In periods of utmost worth volatility resulting in huge market losses, it is very important perceive the place most of those losses come from. Whereas earlier fromcrypto evaluation targeted on the distinction between the conduct of lengthy and brief holders, there may be one other layer of depth within the information chain that may present a greater understanding of market sentiment.

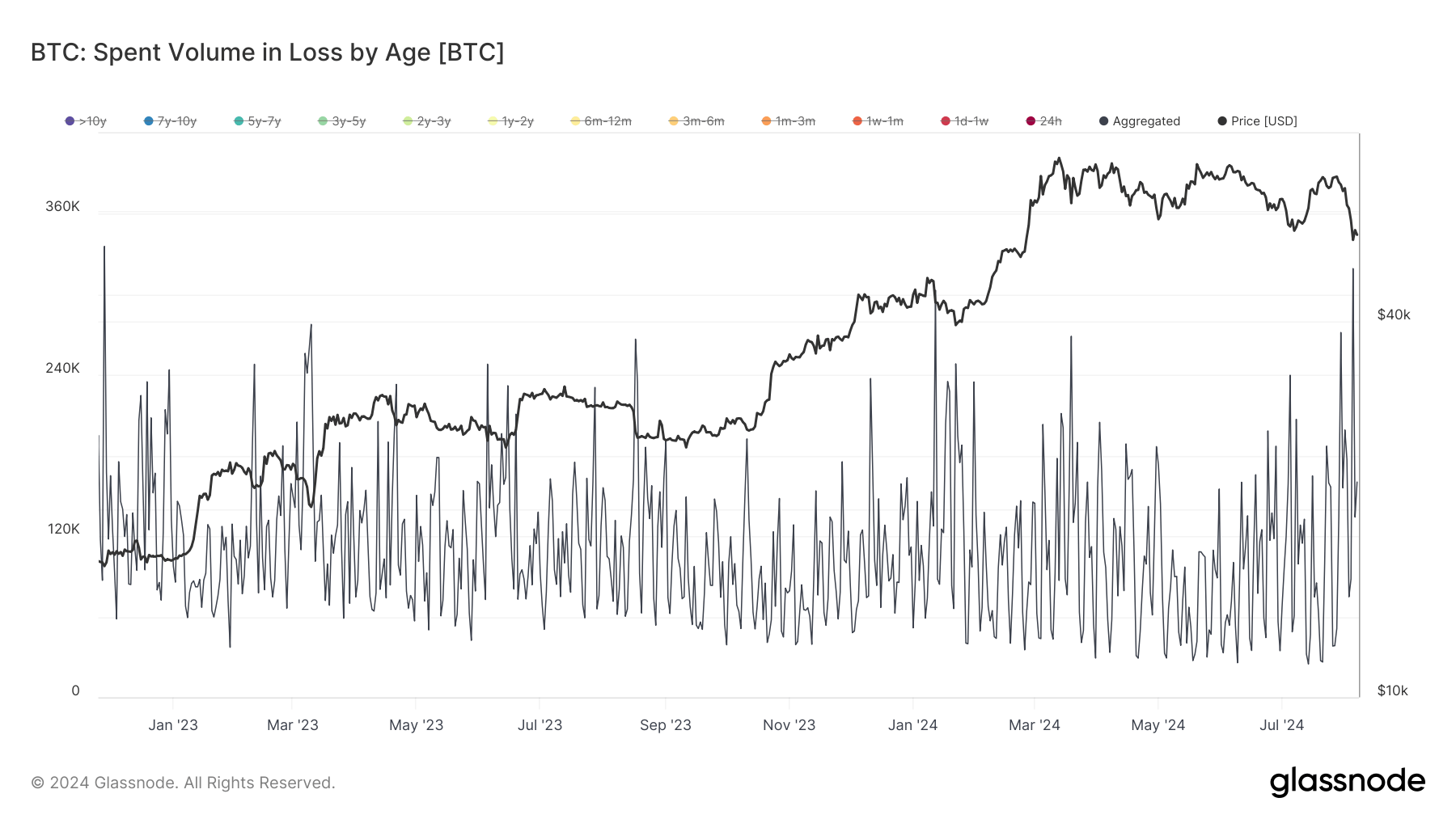

Certainly one of these metrics is quantity spent at a loss, which calculates the overall quantity of bitcoins bought under the acquisition worth. By categorizing this quantity of losses by age cohorts and pockets sizes, we will higher perceive the distribution of loss actions throughout totally different investor courses and time durations.

Bitcoin's drop from $60,000 to $54,000 between August third and fifth led to a major enhance within the quantity of losses spent on Bitcoin. The full spent quantity in loss was simply over 74,890 BTC on August third and rose to 319,290 BTC on August fifth. That is the best quantity spent at a loss since November 28, 2022.

