As a younger immigrant in Brooklyn, Mo Shaikh typically thought of his father's cab earnings. His father would say he made $100, however Shaikh couldn't perceive why he solely obtained residence with $60. (The remaining, he discovered, went to intermediaries.) This early expertise fueled his curiosity about monetary methods, but in addition about their flaws and the necessity for change.

Shaikh went on to review finance, economics and psychology at Hunter School earlier than incomes an MBA from the College of Rochester. After graduating, he started to determine himself within the skilled world at locations like BlackRock and the Boston Consulting Group. But it surely was his transfer first to blockchain startup Consensys after which to Meta to work on his cryptocurrency endeavors that he realized this was an answer to the inefficiencies he had witnessed since childhood.

“I knew this was the place I needed to be,” he mentioned.

He co-founded Aptos with Avery Ching in 2021.

It's been a wild journey for Shaikh and Aptos. Inside three months of leaving Meta in December 2021 and founding a startup, she raised $200 million in a valuation over $1 billion, led by Andreessen Horowitz. Simply three months later, it raised one other $150 million. However the wild journey had some bumps: its buyers included the ill-fated FTX.

In the meantime, the corporate continued to develop whereas overcoming most of the identical challenges that different crypto corporations confronted. In April, it launched Aptos Ascend, a full suite of monetary options.

And now Aptos and Shaikh are eyeing growth in Asia.

Aptos already works with native companions. On Friday, it introduced a partnership with Libre, an funding infrastructure startup centered on tokenizing monetary belongings. Libre is a three way partnership launched by Japanese financial institution Nomura, digital belongings unit Laser Digital, and hedge fund Brevan Howard, fintech and web3 incubation heart WebN Group.

Libre launched the web3 protocol to entry hedge funds and personal debt funds on the Aptos community. The partnership will give Aptos licensed customers entry to a spread of on-chain funds, together with Brevan Howard Grasp Fund, Hamilton Lane Senior Credit score Alternatives and BlackRock ICS Cash Market Fund.

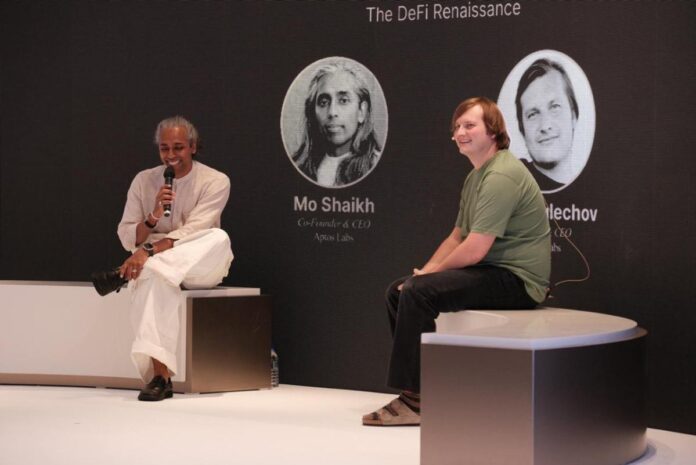

fromcrypto sat down with Shaikh this week on the Korea Blockchain Week 2024 convention in Seoul to speak about Aptos' growth in Asia, notably in nations like South Korea, Japan, Singapore and the Center East; its partnerships with main Asian web2 corporations; and the way Aptos makes use of blockchain to make monetary transactions seamless and cost-effective.

“Asia most likely has one of many greatest wants for web3. There are numerous totally different cost methods. There are such a lot of monetary establishments which have very previous infrastructure,” mentioned Shaikh. “I lived in Dubai after I labored at BCG, so I do know all of it (East Asia, Southeast Asia and Center Japanese nations). the use circumstances had been how folks earn cash simply, seamlessly and globally. … You wish to be as clear as doable. Monetary establishments need it, regulators need it, and customers need it.”

“As a substitute of paying 15%, you pay 0% (by a blockchain cost system), so it means I get all the cash you despatched me as an alternative of dropping it due to all these charges… (In Asia, ) They’re actually excited, that they might go ahead.'

