The Bitcoin market is experiencing a land seize of spectacular proportions. Pushed by institutional curiosity and rising costs, traders are scrambling to get a bit of the digital gold rush.

On March 13, Bitcoin hit a brand new all-time excessive of $73,750, breaking all-time information and sending shockwaves via the monetary world.

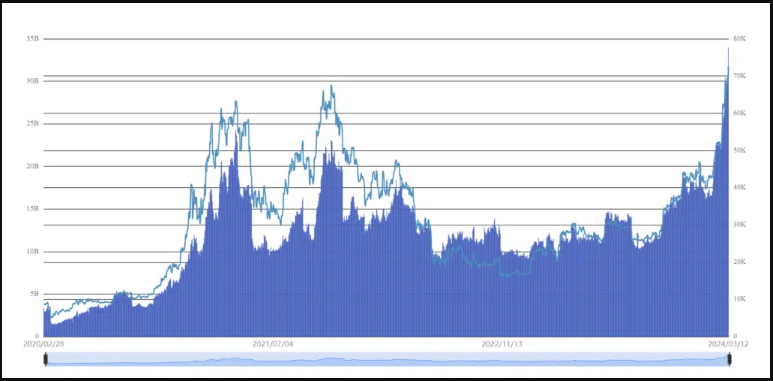

The variety of open bitcoin pursuits is exploding

This stratospheric rise coincides with a rise in open curiosity in Bitcoin futures contracts, a metric that signifies investor expectations for future value actions.

In line with SoSo Worth, a cryptocurrency analytics agency, open curiosity reached a staggering $34 billion, surpassing the excessive set through the 2021 bull run.

Bitcoin futures open curiosity. Supply: SoSo Worth

Bitcoin ETFs: Gateway to Wall Avenue

This surge in investor enthusiasm is just not restricted to conventional futures markets. Spot Bitcoin ETFs, exchange-traded funds that immediately monitor the value of Bitcoin, are experiencing file inflows.

BlackRock’s iShares BTC ETF (IBIT) took in a staggering $850 million on March 12, the very best one-day internet influx ever recorded for a Bitcoin ETF.

This unprecedented demand underscores the rising urge for food for Bitcoin amongst institutional traders who more and more view the cryptocurrency as a professional asset class.

BTCUSD buying and selling at $73,397 on the 24-hour chart: TradingView.com

Bitcoin ETF: Wall Avenue Joins Digital Gold Rush

Amidst the celebratory champagne corks, nonetheless, a warning emerges from the world of derivatives. SoSo Worth, whereas acknowledging the bullish sentiment, warns that the excessive funding charges related to bitcoin futures contracts may sign an impending pullback.

Funding charges primarily signify the price of holding a futures contract, and elevated ranges can point out an overheated market ripe for a correction.

In the meantime, undeterred by these whispers of warning, bitcoin evangelists like Michael Saylor, govt chairman of MicroStrategy, stay steadfast of their convictions.

Saylor just lately doubled down on his prediction that bitcoin is the “endgame” of digital property, a perception that underpins MicroStrategy’s aggressive bitcoin acquisition technique.

The corporate at present boasts a battle chest of greater than 200,000 bitcoins, a stake value greater than $15 billion.

Saylor envisions a future the place a good portion of the world’s wealth, estimated at round $900 trillion, migrates towards bitcoin as traders search a protected haven for his or her capital.

The latest value surge and file open curiosity paint a bullish image for Bitcoin. Nevertheless, the specter of excessive funding charges and potential market corrections looms massive.

The approaching weeks and months shall be essential in figuring out whether or not that is the daybreak of a brand new period for Bitcoin or a brief peak earlier than a recalibration.

Featured picture from Freepik, chart from TradingView