- Bitcoin perpetual futures open curiosity returns to $16 billion, however funding charges stay subdued.

- That determine matches Bitcoin, which is at $71,400 immediately, led by Binance merchants.

- The SOPR short-holder metric reveals managed profit-taking at 1.017, under the overheating stage.

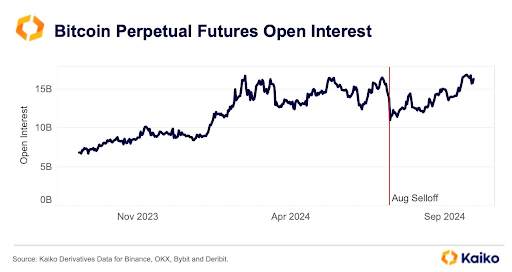

As bitcoin nears its all-time excessive, open curiosity within the perpetual futures market has climbed again to $16 billion, in line with Kaiko Knowledge.

This brings open curiosity again to the extent seen in August, simply earlier than the large sell-off. Capital inflows point out elevated market participation.

Notably, the newest determine coincides with Bitcoin regaining the extremely anticipated $70,000 mark, a stage it has struggled to succeed in for the previous 4 months. Bitcoin is now making vital progress in direction of its earlier all-time excessive, hitting an intraday excessive of $71,400. That places it simply 3.48% away from the file excessive of $73,750.

Regardless of elevated exercise within the perpetual futures market, which is returning to August highs, funding charges stay subdued. This implies softened demand, even when the worth of Bitcoin rises to $71,000. Funding charges replicate the prices related to holding lengthy or brief positions and supply perception into market sentiment.

Binance Whales Drive Bitcoin's Uptrend

In response to CryptoQuant, the latest enhance within the value of Bitcoin could also be linked to the numerous buying and selling exercise of Binance whales. CryptoQuant discovered that Binance whales have been lively throughout Asian buying and selling hours since October 14, impacting the Coinbase Premium Hole (CPG) – which tracks the worth distinction between Coinbase and Binance. Regardless of rising bitcoin costs, CPG has fallen, suggesting a “adverse premium.”

This adverse premium doesn’t replicate the decline in US demand. Over the previous two weeks, US Bitcoin spot ETFs have seen vital inflows of roughly $3.34 billion. So whereas sturdy demand within the US often results in a constructive CPG, the present adverse premium means that Binance's giant merchants are primarily driving the worth of Bitcoin.

Brief-term holders are exhibiting reasonable profit-taking

In a separate evaluation, CryptoQuant highlighted the short-term Spent Output Revenue (SOPR) indicator for Bitcoin, which at the moment stands at 1.017. This metric measures revenue realization for cash held between one hour and 155 days. Values above 1 point out that short-term holders are promoting at a revenue.

Traditionally, a SOPR stage above 1.03 indicators that the market is approaching an overheated state. At 1.017, short-term holders are realizing modest good points with out extreme profit-taking, leaving room for additional value good points.

Disclaimer: The data supplied on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shall not be answerable for any losses incurred because of using mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.