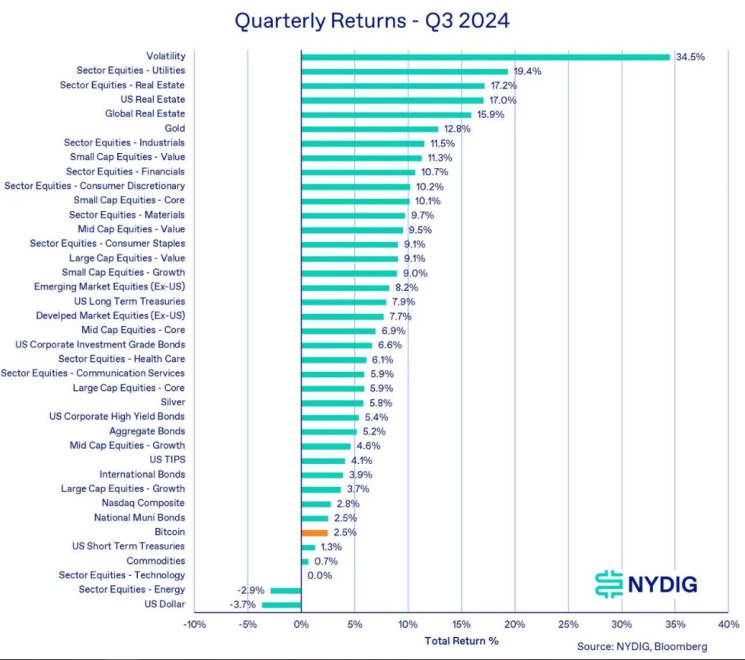

Though the third quarter was troublesome, Bitcoin was very sturdy in 2024 and continues to be the perfect performing forex. A brand new report from the New York Digital Funding Group (NYDIG) says bitcoin posted a small 2.5% acquire within the third quarter after falling within the earlier three months. This 12 months's development thus far quantities to an incredible 49.2%. Bitcoin continues to be doing very effectively though the market is beneath numerous strain.

Market dynamics and challenges within the third quarter

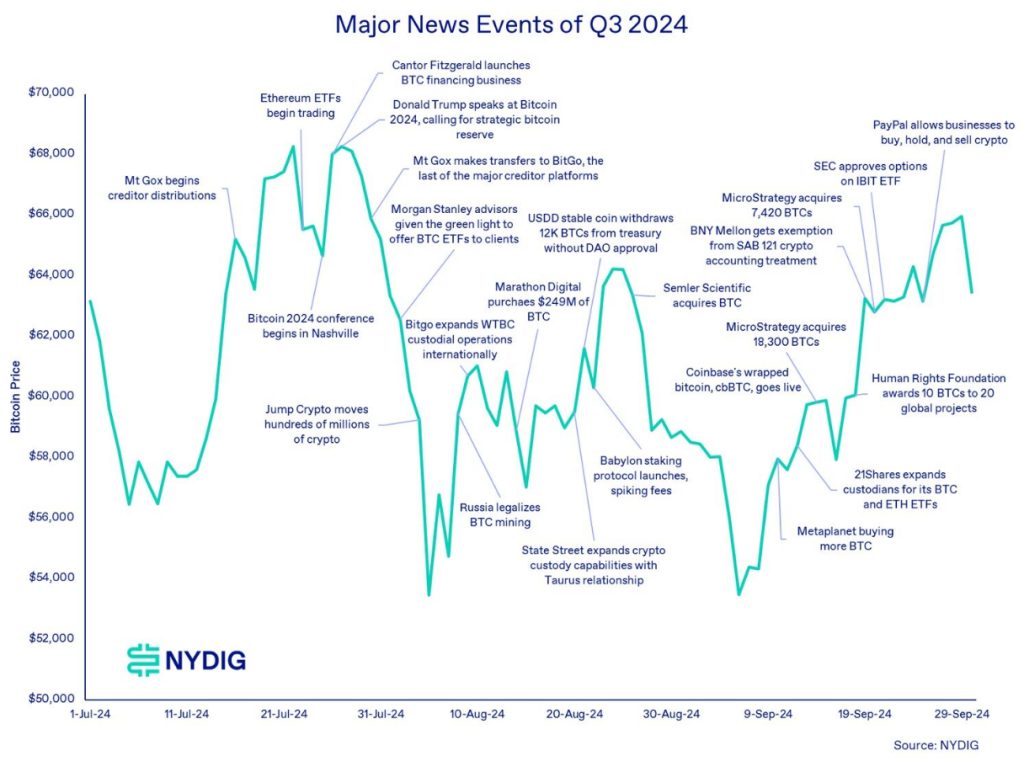

This 12 months has been no exception to the frequent perception that the third quarter of the 12 months is a difficult time for Bitcoin. The cryptocurrency has encountered many obstacles, resembling vital sell-offs by distinguished holders.

It is very important observe that the governments of the US and Germany have bought vital quantities of Bitcoin, which has dramatically affected market sentiment. As well as, resolving long-term bankruptcies resembling Mt. Gox, led to the return of billions of {dollars} in bitcoins to collectors, additional affecting costs.

Regardless of all of the struggles bitcoin has confronted — a month usually marked by declines in digital belongings — it beat expectations with a ten% acquire in September. Whereas different asset courses resembling gold and shares have carried out effectively, Greg Cipolaro, director of analysis at NYDIG, identified that bitcoin's capability to keep up its place as the highest asset is exceptional. The evaluation highlighted that over the previous six months, the worth of Bitcoin has fluctuated between $65,000 and $54,000 with out a clear sample.

ETF inflows assist development

Demand for US spot exchange-traded funds (ETFs) was a considerable issue supporting the worth of Bitcoin throughout this era. In Q3, these ETFs obtained a complete of $4.3 billion in inflows, led by BlackRock's iShares Bitcoin Belief.

This capital injection has allowed Bitcoin to seek out new methods to assist its value in periods of better market volatility. Conversely, Ethereum-based exchange-traded funds have struggled to generate practically the identical stage of curiosity.

BTC market cap presently at $1.22 trillion. Chart: TradingView.com

ETF funding development continues to be on an upward curve, exhibiting investor confidence within the rising potential of cryptocurrencies as an honest asset in mild of considerably risky and risky circumstances throughout the financial setup. Mainstream markets are nonetheless wholesome, though indices such because the S&P 500 have lately proven enchancment. Due to this, Bitcoin's place is uniquely completely different and actually helps multi-asset portfolios present diversification advantages.

Picture: StormGain

Future Prospects: Potential Catalysts

As we enter the fourth quarter, analysts see nice promise for Bitcoin. Traditionally, the perfect cryptocurrency has had a very good run throughout this era. Cipolaro famous that one of many many doable triggers that might push costs increased is the upcoming U.S. presidential election on Nov. 5. If former President Donald Trump, who has proven assist for cryptocurrencies, wins, Bitcoin will acquire considerably.

As well as, world financial easing and stimulus measures from nations like China may additional affect Bitcoin's trajectory within the coming months. Whereas some traders could really feel annoyed by the restricted vary of Bitcoin buying and selling in latest months, Cipolaro has assured them that this isn’t uncommon for this time of 12 months.

Featured picture from StormGain, chart from TradingView