- Arthur Hayes notes Bitcoin's 10% plunge since Powell's speech, pushed by a shift in market liquidity and RRP yields.

- BitElite warns of potential draw back dangers for altcoins and compares the present ALT/BTC pair to the 2019 price lower cycle.

- Henrik Zeberg alerts warning as financial indicators counsel a price lower might come too late to avert a recession.

Markets reacted in a different way than anticipated following Federal Reserve Chairman Jerome Powell's latest feedback a few potential Jackson Gap price lower. Distinguished voices within the monetary world, together with former BitMEX CEO Arthur Hayes, spotlight the important thing components resulting in this uncommon response.

In a latest social media put up, Hayes famous that bitcoin has fallen 10% since Powell's announcement. He means that this decline could also be associated to shifts in market liquidity, particularly the Federal Reserve's Reverse Repo Program (RRP).

RRP at the moment presents a yield of 5.3%, outperforming any one-year T-bill. This engaging price forces cash market funds to shift investments from T-bills to RRP, successfully withdrawing liquidity from the market. Since Powell's Jackson Gap speech, the RRP stability has elevated by $120 billion, and Hayes believes that pattern will proceed so long as Treasury invoice charges stay beneath RRP yields.

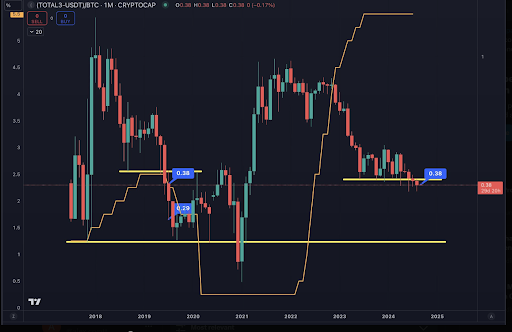

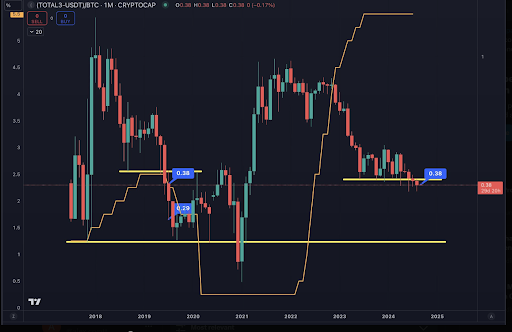

The broader crypto market, significantly altcoins, might face draw back dangers as price cuts loom. Analyst BitElite in contrast the present altcoin/bitcoin pair (ALT/BTC) to its conduct throughout the 2019 price lower cycle.

At the moment, the ALT/BTC ratio dropped from 0.38 to 0.29, resulting in a pointy decline in altcoin valuations. With the present pair as soon as once more standing at 0.38, BitElite warns that one other collapse may very well be imminent. He expects an eventual rise in Bitcoin dominance, adopted by a decline in altcoins that would peak in October.

Market watcher Henrik Zeberg factors to financial indicators that point out potential issues forward. Rising unemployment is forcing the Federal Reserve to think about slicing charges to attain a “smooth touchdown.”

Zeberg means that this technique could also be too little, too late. Traditionally, inventory markets are inclined to peak and fall across the first price lower, resulting in a bear market. He warns that deflationary pressures from these delayed actions may very well be extreme and portend a recession.

The Federal Reserve is anticipated to fulfill on September 17-18, with many anticipating a lower within the federal funds price from the present vary of 5.25% to five.5%. Analysts forecast a modest preliminary lower, marking the primary lower since July 2023.

Credit score markets have already thought-about the potential of additional price cuts, as evidenced by falling authorities bond yields. The 2-year Treasury yield fell from 5.1% in April to three.92% on the finish of August, whereas the 10-year yield equally fell to three.91%.

Associated information:

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shall not be accountable for any losses incurred on account of the usage of mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.