Anchorage Digital, a number one institutional-level crypto platform, has launched a rewards program for institutional buyers who maintain PYUSD on its platform or in its personal Porto pockets, in accordance with an announcement on August 22.

The corporate introduced that establishments utilizing its providers or Porto can now earn “aggressive rewards” on their PYUSD holdings. Not like different rewards applications that contain remortgaging, staking or lending, the Anchorage Digital program permits contributors to earn rewards whereas holding their property totally accessible and segregated of their accounts for fast deployment.

The announcement indicated that whereas this system at the moment helps PYUSD, different stablecoins could also be included sooner or later.

Anchorage Digital CEO Nathan McCauley mentioned this system aligns with crypto innovators' need to generate income from their state property with out compromising safety or availability. added:

“Anchorage Digital seems ahead to working with crypto innovators – together with protocols, foundations, VCs and startups – to unlock the following part of development by supporting entry to our stablecoin rewards program.”

PayPal's basic supervisor of blockchain, crypto and digital foreign money additionally mentioned that the initiative will increase the utility of PYUSD and produce advantages to institutional customers.

$1 billion milestone

The partnership comes as PayPal's PYUSD nears its $1 billion market cap, pushed by sturdy adoption of the stablecoin on the Solana community.

PYUSD provide has elevated by roughly $400 million over the previous month, a 60% improve. This development positioned PYUSD because the quickest rising stablecoin, reaching $960 million at press time, in accordance with knowledge from fromcrypto.

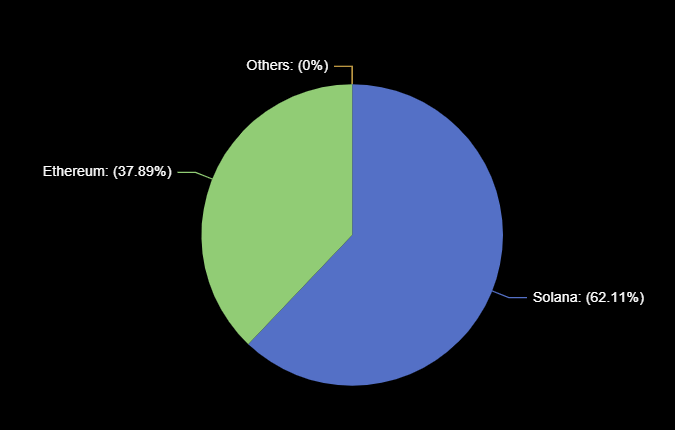

DeFillam's knowledge additional confirmed that almost all of PYUSD is on the Solana blockchain, with $590 million on Solana in comparison with about $366 million on Ethereum.

Market watchers have linked the success of PYUSD on Solana to the excessive returns supplied by Solana-based DeFi protocols resembling Drift. This platform supplies important rewards to customers and presents nearly 20% annual return for many who deposit the stablecoin.