- Bitcoin fired nearly 4% after the metaplanet purchased 150 BTC.

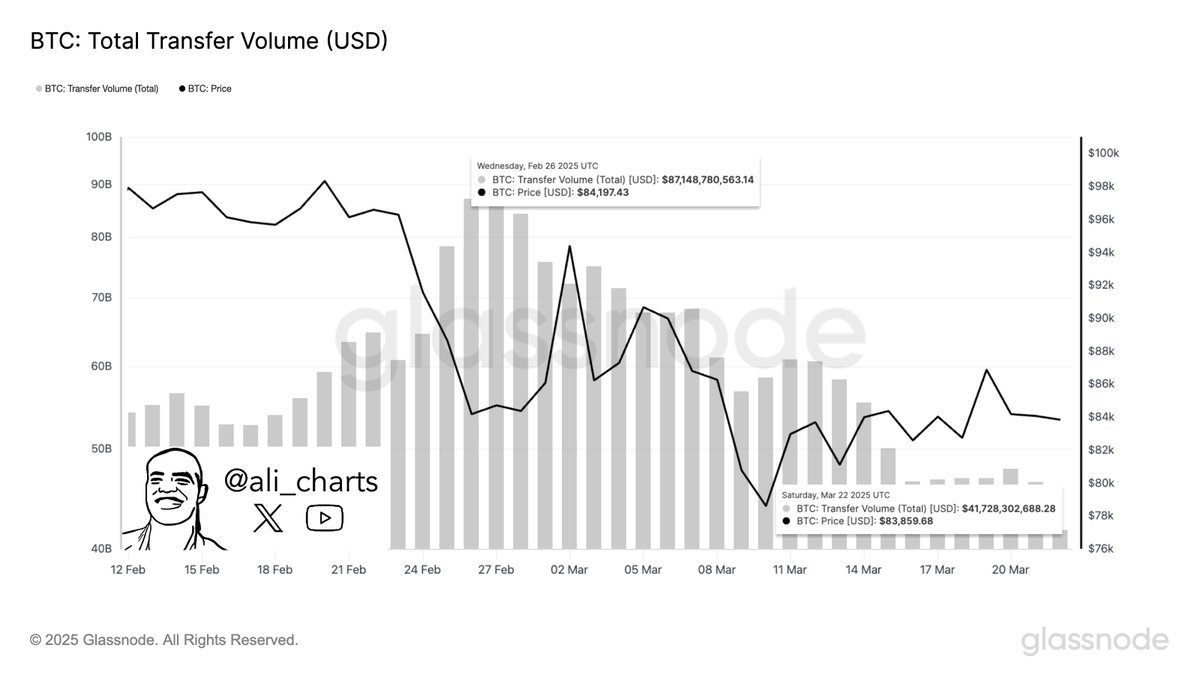

- The overall quantity of bitcoins final month fell from $ 87 billion to $ 42 billion.

- BTC additionally regenerated 20 -day exponential gliding common (EMA) to $ 85,515.

Bitcoin (BTC) has traders rigorously monitoring after the latest growth suggests a robust transfer again to $ 90,000.

The entrance digital asset efficiently climbed above 20 days exponential gliding common to $ 85,515 and is presently traded for $ 87,339.80, which, in keeping with Coinmarketcap, has been a rise of three.57percentwithin the final 24 hours.

What does the newest Bitcoin accumulation?

The value leap adopted by the Tokyo funding firm Metaplanet, which elevated its bitcoin shares with one other buy of 150 BTC, which elevated a complete of three,350 BTC. At right now's market costs it’s about $ 292 million.

The metaplanet, who added to the bull alerts, just lately appointed Eric Trump, son of US President Donald Trump, to their strategic advisory board. This vital step may additional enhance the place of bitcoins amongst institutional traders.

https://twitter.com/fromcrypto/standing/1902947940999827788

Associated: Arizon Committee for Greenlights Bitcoin Reserve Invoice

Is the discount of the transmission bundle?

Regardless of the bull's perspective of the metaplanet, the amount of bitcoins switch decreased considerably final month. In accordance with Ali Martinez analyst, BTC switch from $ 87 billion to $ 42 billion has fallen within the final 30 days.

Though this decline may initially fear about one of many brief -term liquidity, Martinez factors to key help and stage of resistance. The primary help space of Bitcoins lies between 82,590 and $ 85,150, the place $ 1.16 million purchased 625,000 BTC. Alternatively, the first resistance is between $ 95,400 and $ 97,970, the place $ 1.77 million holds 1.44 million BTC.

https://twitter.com/ali_charts/standing/1903913140313624868

How do macroeconomic elements of bitcoins assist

The latest trace of US President Donald Trump on a extra versatile strategy to the upcoming mutual tariffs of April 2 elevated the market sentiment. This shift, together with the obvious willingness of the federal reserve system to look past brief -term inflationary considerations, created a extra nice setting for threat belongings comparable to bitcoins.

Associated: Bitcoins spikes on 87k: This one is on Fed to take care of measure

Markus Thielen, founding father of 10x Analysis, famous that bitcoins appear to type the underside of the worth, supported by these macroeconomic modifications.

Evaluation of Bitcoin Worth

Bollinger Bands is presently displaying Bitcoins buying and selling close to the center group, with a prime resistance of round $ 9,250 and decrease help to $ 78,823. Shifting above the center bands may drive BTC to $ 90,000, whereas a drop beneath $ 84,536 may sign additional by a drawback.

RSI BTC's RSI at 51,96, which signifies impartial momentum. Nonetheless, if RSI rises above 55 years, this might point out a rise in bull drive, which doubtlessly will increase costs.

Renunciation of duty: The data on this article is just for data and academic functions. The article doesn’t characterize monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses on account of the usage of content material, services or products. It is strongly recommended that the readers ought to proceed with warning earlier than taking any measures with the corporate.