- Coinbase analyst David Han believes that the USDe stablecoin is now a formidable rival to DAI.

- USDe has gained a market cap in opposition to DAI as a consequence of excessive yields and incentives to say no.

- USDe added $500 million in two days, whereas DAI remained comparatively stagnant.

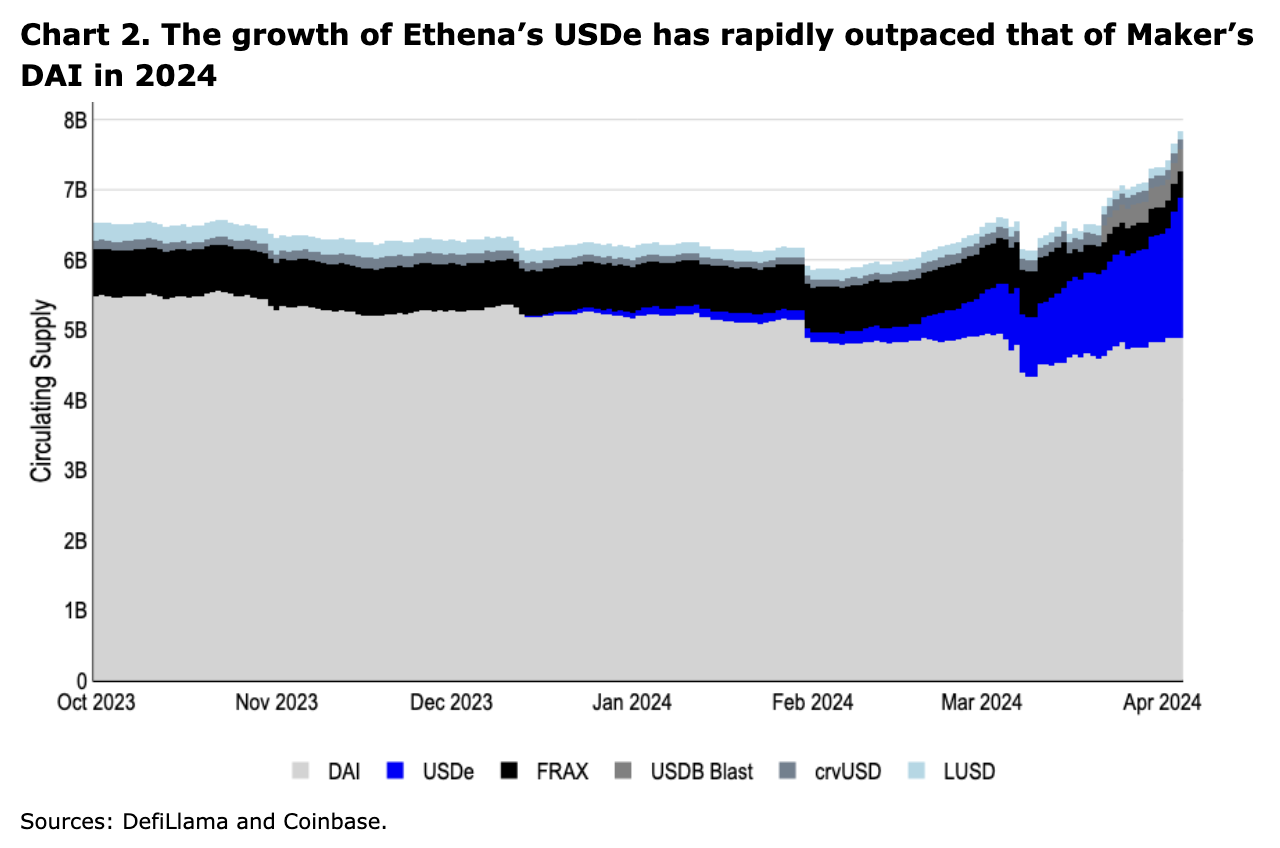

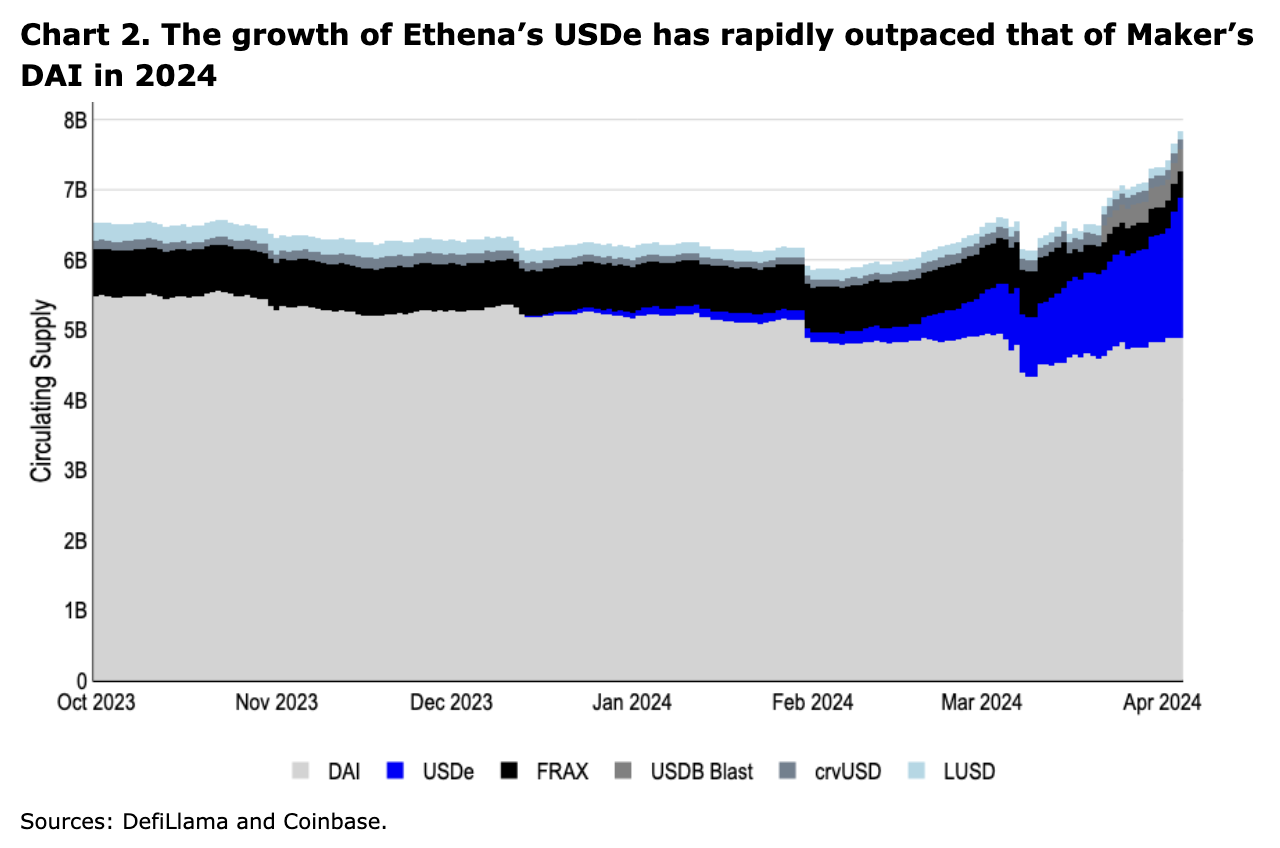

David Han, a analysis analyst at Coinbase, singled out Athena’s newly launched USDe stablecoin as a formidable rival to MakerDAO’s DAI stablecoin. Within the newest Coinbase market developments report, analysis analyst David Han highlighted that USDe’s development in 2024 has considerably outpaced MakerDAO’s DAI.

In accordance with the researcher, USDe has gained market share in comparison with DAI as a consequence of engaging returns and drop-in incentives. Moreover, he attributed the rise to contentious governance adjustments inside MakerDAO and ongoing debates throughout the DeFi group relating to the potential removing of DAI as collateral from Aave markets.

At press time, the USDe stablecoin has a market cap of $2.05 billion, whereas DAI stays nicely forward with $5.35 billion. In the meantime, the USDe has attracted a good portion of its market share over the previous seven days.

As of April 2, USDe has a market cap of $1.58 billion. Between April 3 and 4, it posted a major achieve, getting into $2 billion for the primary time, and continued to defend its place. Curiously, USDe had a cap under $350 million on the finish of February. Throughout these intervals, the DAI stablecoin market capitalization remained comparatively stagnant.

Whereas USDe outperforms DAI, a extra established participant available in the market, a Coinbase analyst acknowledged comparable limitations in each stablecoins. He identified that DAI and USDe are operating into limits on their issuance capability. Particularly, DAI depends on over-collateralization, whereas USDe’s issuance capability is proscribed by the dynamics of the open futures market.

As well as, business specialists equivalent to Ki Younger Ju, CEO of knowledge analytics platform CryptoQuant, have expressed issues about USDe’s construction. Younger Ju argues that Athena’s choice to make use of Bitcoin as collateral mirrors the scenario with Terra Luna UST, the place the Terra Luna group typically offered BTC to keep up stability in UST.

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shall not be answerable for any losses incurred on account of using mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.