- Bitcoin ETF inflows hit a staggering $91.3 million on April 11, sustaining optimistic momentum.

- Whole web inflows to the Bitcoin ETF market reached a exceptional $1.5 billion.

- BlackRock’s An influx of US$192.1 million led to the reversal of the outflow on April 11.

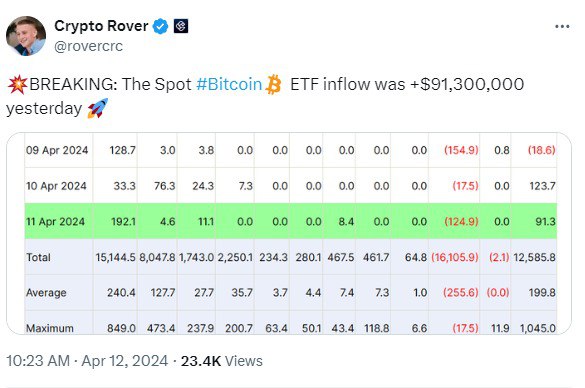

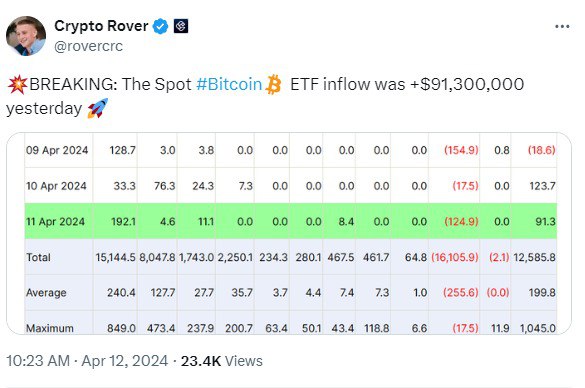

Bitcoin ETF inflows surpassed a whopping $91 million on April 11, 2024, sustaining optimistic momentum. Analyst Crypto Rover shared X’s put up shedding mild on the large inflow of Bitcoin ETFs that totaled $12.5 billion.

In keeping with the report, the $91,300,000 influx into the Spot Bitcoin ETF on April 11 is far decrease than the $123,700,000 influx on April 12. Nonetheless, this quantity contributed considerably to the general optimistic circulation of Bitcoin ETFs.

On April 8 and 9, Bitcoin ETFs confirmed adverse circulation, with whole outflows exceeding inflows. Whereas outflows had been valued at $223.8 million on April 8, Bitcoin ETFs noticed outflows of $18.6 million on April 9.

WhalePanda, a outstanding voice within the crypto area, shared insights on the optimistic developments within the Bitcoin ETF market on X. In keeping with WhalePanda’s put up, BlackRock’s staggering $192.1 million influx fully canceled out the outflow.

Grayscale’s GBTC has reportedly seen rising outflows. From a $17.5 million outflow on Wednesday, GBTC reached an enormous $124.9 million on Thursday. WhalePanda stated Grayscale’s outflow is instantly proportional to market energy.

As well as, WhalePanda revealed declining Bitcoin holdings in Grayscale. In keeping with Grayscale’s official web site, their BTC holdings dropped to 316,000, and based on Arkham Intelligence, BTC holdings in GBTC decreased to 321,000.

In the meantime, Bitcoin is hovering above the landmark $70,000 mark because the much-anticipated halving occasion approaches. At press time, Bitcoin is pegged at $70,972, a marginal enhance

0.35% for at some point and a exceptional 6.35% for 7 days. Nonetheless, over the previous month, Bitcoin has seen a slight decline of 1.26%.

Disclaimer: The data supplied on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shall not be responsible for any losses incurred because of using stated content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.