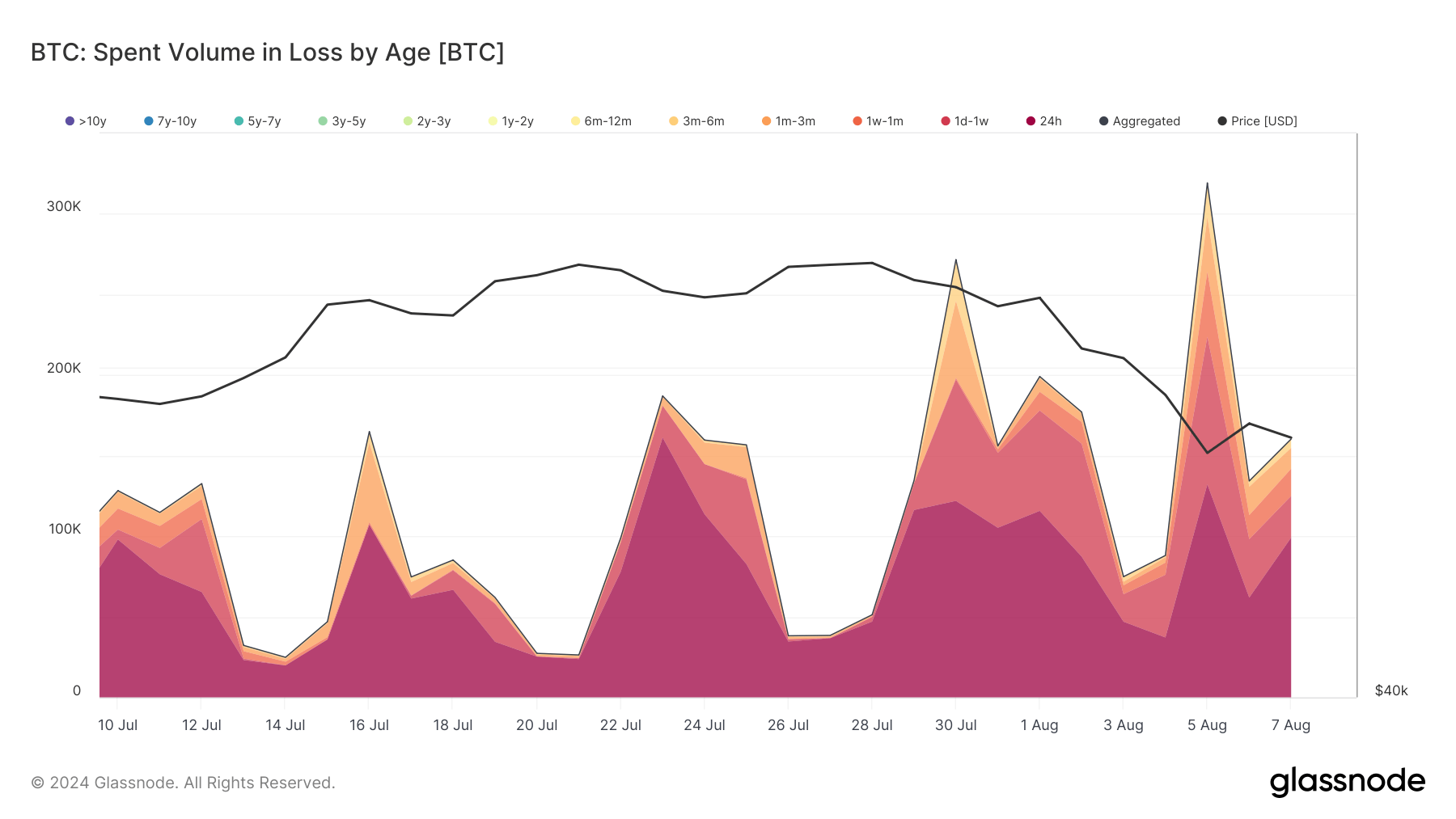

Trying on the age cohorts, we will see that a lot of the quantity spent in loss was spent by wallets that held BTC for lower than 24 hours — 132,180 BTC. The second highest quantity got here from the 1-day and 1-week cohort — at 91,685 BTC.

The 1 week to 1 month cohort spent 40,235 BTC, the 1 month to three month cohort spent 34,088 BTC, and the three month to six month cohort spent 18,869 BTC in loss. In the meantime, the 6-month to 12-month cohort spent 1,077 BTC, whereas cohorts older than one yr spent a complete of lower than 1,300 BTC.

This important quantity might be attributed to a number of components. Traders who purchase bitcoins with the intention of short-term features typically react rapidly to market actions. As well as, many merchants use stop-loss orders to robotically promote their property when the worth falls to a sure stage. A pointy drop in worth might set off a cascade of stop-loss orders, leading to a major quantity of Bitcoin being bought at a loss in a short while body.

As well as, automated buying and selling robots that carry out high-frequency trades might have contributed to the big quantity of bitcoins spent in loss. These bots are programmed to react to market actions inside seconds or minutes, leading to a major variety of transactions from the newly acquired cash.

