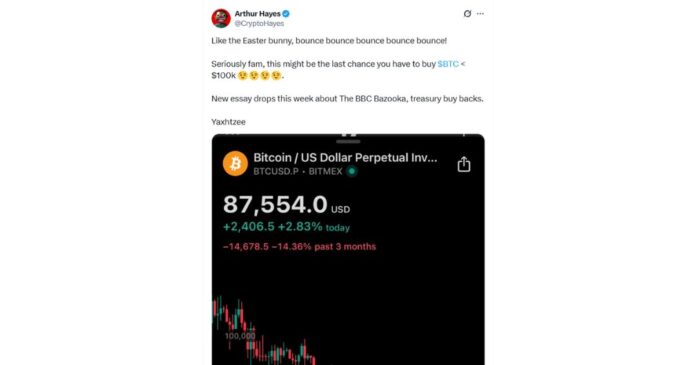

- Bitcoin elevated round $ 87,700, pushed by the weakening of the US greenback and potential US treasury.

- Arthur Hayes predicts that the acquisition of the Treasury might be a “Bazooka” that pushes BTC round $ 100,000 (“Final Probability” beneath).

- The weak greenback (the bottom since March 2022) and the rising correlation correlation promotes the attraction of bitcoins.

The latest ascending of Bitcoins, for a second, has developed $ 87,700, declaring important consideration, and necessary analysts are heading in the direction of macroeconomic shifts and potential authorities actions as key drivers who might drive a cryptocurrency far past $ 100,000.

Convergeration of the weakening US greenback, anticipated the acquisition of US money owed and an enduring institutional curiosity of portray more and more bull picture for digital asset.

Makro Tailwinds: Greenback Dips, Treasury 'Bazooka' Eyed

The first issue supporting bitcoin output is the declining worth of the US greenback, which just lately touched the minimal that haven’t been seen since March 2022.

Because the greenback weakens, property like bitcoins usually change into extra engaging to world buyers in search of a hedge in opposition to the devaluation of Fiat forex.

Including sturdy gas to this narrative is the prospect that the US Treasury is shopping for its personal debt.

Arthur Hayes, an influential co -founder of Bitmex and the present Cio Maelstrom, emphasised this potential step as a major catalyst.

He assumed that the upcoming money register redemptions might be accommodated into the monetary system with appreciable liquidity and successfully perform as a “Bazooka” at the price of Bitcoins.

Hayes went to this point that he indicated that this era might be a “final likelihood” for buyers to get bitcoins beneath $ 100,000 and anticipated that these backups might simply push the worth round this psychological barrier.

Technical indicators and case of institutional belief

Bull's sentiment finds a resonance in technical evaluation and persevering with institutional acceptance.

Ryan Lee, the primary analyst Bitget Analysis, famous that the Bitcoin value chart has just lately accomplished a “descending wedge escape”, a technical components usually interpreted as supporting additional motion ascending.

This technical picture is complemented by a rising Correlation of Bitcoins with gold, one other conventional asset of Secure-Haven, which this yr elevated nearly 30%.

As well as, the worldwide institutional urge for food for bitcoin seems regardless of the latest value volatility.

The information means that funding corporations, particularly Japan and the UK, have maintained their obligation and directed capital to the cryptocurrency.

This everlasting indicators of the institutional tide persist within the lengthy -term design of bitcoins.

Eye analysts six -digit vacation spot in the midst of Fiat enlargement

When bitcoins take a look at the degrees of resistance which can be near $ 90,000, some analysts give attention to their monuments considerably greater.

Jamie Couts Actual Imaginative and prescient Prognass, which expands the cash provide of Fiat (M2) might convey bitcoins as much as $ 132,000 by the tip of the yr.

This projection will discover a firm with an evaluation by economist Timothy Peterson, who quoting historic market patterns means that Bitcoin might probably attain $ 138,000 over the subsequent three months.

Political pressures add gas to the hearth

The complicated macroeconomic picture is additional sophisticated by the political panorama.

President Donald Trump's public requires the removing of the chairman of the Jerome Powell federal reserve system to accentuate the market expectations of the potential discount in rates of interest.

Such cuts on the stimulation of the economic system would in all probability put additional strain down on the US greenback and probably create an much more favorable surroundings for evaluating the costs of bitcoins.

Be aware Care in the midst of the Bull Corps

Regardless of the confluence of optimistic indicators, some market observers urge warning concerning brief -term value actions.

Analyst Michaël van de Poppe warned {that a} weekend gathering could generally show to be disleading and that Bitcoin might face a pullback earlier than the important thing zones of resistance conquers.

The extent of $ 91,000 is extensively thought of to be one other important impediment.

Till Bitcoin doesn’t safe firmly above this model, the potential for brief -term repairs stays.

The mixture of the weakening Fiat dynamics, the anticipated liquidity injections by way of the money register repurchase, the sturdy institutional assist, and the supporting technical patterns creates a convincing story for bitcoins.

Publish Bitcoin Eyes $ 100K? Hayes quotes money areas, a weak greenback as a result of the catalysts appeared for the primary time on fromcrypto.