Krypto analyst Ali Martinez shares some vital information concerning the present Bitcoins market (BTC) primarily based on UTXO (URPD) costs. Utilizing this metric, a famend knowledgeable available on the market emphasised the important thing assist and stage of resistance with a doubtlessly robust influence on the instant motion of the BTC value.

After one other week, in depth market uncertainty stays bitcoins costs in consolidation and failed to attain an efficient escape of over $ 84,380.

Bitcoin Bull Run: 97 532 $ holds the important thing to renewed bull dynamics

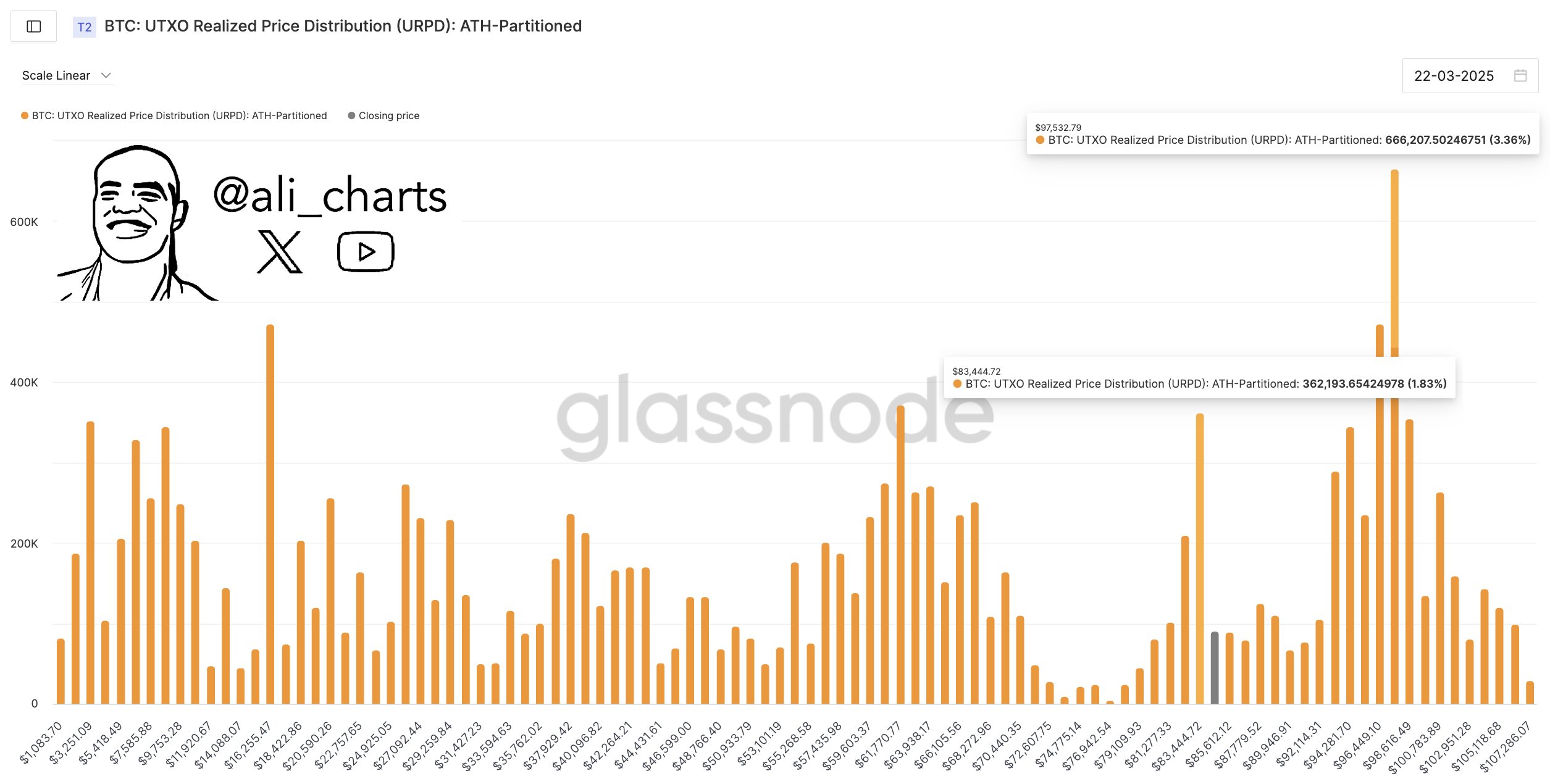

Within the evaluation on the chain, the unused transaction output (UTXO) represents the remaining a part of the bitcoin after every transaction that can be utilized as an enter within the new transaction. Subsequently, the UTXO distribution made permits analysts to establish value ranges at which the present provide of bitcoins has been moved for the final time. Emphasizing value ranges with excessive UTXOS focus is a crucial metric when discovering the extent of resistance and assist.

In March 22, from Martinez, Glassnode knowledge exhibits a robust UTXOS clump round $ 83,444, suggesting that many traders have a base round this stage. At current, the BTC value is considerably above this stage of assist that exhibits the intention of a possible rise. Martinez, nonetheless, notes that arduous resistance awaits market bulls at a value stage of $ 97,532, which additionally hosts an enormous quantity of UTXOS.

The analyst explains that profitable permits of this value stage of resistance would signaled renewed bull momentum on the BTC market, which has undergone a big restore in the previous few months. In a extremely constructive situation, bitcoins are more likely to develop in the direction of new historic maximums. Nevertheless, a misunderstanding of round $ 97,532 could pressure BTC to stay in consolidation and even rectify to decrease assist ranges.

Bitcoin breeding to revive uptrend?

In one other growth Martinez prompt that the present correction of Bitcoins might be nonetheless on the idea of the Sharpe bitcoins ratio. For the context, the Sharpe ratio determines whether or not BTC's return is at the moment well worth the danger stage.

The analyst explains that one of the best market objects have occurred when the bitcoins ratio Sharpe is at low danger, which is a good procuring alternative. Nevertheless, the present Sharpe ratio suggests a excessive danger, suggesting that future BTC traders should carry out endurance.

Martinez stated:

We’re not there but, however the zoom might sign the principle procuring window!

On the time of BTC writing, it continues to commerce for $ 84,075 after a rise in value by 0.27% within the final 24 hours. Nevertheless, the every day quantity of property with a lower in market involvement has collapsed by 46.41%.

The principle image from Morningstar, FROM TradingView Graph

Editorial course of For , it’s centered on offering a completely explored, correct and neutral content material. We keep strict supply requirements and every web page undergoes cautious overview of our group of one of the best know-how consultants and seasoned editors. This course of ensures the integrity, relevance and worth of our content material for our readers.