In line with the most recent on-chain remark, the realized losses of Bitcoin merchants have reached a stage that has confirmed vital for the coin's motion a number of occasions lately. This begs the query – is the worth of Bitcoin bottoming out?

Merchants' Realized Losses Beneath -12 Once more — What Occurred Final Time?

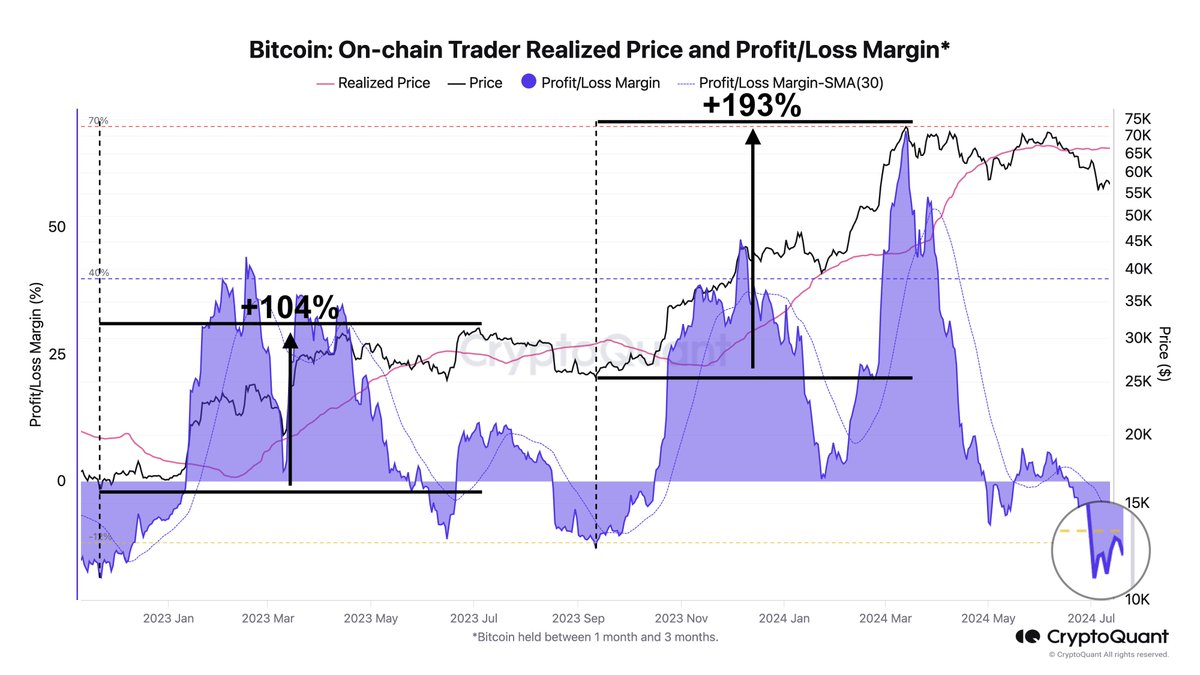

In a current put up on Platform X, distinguished crypto analyst Ali Martinez identified that the quantity of losses realized by Bitcoin merchants has been growing in current weeks. This on-chain disclosure is predicated on the CryptoQuant Revenue/Loss Margin metric, which aggregates income and losses from all Bitcoin transactions.

Revenue/Loss Margin primarily assesses the general profitability of buyers of a specific cryptocurrency (Bitcoin on this situation). When the metric worth is constructive, it signifies that extra BTC is being bought at a revenue. A unfavourable revenue/loss, however, signifies that extra bitcoins are being bought at a loss.

In line with CryptoQuant knowledge, the P/L is presently under -12, which signifies that merchants out there are realizing extra losses than income in the mean time. Traditionally, this stage is extra vital contemplating that the metric has been under -12 in previous cycles.

Apparently, the current interval the place the P/L margin dipped under -12 has been adopted by intervals of great bullish worth motion. As proven within the chart and highlighted by Martinez, the final two occasions the metric fell under this stage have been marked by worth will increase of 104% and 193%.

Supply: Ali_charts/X

If this historic sample is something to go by, then it’s doubtless that the worth of Bitcoin may even see some exceptional bullish exercise within the close to future. Moreover, observing vital losses out there might point out the underside of a bear cycle and the start of a extra constructive section.

Bitcoin worth rise? Listed below are the necessary ranges to look at

If the historic sample holds and the worth of Bitcoin is growing, there are a number of worth zones to be careful for. In line with Martinez, the main cryptocurrency has main resistance ranges across the $61,340 and $64,620 zones.

This disclosure is predicated on the fee base of Bitcoin buyers and the distribution of BTC provide in numerous worth ranges. The dimensions of the dots within the chart under displays the power of resistance and help and the quantity of BTC purchased in every worth zone.

Key resistance ranges for #Bitcoin for monitoring are $61,340 and $64,620. The essential help stage to look at is $57,670! pic.twitter.com/YrBPkJmWzn

— Ali (@ali_charts) July 13, 2024

On the time of writing, the worth of Bitcoin is round $59,467, reflecting a 2.7% enhance over the previous 24 hours. In line with knowledge from CoinGecko, the flagship cryptocurrency has gained 2% over the previous week.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Pexels, chart from TradingView