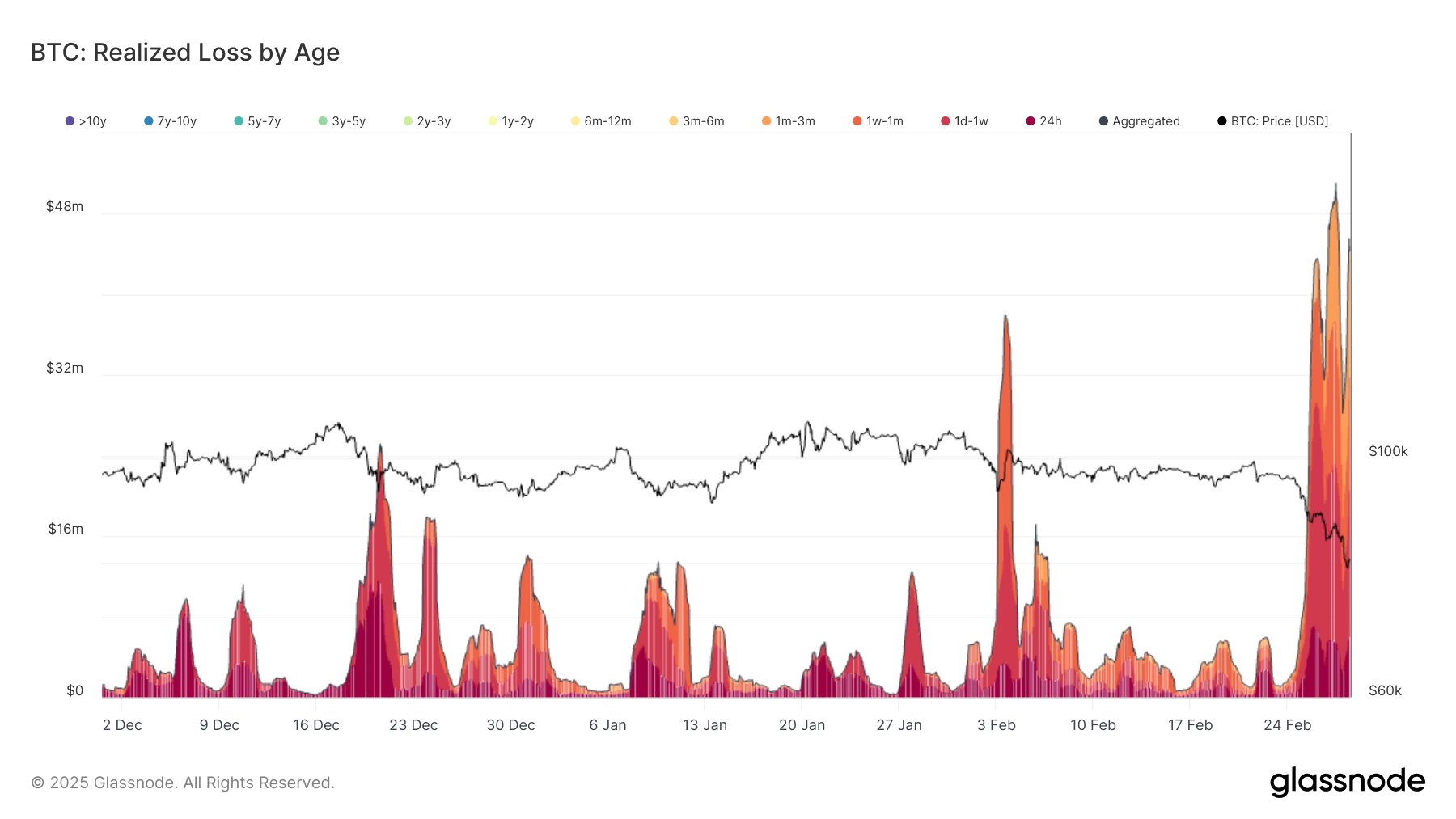

The Bitcoins market (BTC) has been very risky within the final week and below a robust bear affect. Throughout this era Bitcoin crashed by greater than 15% by as much as $ 80,000. Curiously, Blockchain Analytics has offered Glassnode in -depth evaluation of buyers' conduct in the course of this worth drop, which emphasised the cohort with the most important losses.

BTC 1-day to 1-week holder leads market liquidation strain

On Friday, February 28, Bitcoins decreased beneath $ 80,000, which final worth ranges that have been final noticed in November 2024. In response, the BTC market recorded $ 685 million in realized losses apart from the preliminary $ 2.16 billion between 25 to February. In a current X put up, Glassnode analysts have been immersed out there sale on Friday, suggesting that this current give up is primarily concentrated between quick -term holders (STH), who understand losses a lot increased than lengthy -term holders.

Of the Glassnode report, probably the most affected STH cohort was the brand new market contributors final week, as proven within the following values: 1-day to 1-week holders with $ 238.8 million in losses, 1 weekly 1 month holders ($ 187.6 million), $ 1 for 3 months) (132.4 million). Nonetheless, it ought to be famous that holders from the final 3-6 months have additionally skilled a major enhance within the losses realized. This group recorded a $ 12.7 million losses on Friday, which represents a revenue of 95.4% of the day before today.

The Glassnode report checked out additional and likewise realized that the worth drop on Friday additionally moved the common stage of implementation of Bitcoins loss to $ 57.1 million per hour. The velocity of implementation on the sth-kterna cohort represents many of the market losses, as follows: 1-day to 1 week holders with $ 19.9 million/hour, 1 week to 1 month holders ($ 13.9 million/hour), 1 month to three month holders (14.2 million) and 24 hours (8.04 million).

As anticipated, 1 -day to 1 -week cohort is the dominant power in controlling liquidity strain with a level of lack of virtually double for the following largest group.

Bitcoins Lengthy -term holders stay decision

In line with different knowledge from the Glassnode report, long-term Bitcoin holders from the final 6-12 months have proven a minimal, negligible realization of loss regardless of the widespread market give up.

This growth means that longer -term buyers are largely destroyed by a current sale and worth corrections with robust confidence to leap to the market. Through the press, bitcoins are traded for $ 85,200 after some worth restoration on Friday. Nonetheless, its weekly losses stay 11.34%, indicating the present bear step available on the market.

Most important picture from Getty Pictures, FROM TRANINGVIEW Graph