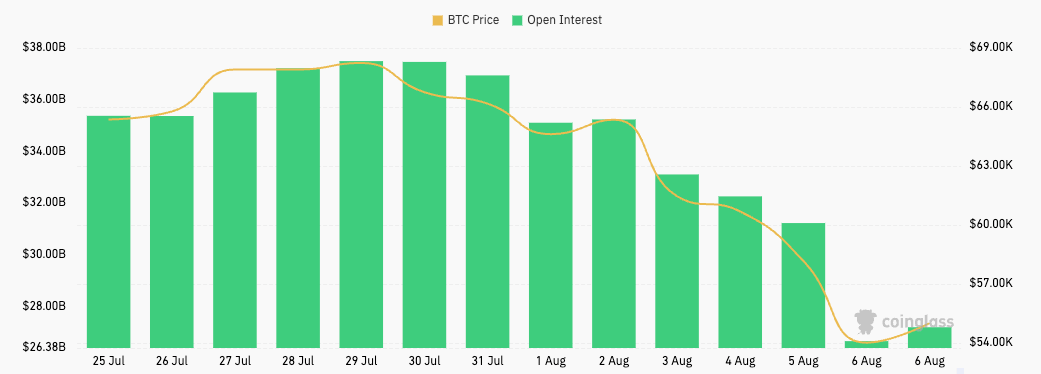

This week's crash resulted in a few of the highest losses seen because the FTX collapse, wiping billions from the crypto market. Bitcoin's fall beneath $50,000 dramatically affected the futures market, with open futures curiosity falling from $31.22 billion on August fifth to $26.65 billion on August sixth.

Such a pointy drop in simply 24 hours was most probably attributable to pressured liquidations of futures positions because of margin calls. When the value of Bitcoin falls beneath the essential stage wanted to keep up the collateral, it normally triggers a cascade of liquidations, and overleveraged merchants have their positions forcibly closed.

The wipeout of open curiosity in futures that we noticed this week reveals {that a} important variety of merchants wager on Bitcoin's continued progress and have been caught off guard by the sudden drop, which led to large deleveraging.

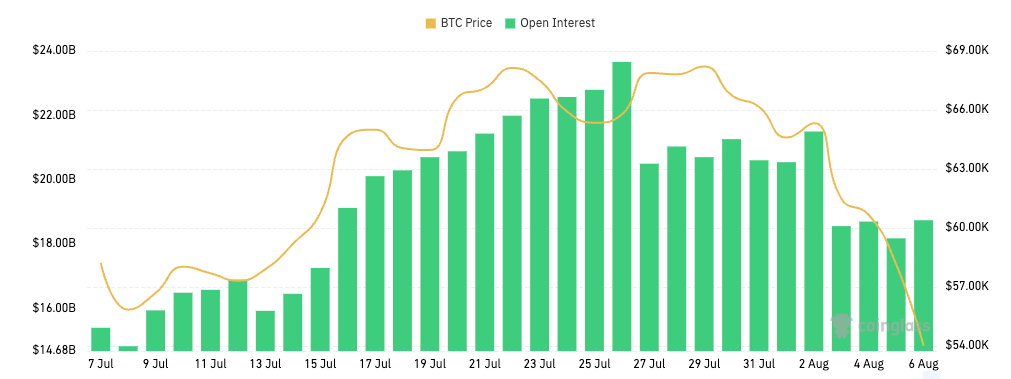

Then again, the choices market remained comparatively steady in the course of the value decline. Open curiosity in choices remained roughly flat, hovering barely round $18 billion over the weekend.

Not like futures, choices don’t embrace a margin name that may power positions to be closed instantly. As an alternative, they offer merchants the appropriate, however not the duty, to purchase or promote BTC at a predetermined value. This inherent property permits choices merchants to carry their positions with out fast threat of liquidation, even during times of utmost value volatility.

