Institutional buyers more and more sought publicity to cryptocurrencies through the first quarter of the 12 months following the launch of a number of US spot bitcoin exchange-traded funds (ETFs) in January.

The CoinShares Digital Fund Supervisor survey revealed that these institutional buyers considerably elevated their allocations to digital belongings, reaching 3% of their portfolios. That is the best stage because the survey started in 2021.

Many of those buyers attributed their elevated publicity to digital asset investments to distributed ledger know-how.

Moreover, they now see digital belongings as providing good worth and elevated demand for investing in BTC as a diversifier.

Bitcoin reveals probably the most convincing development outlook.

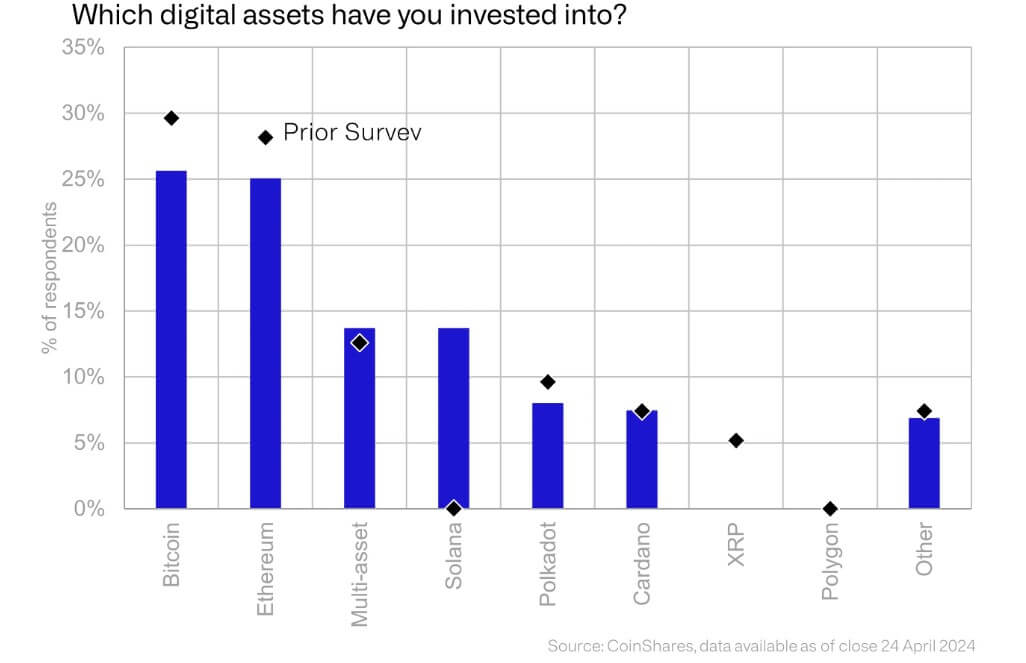

Institutional buyers' portfolios primarily include bitcoin, the main digital asset in demand amongst this cohort. In response to James Butterfill, head of analysis at CoinShares, greater than 1 / 4 of those respondents stated their portfolios are uncovered to BTC by way of spot ETFs.

After Bitcoin, Ethereum stays in second place, though investor curiosity has declined because the earlier survey.

In response to buyers, BTC and ETH stay the digital belongings with probably the most compelling development outlook.

Nevertheless, Solana has seen a surge in investor enthusiasm, as evidenced by a rise in allocation to 14%. This improve is pushed primarily by a choose group of high-profile buyers increasing their stakes within the fast-growing blockchain community, which has loved speedy development in value and adoption over the previous 12 months.

Whereas different various digital belongings have struggled, XRP stands out for its important decline. Not one of the buyers interviewed talked about holding it.

Funding obstacles

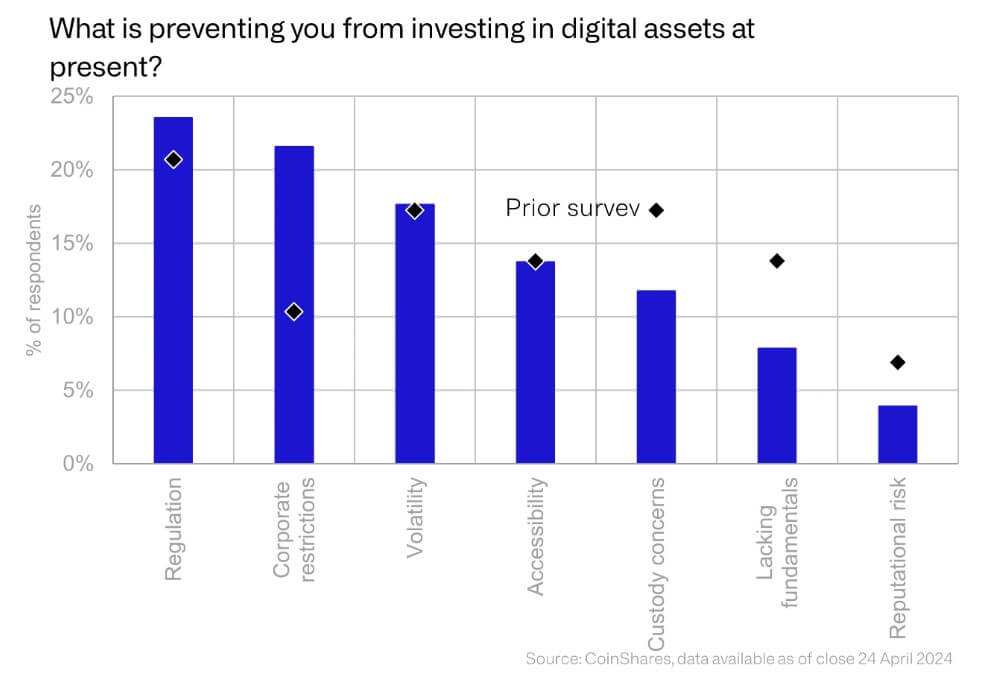

Regardless of rising publicity to digital belongings and the rise of Bitcoin ETFs, many buyers are nonetheless struggling to realize entry to the asset class.

A CoinShares survey discovered that regulatory considerations stay the primary impediment for many buyers. The rising trade is going through regulatory scrutiny, particularly within the US, the place monetary regulators just like the SEC have filed a number of authorized actions in opposition to main gamers like Binance and Coinbase.

In the meantime, the rising sector's inherent volatility continues to be a significant concern for some buyers. Nevertheless, escrow points, reputational threat and the absence of a basic funding case have gotten much less of a difficulty.