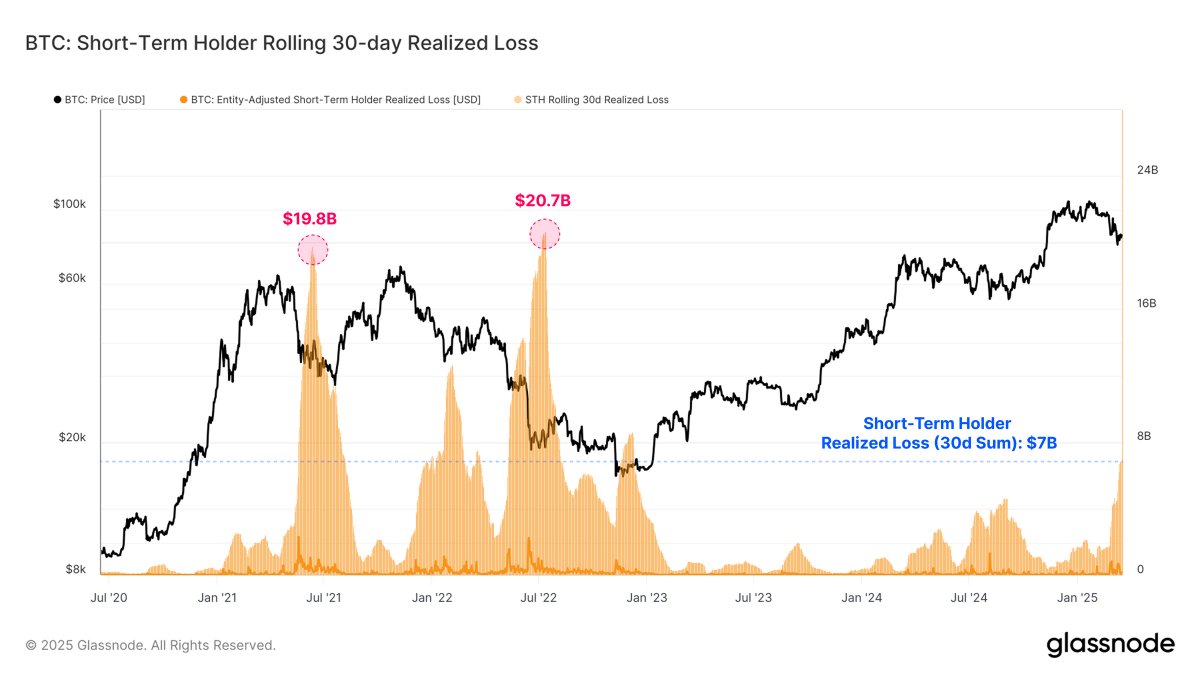

To additional illustrate this, Glassnode revealed that the cylindrical 30 -day loss for brief -term Bitcoin holders has now exceeded $ 7 billion, which is the biggest occasion of everlasting loss within the present cycle. Regardless of the significance of this concern, it’s nonetheless a lot much less critical than the give up occasions that appeared initially of the previous bear markets.

For instance, the losses of bitcoins throughout the principle value repairs in Might 2021 and 2022 elevated to $ 19.8 billion and $ 20.7 billion. Because the realized losses are nonetheless considerably underneath the earlier give up occasions, there’s a probability that the market has not but reached the panic regime.

Bitcoin value at first sight

Since this writing, the worth of bitcoins is round $ 84,300, reflecting a rise of 0.3% within the final 24 hours. In line with information from Coingecko, the flagship of cryptocurrencies is just 0.6percentwithin the final seven days, emphasizing the jerky market standing.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Predominant image from Istock, Graph from TradingView

Editorial course of For , it’s centered on offering a totally explored, correct and neutral content material. We keep strict supply requirements and every web page undergoes cautious evaluation of our workforce of the very best expertise consultants and seasoned editors. This course of ensures the integrity, relevance and worth of our content material for our readers.