In response to CoinShares' newest weekly report, digital asset funding merchandise noticed an inflow for the second week in a row, with buyers pouring $321 million into the business.

This inflow elevated complete belongings below administration (AuM) for crypto exchange-traded merchandise (ETPs) by 9%, bringing the full to $85.8 billion. Whole funding product quantity additionally elevated to roughly $9.5 billion.

James Butterfill, head of analysis at CoinShares, linked this optimistic development to the Federal Reserve's current resolution to chop rates of interest by 50 foundation factors. He defined:

“This improve was possible pushed by feedback from the Federal Open Market Committee (FOMC) final Wednesday, which took a extra dovish stance than anticipated, together with a 50 foundation level rate of interest lower.”

Bitcoin flows, US dominates

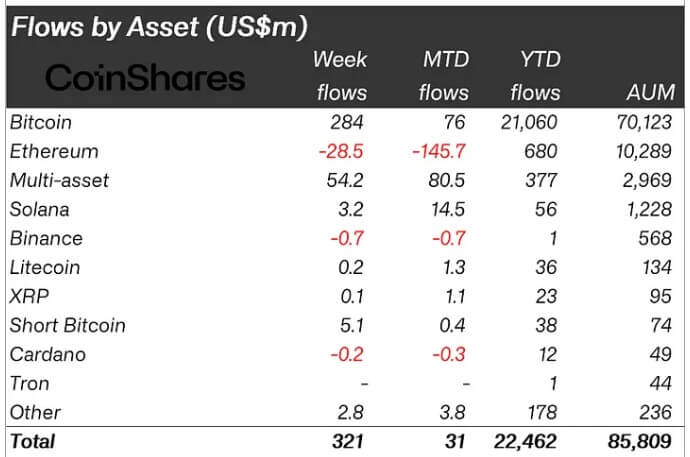

A breakdown of the flows confirmed that bitcoin-based funding merchandise led the inflows, producing $284 million in web revenue final week. Massive crypto funds from corporations equivalent to BlackRock, Bitwise, Constancy, ProShares and 21Shares contributed particularly to this restoration, including a mixed $321 million in web inflows.

Bitcoin's optimistic value momentum additionally attracted bearish buyers who allotted $5.1 million to short-term bitcoin funds.

Ethereum confronted a fifth straight week of outflows totaling $29 million. This development stems from the continued recall of Grayscale's ETHE merchandise and declining curiosity in new choices.

ETHE noticed outflows of between $13 million and $18 million for 3 consecutive days final week, overshadowing smaller inflows from different merchandise, together with Grayscale's Mini-Belief, based on Farside knowledge.

In the meantime, Solana maintained its present optimistic development, including $3.2 million final week. This move may also be linked to the bulletins of a number of conventional monetary establishments that introduced plans to launch monetary companies on the community over the past Solana Breakpoint occasion in Singapore.

Different large-cap altcoins, together with XRP and Litecoin, noticed mixed inflows of $300,000.

Throughout areas, the US unsurprisingly emerged as the highest contributor to final week's inflows at US$277 million, adopted by Switzerland at US$63 million.

In distinction, Germany, Sweden and Canada noticed outflows of $9.5 million, $7.8 million and $2.3 million, respectively.