- Bitcoin worth is down practically 7% over the previous week, with bulls unable to carry above the $70,000 degree. BTC retreated to round $66,350 right this moment amid renewed promoting strain.

- Whereas costs are falling because the market reacts to macroeconomic occasions, analysts at CryptoQuant say a part of the decline comes from the promoting strain miners are going through.

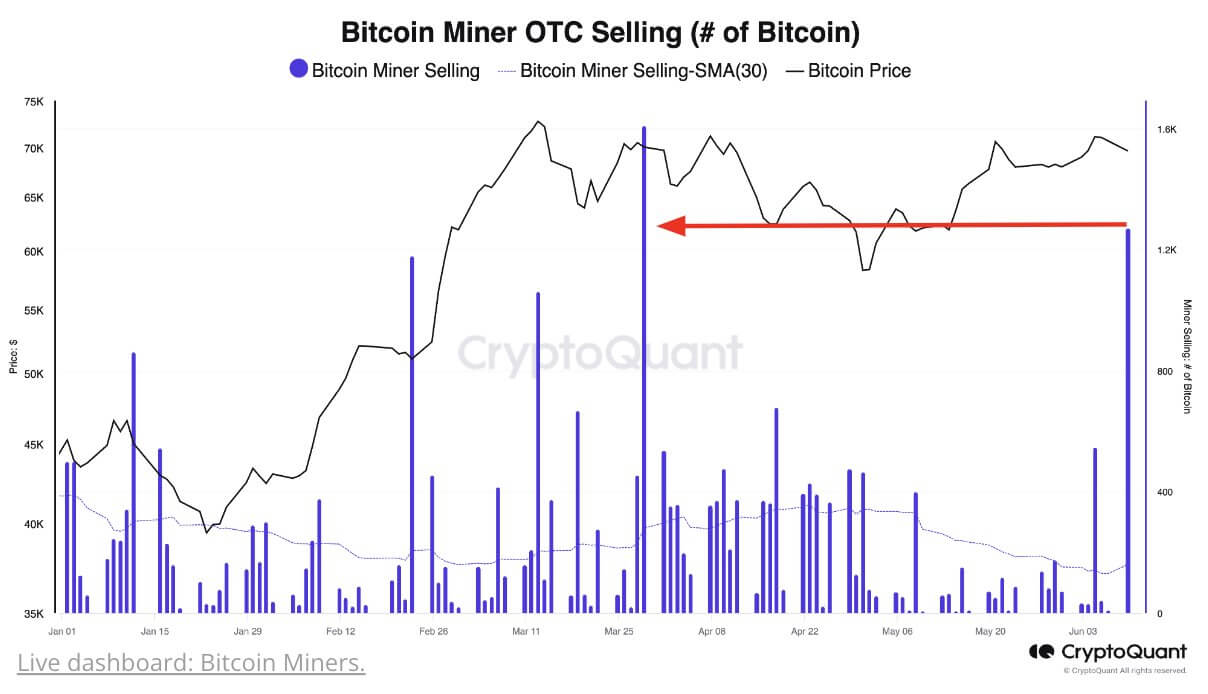

In keeping with Thursday's CryptoQuant replace, there was a rise in mining pool transfers and OTC desk gross sales for BTC. Some giant publicly traded Bitcoin mining firms have additionally lately decreased their holdings.

“BTC miners elevated promoting as costs fluctuated between $69,000 and $71,000. On June 9, mining pool transfers to Binance surged to a 2-month excessive of over 3,000 BTC. This shift is according to the worth correction that dropped Bitcoin to $66,000,” famous the CryptoQuant workforce in a submit on X

The info additionally reveals elevated OTC gross sales, with the newest being a 1,200 BTC sale on OTC desks on June 10.

In the meantime, main U.S. bitcoin mining firms have bought cash—for instance, Marathon Digital (MARA) launched 1,400 BTC in June. The corporate bought solely 390 items in Could.

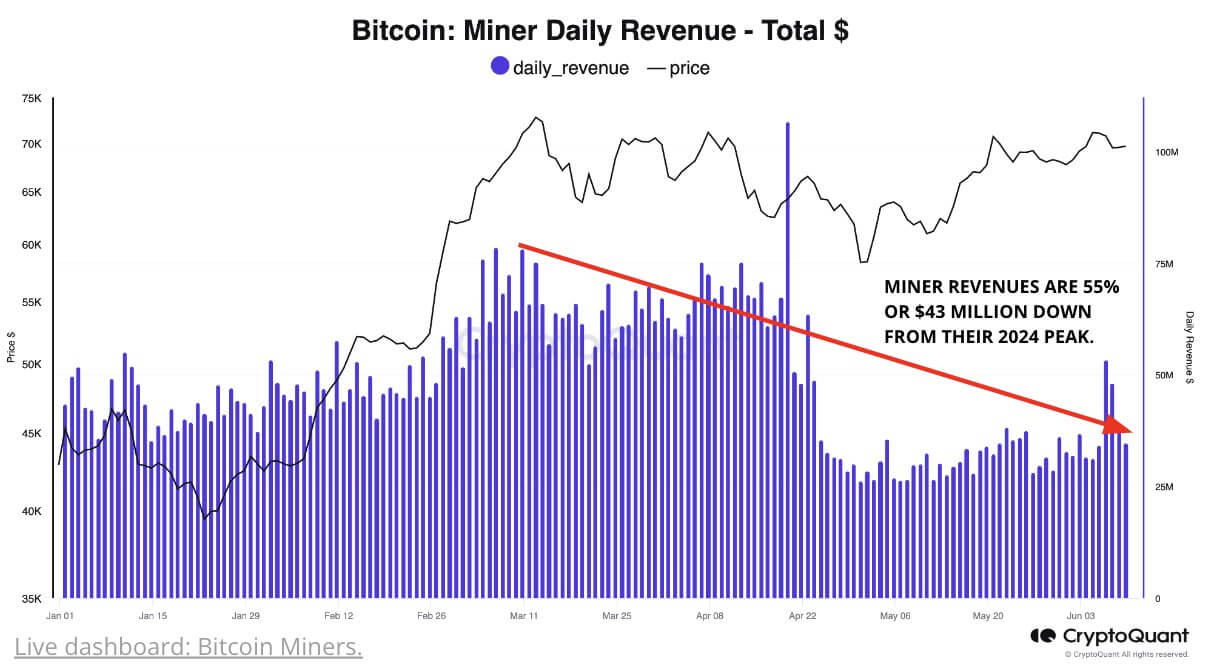

Miner income down 55%

The strain for miners to promote has intensified as mining revenues have fallen.

For instance, the each day revenue of miners after halving reached 35 million {dollars}. It peaked at greater than $78 million in March, indicating a steep 55% decline.

“Amid low miner revenue following the halving, each day bitcoin transaction charges fell to round 65 bitcoins from 117 earlier than April 18. Regardless of file excessive transactions, USD median transaction charges stay low, underscoring the strain on miners' revenue,” famous the CryptoQuant workforce.

Analysts additionally say that the Bitcoin community has additionally seen a drop in hashrate post-halving, however that is solely by 4%.

It means miners face stiff competitors at a decreased block reward, and the mix of low miner revenue and excessive hashrate “typically factors to potential market lows.”

“Miners have confronted a major backlog since Could, suggesting we could also be near a worth backside,”