Bitcoin skilled a pointy decline throughout Asian buying and selling hours, falling under $100,000 as widespread market turbulence affected the broader crypto and fairness markets.

In line with fromcrypto's BTC fell over 6% within the final 24 hours to $97,000 earlier than recovering to $99,290 at press time.

The decline breaks the momentum that pushed Bitcoin to its all-time excessive of $109,000 earlier than the inauguration of US President Donald Trump. Analysts observe that this decline successfully alerts the top of the Trump-induced rally that outlined the market in late 2024.

Arthur Hayes, co-founder of BitMEX, warned of additional declines. He instructed that Bitcoin might briefly fall between $70,000 and $75,000, however stays bullish for the long run.

Hayes predicts Bitcoin will attain $250,000 by the top of the yr, citing potential monetary instability and renewed financial easing as key catalysts.

In the meantime, different main cryptocurrencies have mirrored Bitcoin's trajectory. Ethereum, BNB, Solana, XRP, Dogecoin and Cardano every misplaced as much as 9%, reflecting widespread market warning.

The inventory market can be falling

Moreover, the ripple impact of the crypto market decline was additionally evident in US inventory indexes, with Nasdaq 100 futures down greater than 2%.

The Kobeissi Letter estimates that US inventory markets might shed $1 trillion in market worth, underscoring the extent of investor issues.

The agency attributed the market turbulence to the rising reputation of DeepSeek, which had propelled it to the highest spot within the App Retailer and fueled issues about its influence on main US tech companies.

DeepSeek is a Chinese language AI firm whose free and open-source R1 mannequin outperformed ChatGPT OpenAI. Enterprise Capitalist Marc Andreessen described the app as:

“The AI Second on Sputnik.”

Liquidation insanity

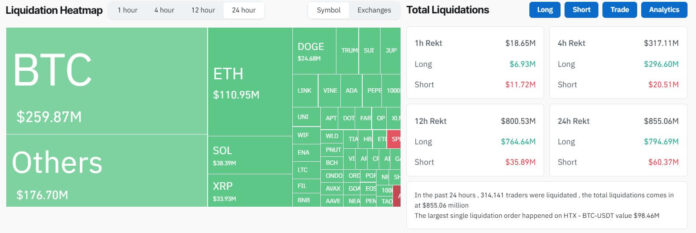

The widespread volatility of the crypto market has triggered a liquidation spree, with knowledge from CoinGlass exhibiting that over $855 billion has been worn out. This affected greater than 313,000 retailers.

In line with the information, the heaviest losses have been suffered by lengthy merchants – those that guess on value will increase – at $794 billion. Then again, brief merchants who guess on falling costs misplaced round $59 million.

Bitcoin merchants confronted probably the most important losses, with liquidations totaling round $259 million, together with $247.5 million from lengthy positions. Ethereum merchants adopted, recording $110 million in liquidations, with $104.8 million from lengthy positions.

The biggest single liquidation occasion occurred on HTX, involving a $98 million BTC-USDT lengthy place.