In keeping with a latest Clear Avenue report, Bitcoin miners are making use of income methods for his or her BTC holdings and diversifying into AI computing.

A message titled “BTC Mining: Key Themes of 2025 Rising,” outlines three themes for 2025: producing income from bitcoin reserves, leveraging present infrastructure for HPC initiatives, and benefiting from a shift in US regulatory management.

Bitcoin yield and spot ETF upgrades

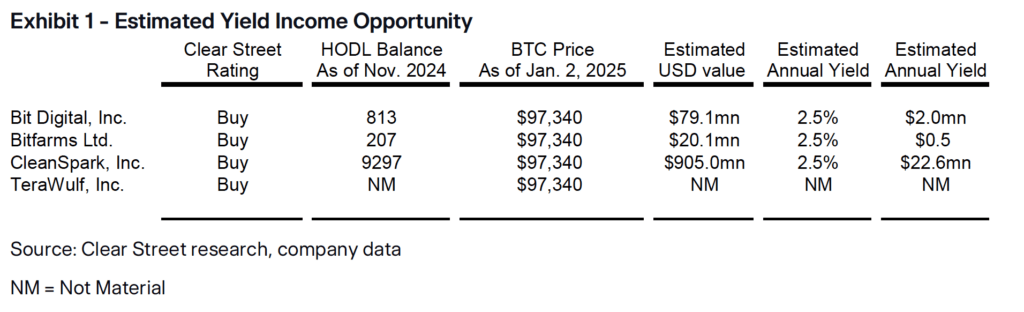

Clear Avenue's authors point out that a number of miner administration groups are exploring methods to generate earnings from saved BTC, with securities lending described as a probably viable method pending regulatory changes. The report states that the SEC's new stance may permit BTC exchange-traded funds to create in-kind shares, permitting miners to trade bitcoins straight for ETF models after which work with prime brokers to earn share-lending earnings. Low to mid-single digit yields are seen on normal collateral securities, whereas increased charges could apply if ETF shares are harder to borrow.

Clear Avenue provides that the authorized adjustments would put BTC securities lending on a par with broader lending practices, forcing sector members to deal with operational particulars. In keeping with the evaluation, CleanSpark has a outstanding HODL steadiness and will earn tens of millions of {dollars} in annual curiosity as soon as the technique expands. Bit Digital, Bitfarms, and TeraWulf are cited with completely different holdings or approaches, together with applications to carry bitcoins or not maintain them in any respect, relying on firm coverage. Clear Avenue envisions that such income mechanisms may unlock further income streams and assist miners optimize large-scale operations which may in any other case be idle.

HPC computing and AI diversification

The report additionally highlights the rising pattern in the direction of HPC compute, the place miners are remodeling knowledge facilities, energy provides and superior gadgets to serve AI-driven workloads. The authors see a method for corporations to diversify earnings exterior of mining. Bit Digital is claimed to be transitioning into an information heart enterprise by means of acquisitions in Montreal to host HPC shoppers for steady charges and potential progress. TeraWulf is thought for a brand new HPC deal that would increase capability to greater than 100MW and goal demand for complicated AI analysis wants. Clear Avenue's figures present that HPC providers can generate engaging returns per megawatt, with the vary of margins relying on knowledge heart configuration and contract measurement.

Coverage shifts can also increase the business's outlook, in keeping with the report. President Trump's administration is being portrayed as friendlier to Bitcoin pursuits attributable to potential adjustments on the SEC and Division of Vitality and extra open-minded views on BTC merchandise. Trump's nominee for SEC chairman Paul Atkins has been concerned in digital asset initiatives prior to now, and proposed Treasury Secretary Scott Bessent is seen as extra receptive to cryptocurrencies than earlier management.

However the analysis warns that cuts in federal spending or adjustments in vitality coverage may convey uncertainty, particularly if renewable vitality credit change. Clear Avenue additionally factors to the likelihood that decreased authorities spending may cut back inflationary pressures, which some buyers see as useful for bitcoin.

The evaluation highlights a number of corporations as high performers primarily based on valuation, growth potential and present HPC plans.

Clear Avenue Suggestions for Bitcoin Miners

Bit Digital ( BTBT ) is rated a Purchase attributable to its shift away from a low-asset mining mannequin in the direction of HPC income, with administration itemizing plenty of potential knowledge heart tenants. CleanSpark (CLSK) is offered as a preferred pure-play miner, backed by best-in-class vitality methods and a progress pipeline to 2027. TeraWulf (WULF) has a better a number of in comparison with others, however is struggling to justify it with new HPC choices and improved mining metrics. Thought-about a BTC mining specialist, Bitfarms (BITF) reportedly has steady vitality contracts and is poised for a possible HPC foray in late 2025 or early 2026.

In keeping with Clear Avenue, these projections relaxation on every agency's capability to scale knowledge heart operations, safe or renew energy contracts and handle the newest regulatory strikes for securities lending. The authors emphasize that clarification from the SEC relating to the creation of in-kind BTC ETFs will probably be key to unlocking returns on HODL balances.

Their projections level to increased revenues for collaborating miners as new practices mature and capital inflows increase from institutional companions looking for further publicity to digital belongings. Bitfarms, Bit Digital, CleanSpark and TeraWulf stay within the highlight primarily based on Clear Avenue's present predictions.