These elements are contributing to financial development in Asia, resulting in elevated effectivity and profitability for corporations and customers, Shaikh mentioned. Corporations can cut back their prices of redistributing funds and other people can get monetary savings by sending worldwide at no cost. For instance, SK Group's Korean telco SKT sees the significance of constructing a cryptocurrency pockets for customers to have higher and extra environment friendly types of cash, Shaikh instructed fromcrypto.

Aptos has cast strategic partnerships with tech giants reminiscent of Microsoft and Google, in addition to media conglomerates reminiscent of NBC Common within the West. In Asia, Aptos has partnered with main corporations reminiscent of SKT, a significant telco from SK Group, Korean retail large Lotte and the web3 arm of Japanese financial institution Nomura.

“I believe all this stuff coming collectively in Asia have been phenomenal. However there may be one secret sauce, I might say, Asians are continentally clever and really prepared to embrace new applied sciences. They’re very cellular pleasant; they’re all the time enterprising. They suppose forward and that's wonderful. In terms of web3, they're prepared to strive issues in a really experimental manner, however they know the chance is there. And so all the issues we're fixing, mixed with person urge for food, make it an ideal place for Aptos.”

Just lately, Aptos has invested in lots of corporations based mostly in Hong Kong.

Shaikh additionally affords the efficiency of blockchain expertise by way of value and velocity. “Lots of people speak concerning the muddy motion. Lots of people declare they will do these cool issues, however I don't suppose anybody has proven the facility of blockchains,” he mentioned.

“So there's a gaming firm. A gaming firm launched a recreation on our blockchain. They produce each transaction on this recreation on our blockchain at Aptos. Think about this transaction, in the event you transact on the blockchain, it can value you cash on Solana. There are prices related to Ethereum. Our blockchain is constructed extremely effectively. So the price of that transaction is 1,000 cents, so it's principally free, and that makes this recreation run very well,” the CEO mentioned. “In case you are a web2 recreation developer, you’ll be able to run our blockchain and make the most of this low-cost transaction. But it surely additionally provides you velocity and throughput. If you happen to're establishing a transaction in a recreation, let's say each click on of that recreation occurs in a sequence. If there’s a two second delay, even only one second, your recreation might be slower. We had a sub-second ultimate, so transactions occurred in lower than one second, so the sport was not interrupted, and the transactions that occurred in a 24-hour window had been 500 million transactions.”

He talked about that 500 million transactions in 24 hours is the subsequent finest model of the Solana blockchain. And Solana is the earlier era blockchain at this level; essentially the most it has been capable of do is 50 million transactions, Shaikh mentioned. “We've carried out it ten instances, which is loopy. And what occurs with protocols like Solana, these networks go down,” he mentioned.

The CFTC appointed Shaikh to its Digital Property Subcommittee in June. When requested if Aptos works with native governments in Asia, Shaikh mentioned the corporate likes to speak to native governments in Asia and educate them about what they’re doing.

“We really do issues not simply with governments, we do issues with governments,” Shaikh mentioned. “Governments wish to really feel secure; they need a blockchain that may shield their residents. And we're very lucky to have the ability to have these conversations with (native governments in Asia) after which additionally assist them transfer the mannequin up. Governments are getting smarter. They’re enthusiastic about this expertise. It's not simply Bitcoin, however the precise expertise beneath that powers the longer term economic system. We wish to work with regulators and governments and attempt to actually carry options to gentle.”

He mentioned Japan has carried out an outstanding job of letting the business know that that is what you are able to do. “Japan can also be taking note of the work we’re doing right here in Korea. And I believe Korean regulators are very enthusiastic about what can occur with real-world asset tokenization. RWAs are one thing we’re very, very bullish on. Within the Center East, for instance in Abu Dhabi, you have got the worldwide markets of Abu Dhabi and likewise Dubai. Totally different elements of Asia are shifting very quick and that's good as a result of now this expertise can develop in these areas and in these nations cities like Seoul are retaining forward. And that's wonderful for Korea and likewise for Japan, Abu Dhabi and even different locations like Singapore.”