Nonetheless, it’s extremely unlikely that the soundness in possibility OIs that we’ve seen over the previous few days is because of merchants holding on to their positions.

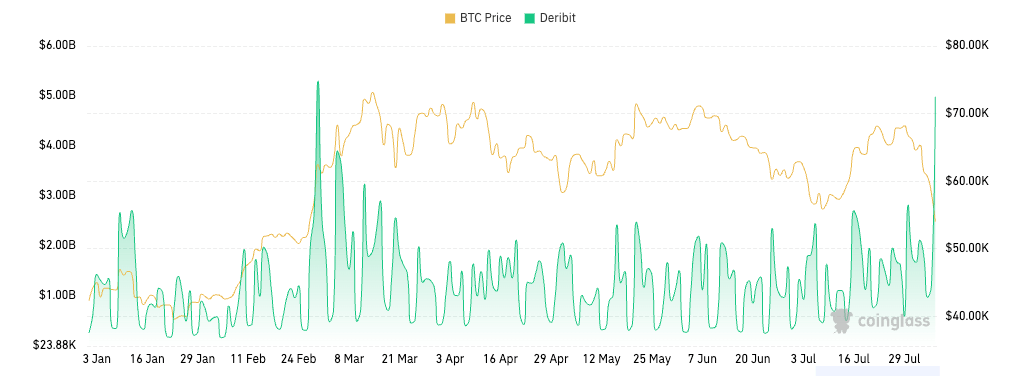

Choices buying and selling quantity on Deribit rose from $1.22 billion on August 5 to $4.98 billion on August 6. That is the second highest quantity of choices ever recorded, surpassed solely by the $5.30 billion the market recorded on February 29 of this 12 months.

Such a excessive enhance in quantity signifies elevated buying and selling exercise the place merchants are actively participating available in the market. A number of elements might have contributed to this phenomenon of open curiosity remaining steady whereas buying and selling quantity elevated.

First, during times of excessive volatility, merchants enter and exit positions extra incessantly, which suggests opening new contracts and shutting current ones rapidly. If the variety of newly opened contracts roughly equals the variety of closed contracts, OI will stay comparatively unchanged whereas quantity will increase. Excessive contract turnover could also be the results of short-term hypothesis, hedging or rolling positions.

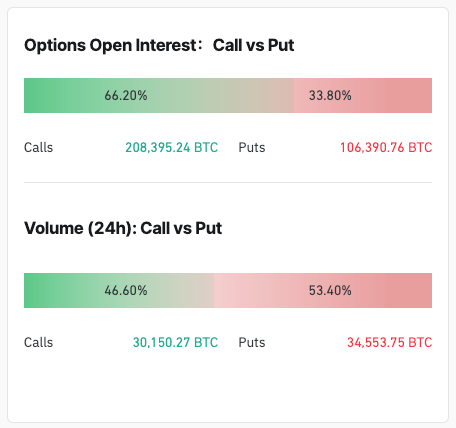

An fascinating side of the choices market on this interval is the tendency in the direction of calls over places. With greater than 66% of choices with open curiosity being calls, it reveals that bullish sentiment continues to be prevalent amongst merchants.

Nonetheless, whereas open curiosity reveals a powerful name bias, buying and selling quantity is skewed in the direction of places. The 24-hour choices buying and selling quantity between August 5 and 6 got here from places. This may be defined by merchants' fast reactions to the value drop. When Bitcoin skilled a pointy decline, merchants probably rushed to purchase places to hedge their current positions or speculate on additional value declines within the quick time period.

In distinction, open curiosity displays the longer-term place of merchants. The vast majority of open curiosity that’s calls means that merchants have constructed these positions over time and keep a bullish view of Bitcoin's longer-term prospects. These positions usually are not adjusted or closed as rapidly as short-term trades, which is why open curiosity stays closely skewed towards calls.

The put up Bitcoin crash wipes out $5 billion in OI futures, however choices stay regular appeared first on fromcrypto.