The vacation spirit didn’t carry any stability to the crypto market, with Bitcoin dropping from $97,300 on December twenty second to $94,800 on December twenty fourth. Christmas Day noticed a slight restoration, however Bitcoin consolidated again to $98,000 because it encountered important resistance above $99,000.

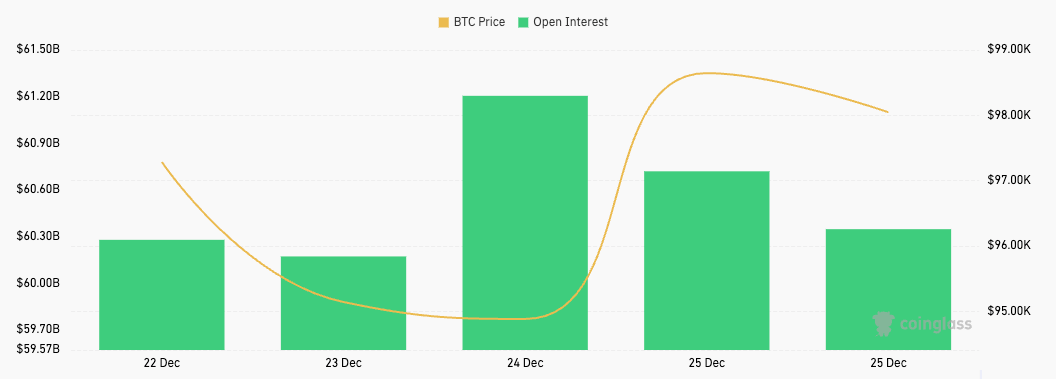

This worth volatility was accompanied by equal volatility within the derivatives market. The futures market maintained comparatively steady open curiosity, starting from $60 billion to $61 billion over the identical interval, falling from $61.21 billion to $60.35 billion on December 25.

This decline in OI futures, together with rising costs, means that merchants are closing leveraged lengthy positions to take income and cut back their urge for food for leverage as the value rises. The timing of this drop in OI, occurring above the $98,000 psychological degree, reveals revenue taking and danger discount by leveraged merchants.

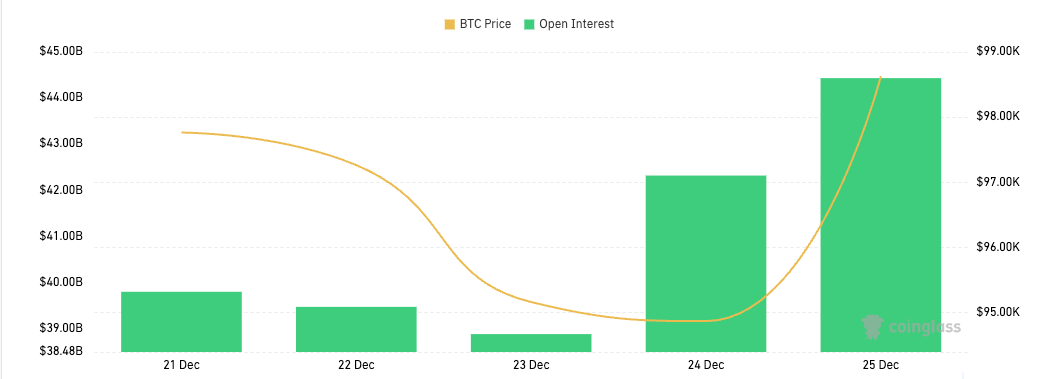

In distinction, the choices market has proven fairly a little bit of power over the previous few days, with OI rising from $39.47 billion to $44.43 billion, a 12.6% improve. CoinGlass information reveals choices sentiment is considerably bullish, with calls dominating each open curiosity (63.58% vs. 36.42% places) and quantity (57.22% vs. 42.78% places). This unfold of possibility placement strongly means that merchants count on additional upside potential.

The divergence between OI futures and choices signifies a change out there's urge for food for danger. Reasonably than representing a web deleveraging, this shift means that merchants have gotten extra nuanced of their strategy to market publicity. The information reveals that merchants are slowly shifting away from extremely leveraged, unlimited-risk futures positions in favor of defined-risk choices methods that supply related publicity potential with superior danger administration. This conduct is especially evident at increased worth ranges, the place draw back danger turns into extra pronounced.

Skilled merchants are those who drive these adjustments out there, as they normally want choices for exact danger administration and place sizing with exact most loss parameters. The expansion in choices exercise, notably in complicated methods akin to spreads and straddles, signifies rising institutional participation and the general maturing of the market. And whereas the futures market remains to be considerably bigger than choices, the expansion we've seen in choices reveals that merchants are growing extra superior danger administration methods because the market infrastructure improves.

This has vital implications for worth and liquidity. With much less outright liquidation danger from futures and extra gamma-driven worth motion from choices, we might even see slower and extra managed strikes to the upside, though sharp worth strikes stay doable if key strike costs are breached. The shift additionally impacts market depth, with futures markets probably experiencing diminished liquidity whereas choices market makers tackle bigger roles, resulting in extra complicated hedging flows within the spot market.

Regardless of usually wholesome market indicators, there are at all times dangers. Excessive absolute ranges of each futures ($60+ billion) and choices ($44+ billion) open curiosity point out important market participation, implying the potential for volatility. Name-heavy positioning may speed up upward strikes and create draw back danger if the value falls.

The publish Bitcoin choices OI hit $44 billion as futures cool appeared first on fromcrypto.