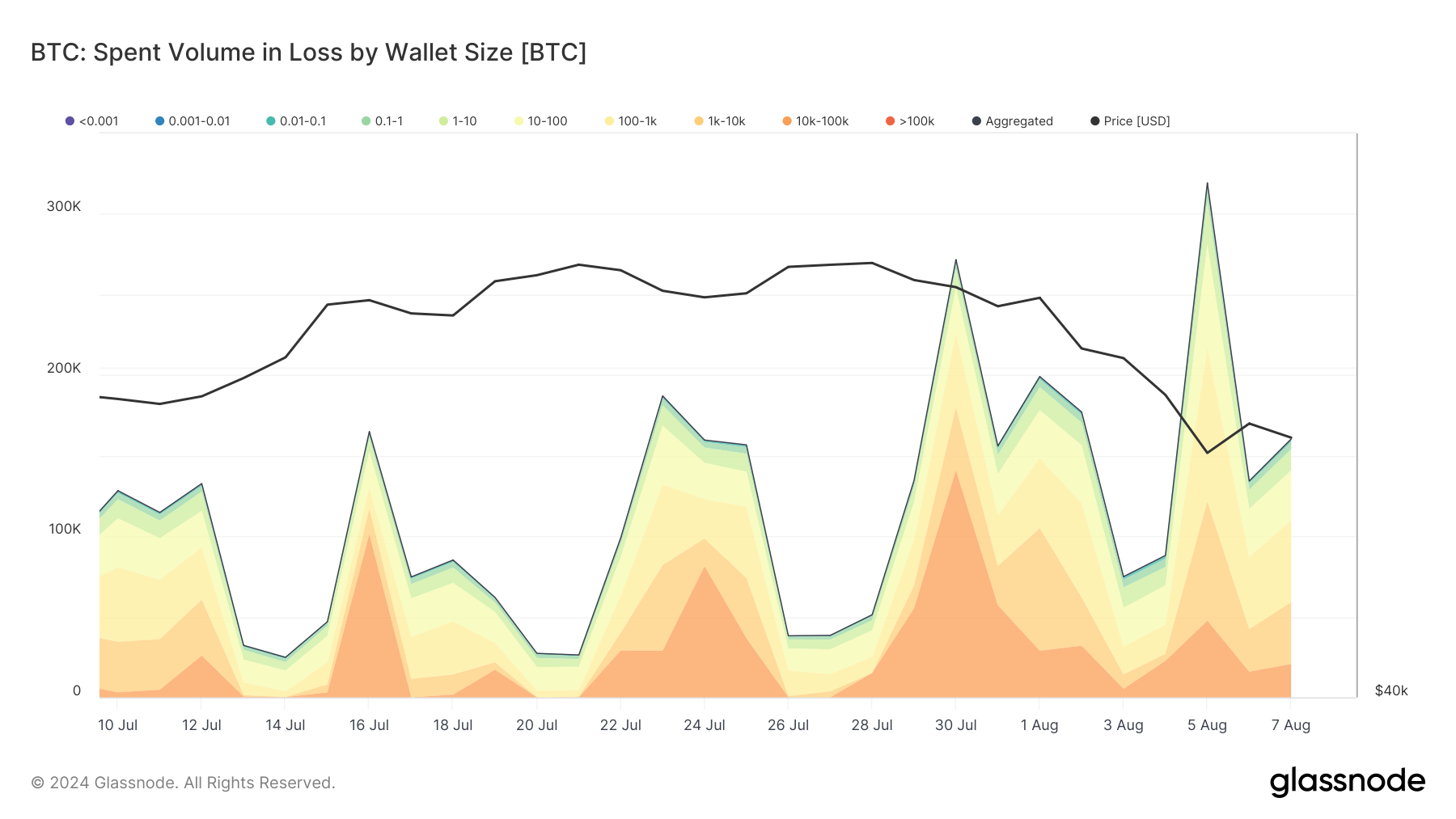

The amount spent in loss by pockets measurement reveals that the best quantity got here from wallets containing between 100 BTC and 1,000 BTC, totaling 95,590 BTC. Wallets holding 1000 to 10,000 BTC spent 73,990 BTC, whereas wallets holding 10 BTC to 100 BTC spent 63,869 BTC in loss.

Wallets holding between 100 BTC and 1,000 BTC typically belong to institutional buyers or massive holders. The info suggests that enormous buyers actively bought their bitcoins through the worth decline. With the rising prevalence of Bitcoin ETFs (Alternate-Traded Funds), important sell-offs from these funds might contribute to the excessive quantity of Bitcoin spent in loss.

ETFs that monitor bitcoin costs should regulate their holdings primarily based on market actions and investor demand, leading to substantial transactions. Moreover, many exchanges maintain massive quantities of Bitcoin in scorching wallets that fall within the 100BTC to 1000BTC vary.

In periods of elevated buying and selling exercise, comparable to speedy worth declines, exchanges might transfer important volumes of Bitcoin to handle liquidity or facilitate massive promote orders from their customers.

The put up Bitcoin Loss Quantity Hits Highest Stage Since FTX Collapse appeared first on fromcrypto.