The digital gold rush is in full swing, and this time the titans of Wall Avenue are main the cost. A current surge in holdings of Spot Bitcoin Trade-Traded Funds (ETFs) suggests a rising inflow of institutional funding into the main cryptocurrency. This inflow of huge cash may push bitcoin costs to new heights, however not and not using a few wrinkles.

BlackRock, Grayscale lead an institutional payment

The rise of spot bitcoin ETFs wouldn’t have been attainable with out the heavyweights of the monetary world. Asset administration giants reminiscent of BlackRock, Grayscale and Constancy Investments have been instrumental in driving this development.

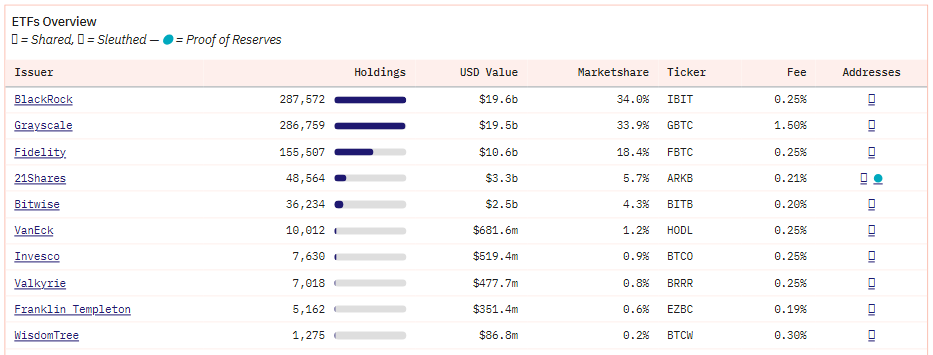

In line with Arkham Investments, a blockchain information analytics firm, Grayscale and BlackRock are the undisputed frontrunners within the world Spot Bitcoin ETF enviornment. Grayscale Bitcoin Belief (GBTC) boasts the biggest battle chest, holding roughly 288,000 BTC, whereas BlackRock's iShares Bitcoin Belief (IBIT) isn't far behind, holding over 284,000 BTC.

Supply: Dune Analytics

Different notable gamers embrace Constancy with their Sensible Origin Bitcoin BTC (FBTC) and established names like Bitwise and Energetic Managers becoming a member of the ETF ecosystem.

Establishments dip into bitcoin pool

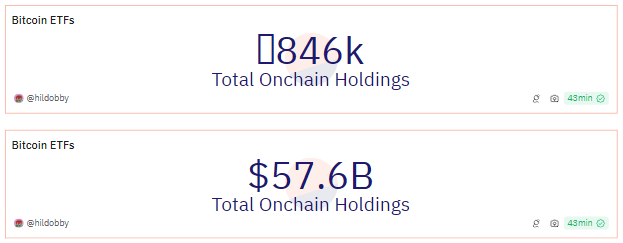

Knowledge from blockchain analytics agency Dune paints a transparent image: Spot Bitcoin ETFs in the US alone are hoarding a major quantity of Bitcoin, at the moment sitting in a collective treasury of round 846,000 cash. This interprets to just about $58 billion beneath administration by these ETF issuers, exhibiting clear institutional curiosity in Bitcoin.

Supply: Dune Analytics

Zooming out into the worldwide panorama makes the story much more compelling. Business estimates point out that world Spot Bitcoin ETF holdings have eclipsed the 1 million BTC mark, marking a major milestone.

32 #Bitcoin The spot ETF now holds ~1 Nakamoto z $BTC pic.twitter.com/OpHridlymc

— Michael Saylor

(@saylor) Might 27, 2024

Bullish signal for bitcoin future

The rise in institutional demand for Bitcoin by means of spot ETFs displays the optimistic sentiment we witnessed earlier this yr. Following the long-awaited approval of spot bitcoin ETFs in January, the value of bitcoin soared to a document excessive above $73,000 in March. This development has coincided with a surge in mainstream adoption, fueled partially by the benefit of entry supplied by spot ETFs.

The rising participation of institutional buyers is an indication that the Bitcoin business is creating. This sample and inspiring technical indicators counsel that Bitcoin could have promising months forward. However a phrase of warning is so as.

BTC market cap at the moment at $1.3 trillion. Chart: TradingView.com

The entry of institutional heavyweights reminiscent of BlackRock and Constancy, with billions of {dollars} at their disposal by means of Spot ETFs, is a major growth for Bitcoin. It legitimizes cryptocurrency within the eyes of mainstream buyers and injects contemporary capital into the market.

Associated studying: Bitcoin adoption in Argentina overblown, El Salvador official says

This unprecedented degree of institutional involvement may very effectively set off one other surge in Bitcoin costs, replicating the one witnessed earlier this yr, and have an effect on the general trajectory of the cryptocurrency market.

Featured picture from Beamstart, chart from TradingView